Delaware’s heavily regulated $30 million medical marijuana market is poised to double the number of vertically integrated operators from three to six at a time when prospects for adult-use legalization also are brightening at the state capitol.

The state, which launched its MMJ market in 2014, has long had only three operators and six dispensaries to serve a patient base that now exceeds 12,000 people. Some patients have complained of a lack of product selection and steep prices.

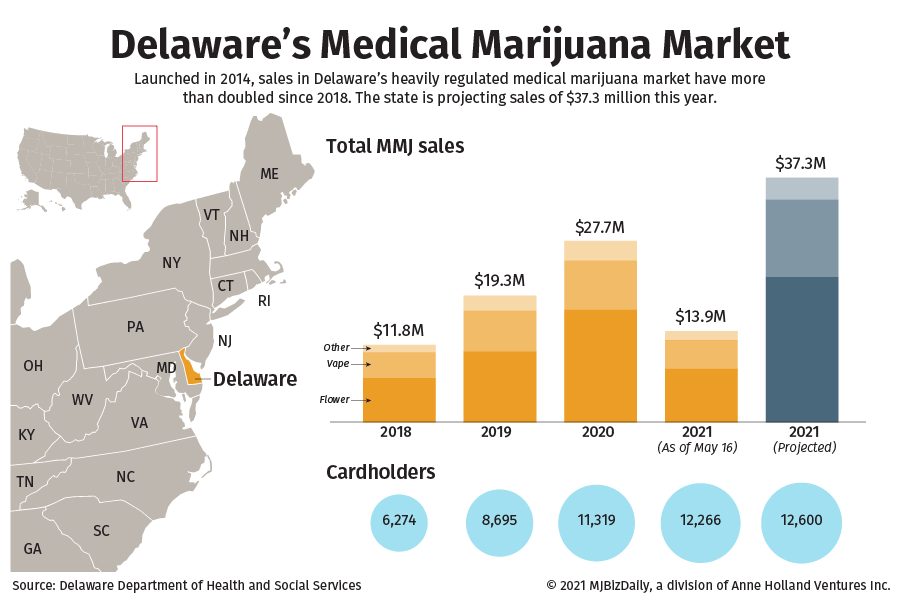

But sales more than doubled from $11.8 million in 2018 to $27.7 million in 2020, according to state figures.

To meet increasing demand, state regulators earlier this year awarded additional vertical licenses to three operators covering four dispensary locations.

Notably, the three new licensees all fall under the category of minority- or veteran-owned business enterprises.

“With new companies and new product lines coming out, we expect sales to jump considerably,” Paul Hyland, Delaware’s medical marijuana director, told MJBizDaily.

The state is projecting sales of $37.3 million for 2021, a 35% increase from last year.

At the same time, lawmakers are discussing adult-use legislation. And that’s where it gets contentious.

While existing MMJ operators favor adult-use legalization in principle, they oppose the initial bill because it wouldn’t give them an automatic berth in the recreational marijuana industry.

They also worry that the measure – House Bill 150, which calls for up to 30 retail stores, 30 processors and 60 cultivators – would result in a glut of cannabis on the market.

At a legislative hearing in March, representatives from five existing MMJ licensees – including New York-based Columbia Care – complained, saying the bill’s provisions would crush the medical cannabis industry by dramatically increasing cultivation capacity and not enabling MMJ operators to automatically participate in a new adult-use market.

Zoe Patchell, executive director of the Delaware Cannabis Advocacy Network, which is lobbying for adult-use legalization, told MJBizDaily the existing MMJ operators can apply for adult-use licenses like everyone else.

They are trying “to protect their private interests and reduce the competition,” Patchell said of the existing MMJ operators.

Small beginnings

For several years, Delaware’s medical cannabis industry has had only three companies: New York-based Columbia Care; First State Compassion, a local company led by a retired state trooper; and Fresh Cannabis, operated by the New Jersey-based Compassionate Care Research Institute.

Marijuana multistate operator Columbia Care is the market leader with a vertical operation and three of the six dispensaries.

The state last fall put out a request for proposals that favored businesses owned by minorities, women and war veterans.

Only 10 companies submitted proposals for four vertically integrated licenses.

At a Feb. 9 meeting of the MMJ program’s oversight committee, Hyland announced that three companies won licenses: CannTech Research, EzyCure (The Farm) and Valor Craft Cannabis.

CannTech won permits to open two dispensaries.

EZCure is planning to open by midsummer, CannTech as soon as the fourth quarter of 2021 and Valor by early in the second quarter of 2022, according to the state’s medical marijuana program.

Adam Goers, Columbia Care’s senior vice president of corporate affairs, said Delaware can fall under the radar, especially compared to the flourishing medical marijuana markets in neighboring Maryland and Pennsylvania.

But, Goers said, “Delaware is an increasingly strong market,” as evidenced by the patient numbers and growing sales.

While there always are challenges in a small market such as diversity of supply, Goers said the expansion will bring more products into the market, which, in turn, likely will increase the number of patients.

“And more access points (dispensaries) will help the market continue to develop,” he said.

In fact, Goers said, Columbia Care helped support one of the unsuccessful minority-owned applicants in the latest licensing round.

Controversial adult-use bill

The adult-use measure is more problematic.

At the March legislative hearing, existing medical cannabis operators sounded the alarm over potential oversupply and the inability for them to automatically opt into the recreational market.

Sharice Ward, Columbia Care Delaware’s retail director, told lawmakers she feared a recreational marijuana program as envisioned would deliver a “crushing blow” to the MMJ market.

Others offered even more dire warnings.

David White, chief legal officer for Fresh Delaware, said the measure would “visit violence on the economic well-being” of MMJ operators.

He said the increase in cultivation capacity would lead to a “non-recoupable loss” and layoffs of the company’s cultivation workers.

Aaron Epstein, chief operating officer of Canntech Delaware, one of the new minority-owned licensees, said he “was shocked to see a bill that would put us out of business before we even have a chance to open our doors.”

Patchell of the Delaware Cannabis Advocacy Network characterized some of the MMJ companies as “big corporate operators” that are trying to obstruct adult-use legalization.

“They want us to give them special privileges that would create an unfair advantage and undermine our social equity and small-business provisions,” she said.

In April, legalization advocates protested outside a Columbia Care dispensary with signs declaring, “Pot is for people, not big business” and “End corporate greed, legalize weed,” Delaware Online reported.

Goers said there’s “always a lot of fits and starts” in key policymaking such as marijuana legalization.

“We want adult use to pass,” Goers said.

But he said the company also wants policymakers to recognize, as other recent legalization measures have, that medical marijuana operators play a key role such as in ensuring adequate supplies for the adult-use marketplace.

Columbia Care, in exchange for being able to opt into adult use, would be open to paying into a fund to help finance social equity programs as it has done in New York, Goers indicated.

It’s unclear what will happen to the adult-use bill this year. One House committee advanced the bill, and the Legislature isn’t scheduled to adjourn until June 30, so there is still time.

But Delaware is early in the adult-use process compared to recent states that have legalized such as New Jersey, New York and New Mexico, Goers noted.

“We’re having discussions,” he said.

Jeff Smith can be reached at jeff.smith@mjbizdaily.com.