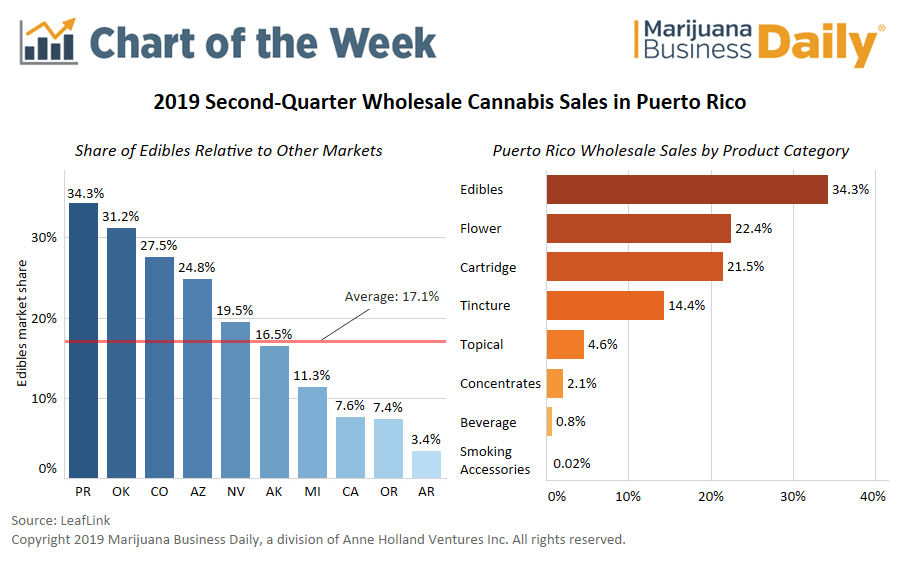

In recent months, cannabis-infused edibles have commanded one-third of wholesale medical cannabis sales in Puerto Rico – twice the average across a sampling of U.S. markets – and the category has room for more entrants.

Data analyzed exclusively for Marijuana Business Daily by LeafLink, a New York- and Los Angeles-based online wholesale marketplace, shows that edibles’ second-quarter wholesale market share in Puerto Rico came in at 34%, double the average across nine state markets.

While orders have been strong, there are relatively few edibles brands in Puerto Rico, according to Ryan Smith, CEO and co-founder of LeafLink.

“Puerto Rico is still a young cannabis market. We know edibles are a top category for retailers there, but as demand grows, there will have to be an increase in output from existing brands or supplemental output from new brands to keep up supply,” Smith told MJBizDaily.

Puerto Rico’s medical marijuana program has undergone significant growth since sales began in January 2017.

The latest release from the Puerto Rico health department shows a patient count of 92,499, meaning nearly 3% of the U.S. territory’s population are registered medical marijuana patients.

This proportion is on pace with state markets such as Arizona and New Mexico.

Several U.S.-based companies have noted this opportunity and announced plans to expand operations to the island, including vertically integrated operators and infused product manufacturers.

The Puerto Rico market will welcome more cultivation since cannabis has recently been in short supply, according to Goodwin Aldarondo, a San Juan-based cannabis attorney and CEO of Puerto Rico Legal Marijuana.

Aldarondo said the shortages stem from a rapid increase in demand coupled with too many cultivators timing their grow cycle to harvest in May and too few harvesting from June through August.

The rapid increase in demand came from a crush of new patients – 15,080 joined the registry between May and July – as well as from tourists.

“During the summer, we received a lot of medical tourists visiting the dispensaries because of our reciprocity clause with other cannabis states,” Aldarondo said.

“This increased the demand for flower outside our local market.”

Maggie Cowee can be reached at maggiec@mjbizdaily.com