(Editor’s note: This story is part of a recurring series of commentaries from professionals connected to the cannabis industry. Jason Hoffman, CPA, is a partner at New York-based accounting firm Janover and the firm’s cannabis industry practice leader.)

(Editor’s note: This story is part of a recurring series of commentaries from professionals connected to the cannabis industry. Jason Hoffman, CPA, is a partner at New York-based accounting firm Janover and the firm’s cannabis industry practice leader.)

While the Marihuana Regulation and Taxation Act (MRTA) legalized the production, distribution and adult use of marijuana in New York state on March 31, there are still more questions than answers about what it means for businesses operating in the space – and those looking to get into the industry.

Questions around the number of licenses available, where counties and localities can opt out, what personal-use plants will look like and how the application process will work remain open as final regulations are crafted.

However, what’s happened since states such as California, Michigan and Massachusetts legalized marijuana might provide a glimpse of what’s to come for New York.

Is it too late to get into the NY cannabis market?

No, but businesses should take their time and research what’s possible with the new law before jumping in.

Final regulations might not come until the end of 2021, with sales not beginning until early 2022, making it challenging to build an accurate business model.

A few ways to prepare include:

- Making connections in the cannabis industry, especially with regulators, bankers, attorneys and CPAs. Many professionals with cannabis experience in multiple states likely will limit the number of applicants they take on if the new Office of Cannabis Management caps the number of licenses to mitigate risk.

- Building a business model for at least the next five years, factoring in the actual product demand and what a business’ tax bill will be.

- Understanding where cannabis businesses can be located (not close to a school or place of worship, among other restrictions). Talk with community leaders and identify a place that will allow a cannabis operation.

The cost will be high

Potential high tax rates might scare away many investors.

New York is expected to have some of the tightest regulations around the production, distribution and use of recreational marijuana, which could mean slim profit margins in the short term.

Experience from other states indicates getting into the cannabis industry might not produce a profit for the first five years.

Meanwhile, cannabis businesses in states with high sales-and-use taxes, such as New York, have seen lower margins than states with lower rates.

The 10 current New York license holders have shown little profit over the past five years, so it might be years until the market matures.

With high state taxes and expected heavy regulation, profits after income taxes (including federal tax provision Section 280E) will be challenging to achieve.

The market might take more time to catch up than business owners have to become financially solvent. Businesses will need to be funded appropriately to get a license.

The survival of the illegal market

As growing small quantities of cannabis becomes legal, will heavy recreational users grow their own or will groups of people be able to grow together for personal use?

Will this personal use and other legal changes assist the illicit markets to operate unabated?

Not everyone illegally purchasing marijuana will move immediately or even in the short term.

They’ll do a cost-benefit analysis and identify where they can get their product the cheapest.

The new law prohibits police from using the smell of cannabis to justify searches.

With adults now permitted to store up to 5 pounds of cannabis flower and cultivate up to 12 plants for personal use at their home, police monitoring for cannabis use will significantly subside.

Simply put, the illicit market isn’t going away.

Regulated cannabis production and sales at approved licensed retailers might be cleaner, safer and higher quality.

Still, it remains to be seen how many businesses will be licensed or permitted to grow for legal resale.

State versus federal law

Once the state Office of Cannabis Management determines the number of licenses to be issued, the question becomes where businesses will set up shop.

Because the sale and use of cannabis remains illegal on the federal level, businesses might run into issues for properties with loans from Federal Deposit Insurance Corp.-insured banks.

Most cannabis companies have to buy real estate with cash or taking out loans at higher interest rates – and the interest might not be tax deductible.

The line between state and federal approval will prove especially tricky in New York City, where many of the buildings have mortgages from major federally recognized banks that include language preventing them from renting to anything that is federally illegal – including cannabis.

Those looking for real estate might need to prepare to pay in cash to avoid loan or lease restrictions.

Vertically integrated and minority-, women-owned businesses

The current law is designed to avoid vertically integrated companies.

That means producers will have to sell wholesale product to retailers, limiting the opportunity to structure around 280E.

With the law allowing existing medical marijuana license holders to keep their vertical integration, this could be a disadvantage for nonmedical businesses as they can grow and sell to themselves.

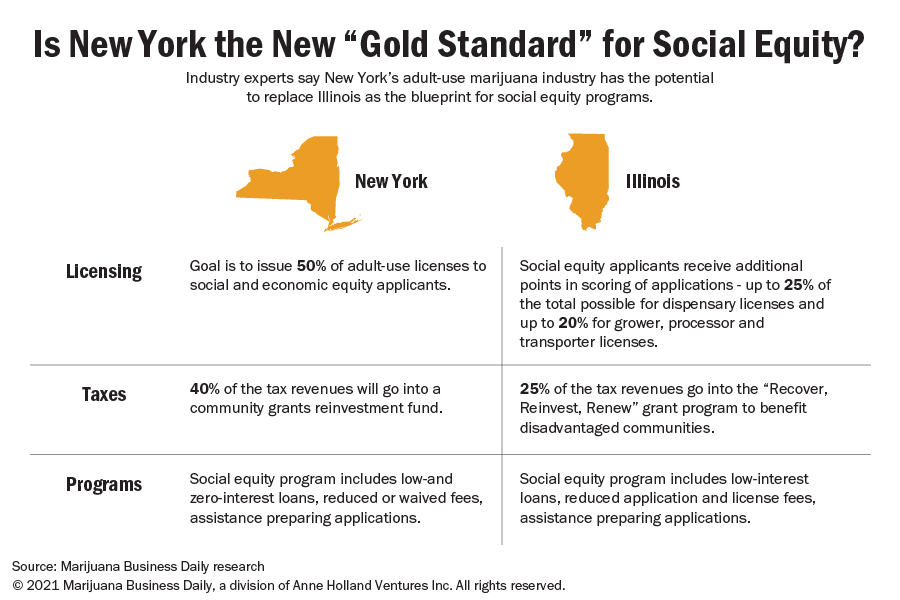

Under the law, half the available licenses are designated for minority- or women-owned businesses, but how the Office of Cannabis Management will define minority- and women-owned businesses is still an open question.

Other states with this provision have had difficulty keeping up with that standard.

Key takeaway

While the MRTA legalizes many components of the cannabis industry, there are still many challenges associated with direct involvement or investment in a cannabis-related business.

It’s not impossible to break into the market, but it’ll take a savvy business operator to navigate the process and become profitable.

Jason Hoffman can be reached at jason.hoffman@janoverllc.com.

The previous installment of this series is available here.

To be considered for publication as a guest columnist, please submit your request to editorial@mjbizdaily.com with the subject line “Guest Column.”