Europe’s legal medical cannabis market might one day eclipse North America’s, but in 2019 the market was worth roughly 240 million euros ($260 million) – meaning the continent is still far from reaching its potential.

Europe’s legal medical cannabis market might one day eclipse North America’s, but in 2019 the market was worth roughly 240 million euros ($260 million) – meaning the continent is still far from reaching its potential.

That is one of the critical takeaways from Marijuana Business Daily’s updated – and free – report, “Medical Cannabis in Europe: The Markets & Opportunities.”

“This report provides industry leaders and investors interested in the European markets with a realistic estimate of current market sizes and a detailed analysis of the countries where the most opportunities exist,” wrote the author of the report, MJBizDaily International Analyst Alfredo Pascual.

Pascual believes executives will benefit from an honest picture of the market as it exists today, instead of relying mostly on wildly speculative projections of what could occur years into the future.

“Most cannabis companies don’t have years of cash available to spend without generating much revenue until those future multibillion markets materialize,” he said in an interview.

“While the long-term expectation of Europe being a massive medical – and, eventually, recreational – cannabis industry continues to show promise, this report highlights the reality of the market today, including the actual sales and the regulatory frameworks that exist in the main European markets,” Pascual wrote in the report.

“Medical Cannabis in Europe” lends credence to executives who are growing their businesses as the European market evolves.

That is another critical takeaway from the report, Pascual said.

“Businesses can only operate within the boundaries of a jurisdiction’s laws and regulations,” he said. “In many cases in Europe, those laws and regulations are in an infantile stage.

“The risk some businesses face is they’re building facilities before laws and regulations are clear and before functional markets develop.”

Marijuana Business Daily estimates total sales of medical cannabis in Europe in 2019 ranged from 230 million to 250 million euros, with the report noting that accurate estimates are complex because of a lack of official data in several of the main markets and no harmonized definitions of medical cannabis across the continent.

Roughly half the retail value was accounted for in the markup that pharmacies add before dispensing the products in countries such as Germany and Italy.

More takeaways from “Medical Cannabis in Europe”:

- 2019 was a good year for the largest markets – Germany and Italy – with double-digit growth over 2018. But all other medical cannabis programs on the continent either didn’t grow much (the Netherlands) or grew meaningfully albeit from a tiny starting point (Czech Republic).

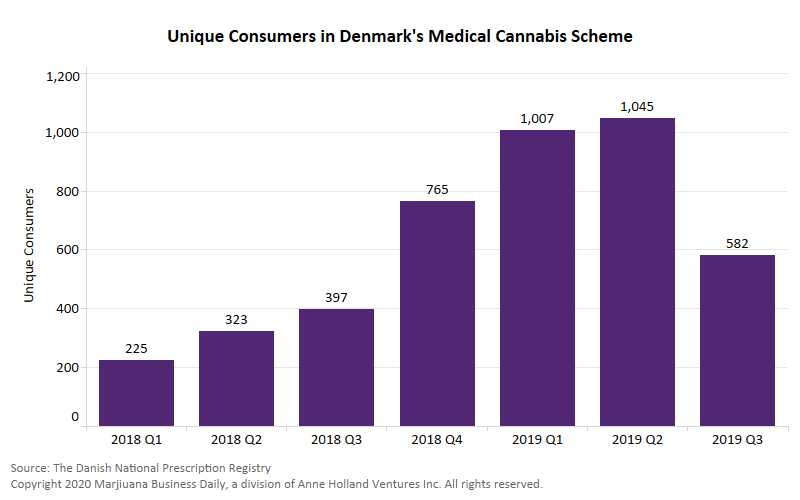

- Corporate expectations that sales will grow exponentially after medical cannabis is legalized is wishful thinking. Irregular growth is common. An example is Denmark.

- Isolated cannabinoids are an important product category in Europe, representing about 30% of reimbursed sales in Germany and the vast majority of sales in Austria. Possibly the largest acquisition of a European cannabis company to date was when Canada’s Canopy Growth purchased C3 in 2019, becoming a regional leader in the category of isolated THC.

- Many countries and entrepreneurs want to export to Germany, but products sold in Germany still come from only a few producers that are able to comply with stringent quality requirements. Not many companies were added to that list in 2019 compared to 2018. And some companies, such as Alberta-based Aurora Cannabis, struggled to comply with the rules last year.

- Supply issues aren’t such a big issue anymore. For example, as of the release of the report, at least 30 different flower varieties were in stock in Germany. Variety for other product types, such as full-spectrum extracts, has room for improvement. The report acknowledges specific supply issues throughout 2019 in different European countries.

- Though adult-use cannabis is not the focus, the report notes that 2019 was largely uneventful when it comes to recreational legalization in Europe. Luxembourg did not take a meaningful legislative step after the announcement of the intention to legalize at the end of 2018. Switzerland has a pilot project in the works, but it remains far from materializing. The Netherlands advanced its recreational pilot project, but it is limited to only a few, small municipalities.

A free copy of the “Medical Cannabis in Europe” is available for download here.

Matt Lamers is Marijuana Business Daily’s international editor, based near Toronto. He can be reached at mattl@mjbizdaily.com.