Connecticut’s projected $750 million recreational marijuana market is unlikely to match the size of neighboring New York’s, but it’s poised to launch first and might turn out to have as strong – if not stronger – of a social equity program, industry experts agreed.

State regulators said recently they are aiming for a relatively full launch by year-end 2022, while New York’s projected $2 billion-plus market likely is slipping into the spring of 2023.

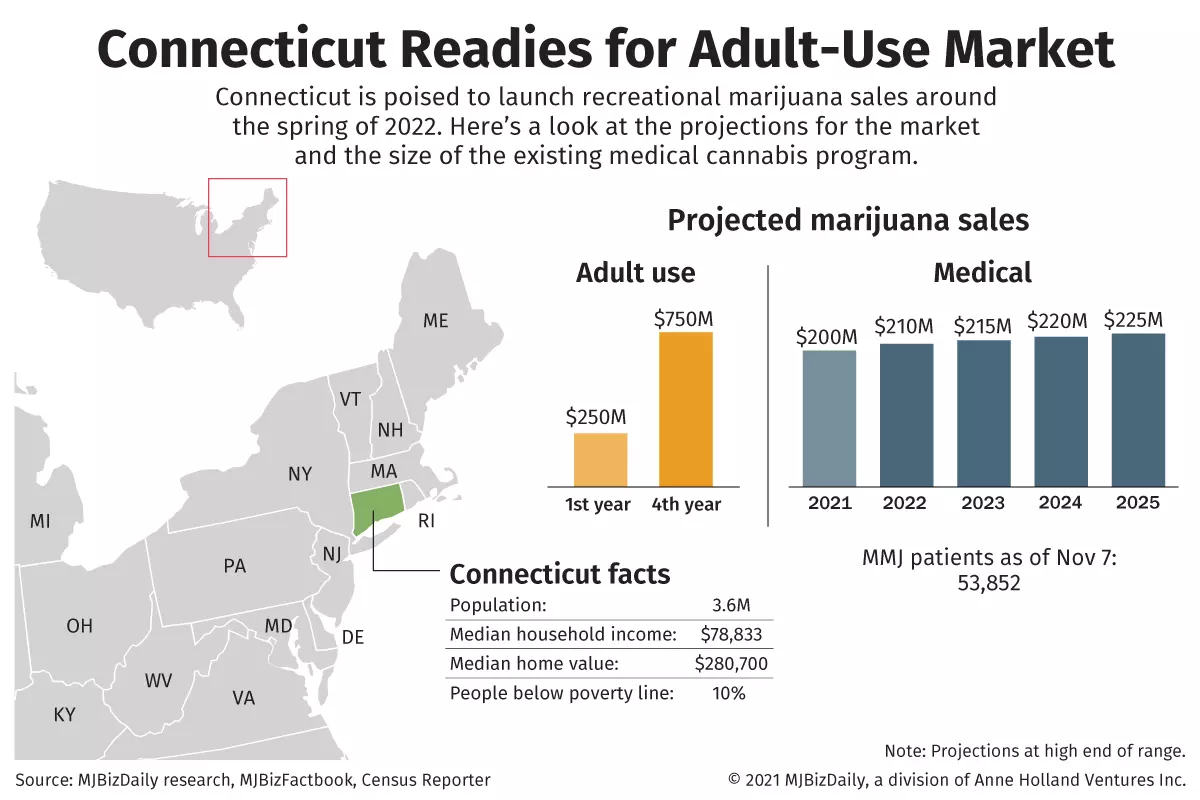

The MJBizFactbook projects that Connecticut’s adult-use sales could total as much as $250 million in the first full year and up to $750 million by the fourth year.

The size of the market and its proximity to New York have prompted a steady stream of acquisition activity over the past three years.

Chicago-based marijuana multistate operator Verano Holdings is the latest company poised to enter Connecticut, announcing last week it agreed to acquire an existing medical cannabis cultivation and processing facility in a deal worth $131.8 million.

The MSO also agreed to buy a dispensary and closed on the purchase of a second retail outlet.

New social equity benchmark?

New York has been touted as a potential social equity gold standard, but Connecticut’s program appears equally robust.

“Definitely a priority is put on to consider the harm done by the war on drugs and to think about the disproportionately impacted communities and how to reinvest in them,” said Kaitlyn Krasselt, communications director for the Connecticut Department of Consumer Protection.

New York and Connecticut were part of a regional effort to coordinate a general adult-use framework, but each program has its own flavor.

Connecticut’s program features these aspects:

- Half the recreational marijuana stores will be allocated to social equity applicants.

- Existing medical marijuana producers and dispensaries can convert to adult use if they meet certain requirements and pay a fee. The fee is $3 million for producers and $1 million for dispensaries. That fee can be cut in half if the MMJ operator partners with a social equity business.

- The initial round of cultivation licenses will be awarded to social equity applicants that locate their facilities in areas disproportionately impacted by the war on drugs.

Are you a social equity cannabis license holder or applicant?

The MJBizCon team is now accepting 2023 Social Equity Scholarship Program applications.

The mission of this program is to provide social equity cannabis license holders or applicants access to the #1 global cannabis industry conference + tradeshow in Las Vegas.

Who can apply?

- Students currently enrolled in a cannabis-related program at an accredited university or college.

- Cannabis executives at licensed social equity cultivation, extraction/processing, retail, manufacturing/brand businesses (or awaiting application approval).

Don’t miss out on this potentially life-changing opportunity.

Apply to attend MJBizCon today – The application period will close on July 24!

Otherwise, licensed operators will be chosen by lottery, but state regulators have yet to determine the number of permits in each of the nine categories.

“We have not set those numbers yet,” Krasselt said. “We’re working on a market analysis, and that will determine how many licenses we will issue.”

Also, nothing happens until Connecticut’s Social Equity Council acts.

“What kicks off everything in licensing is the Social Equity Council coming up with the details (for that program),” said Michelle Bodian, a senior associate attorney in Vicente Sederberg’s Boston and New York offices and the lead on Connecticut licensing.

The Social Equity Council has discussed income and residency requirements but hasn’t yet finalized criteria that will determine where equity licenses go.

Once it does, then within 30 days, the first application for a social equity cultivation license will open.

Existing operators get a leg up

Connecticut’s adult-use marijuana law enables current medical marijuana dispensaries to apply for a hybrid MMJ/adult-use license and then start selling recreational cannabis marijuana products within 30 days, provided cultivators have at least 250,000 square feet of cultivation and processing space.

Analysts were expecting sales to launch by mid-2022 with existing medical cannabis operators.

But state regulators recently said they are looking at a fuller launch with others, including social equity businesses, toward the end of 2022.

The advice to businesses interested in Connecticut’s adult-use marijuana market is similar to that for other states: Check with local governments to see if they will be allowing adult-use sales, and don’t lock up real estate too soon unless you have financial pockets deep enough to do so.

“A lot of municipalities are making decisions now whether they want to allow (adult use),” Krasselt said. “So, before you buy a building, I would be checking in with local officials.”

In New York, nine of the 10 licensed MMJ businesses are multistate operators.

Five multistate operators have a presence in Connecticut and, once Verano closes on one pending deal, will operate 12 of the 18 MMJ dispensaries.

Massachusetts-based Curaleaf and Illinois-headquartered Green Thumb Industries both have vertical operations with four and three dispensaries, respectively, while Florida-based Trulieve Cannabis has one MMJ store.

New York-based Acreage Holdings, which has retrenched in recent years, owns three dispensaries.

The remainder of the dispensaries in Connecticut are owned by private companies.

MSOs dominate cultivation

Large operators dominate the state’s cultivation sector.

Only four medical marijuana cultivation licenses were issued, one to Curaleaf and three to private operators that have since been acquired by larger interests:

- Tuatara Capital, which acquired Connecticut Pharmaceutical Solutions in 2018. Verano now has an agreement to acquire Connecticut Pharmaceutical Solutions.

- Green Thumb Industries, which bought Advanced Grow Labs in 2019.

- Greenrose Acquisition Corp., a special purpose acquisition company, which acquired Theraplant in March.

As a result, analyst Pablo Zuanic of New York-based investment banking firm Cantor Fitzgerald wrote in an investor note: “We believe the four existing med cultivators will grab the lion’s share of the rec wholesale market initially, at least for the first couple of years.”

Vicente Sederberg’s Bodian said there’s keen interest in the adult-use market from within Connecticut and neighboring states.

One of the big questions is the upfront cost to enter a market. In general, she said, Connecticut has a low barrier of entry in terms of application fees.

She said the two-step license structure, which enables a business to get a provisional license while they apply for final licenses, also will help provide flexibility and defer real estate costs.

“I think the state is trying to help businesses not to lock into real estate,” Bodian said.

But, she added, “if a business is interested in a particular municipality, then it’s important to start those conversations now.”

Some businesses, she said, are particularly passionate about certain towns and there’s no reason not to lock into real estate “if they can afford to do so.”

She said some favorite locations are the train routes north toward New York City, Fairfield County and cities such as Hartford and New Haven; the latter is the location for Yale University.

“I think Connecticut is taking a unique approach,” Bodian said of the social equity provisions, low application fees and variety of license types.

“It seems like it is strategic and thoughtful about the practical implications of what it takes to afford to apply.”

Still, she said, like other markets that have boasted about having a strong social equity program, “we’ll have to wait and see how it plays out.”

Jeff Smith can be reached at jeff.smith@mjbizdaily.com.