Deal of the Week / In partnership with Viridian Capital Advisors

On July 5, Harborside (CSE: HBOR; OTCQX: HBORF), a California-based vertically integrated operator, closed its acquisition of Sublimation (“Sublime”).

The total consideration of $43.8 million comprises approximately $38.4 million payable in multiple voting shares of Harborside (207.6 million shares based on volume-weighted average price for trailing 30 days) and $5.4 million in cash.

Sublime has increased revenues at a compound annual growth rate of roughly 70% since 2019 and holds a leading 8% market share in the California pre-rolls market.

Pre-rolls have become one of the fastest-growing cannabis categories because of their convenience.

Through its Fuzzies brand, Sublime is one of the pioneers of higher-potency, infused pre-rolls, significantly increasing the quality level of this category.

Sublime also adds statewide distribution to Harborside’s portfolio with service to 526 active customers, equating to 69% state coverage.

The acquisition completes Harborside’s vertical integration across cultivation, manufacturing, distribution, branding and retail.

The Sublime deal presents clear synergies with Harborside’s s existing portfolio. Sublime’s sales are expected to benefit through placement in Harborside’s dispensaries, and Sublime increases Harborside’s manufacturing capabilities for its existing brands.

The purchase price, representing approximately 1.78X estimated 2021 Sublime revenues of $24.6 million, appears attractive given the additions to Harborside’s vertical integration, a fast-growing and market-leading brand as well as possible acquisition synergies.

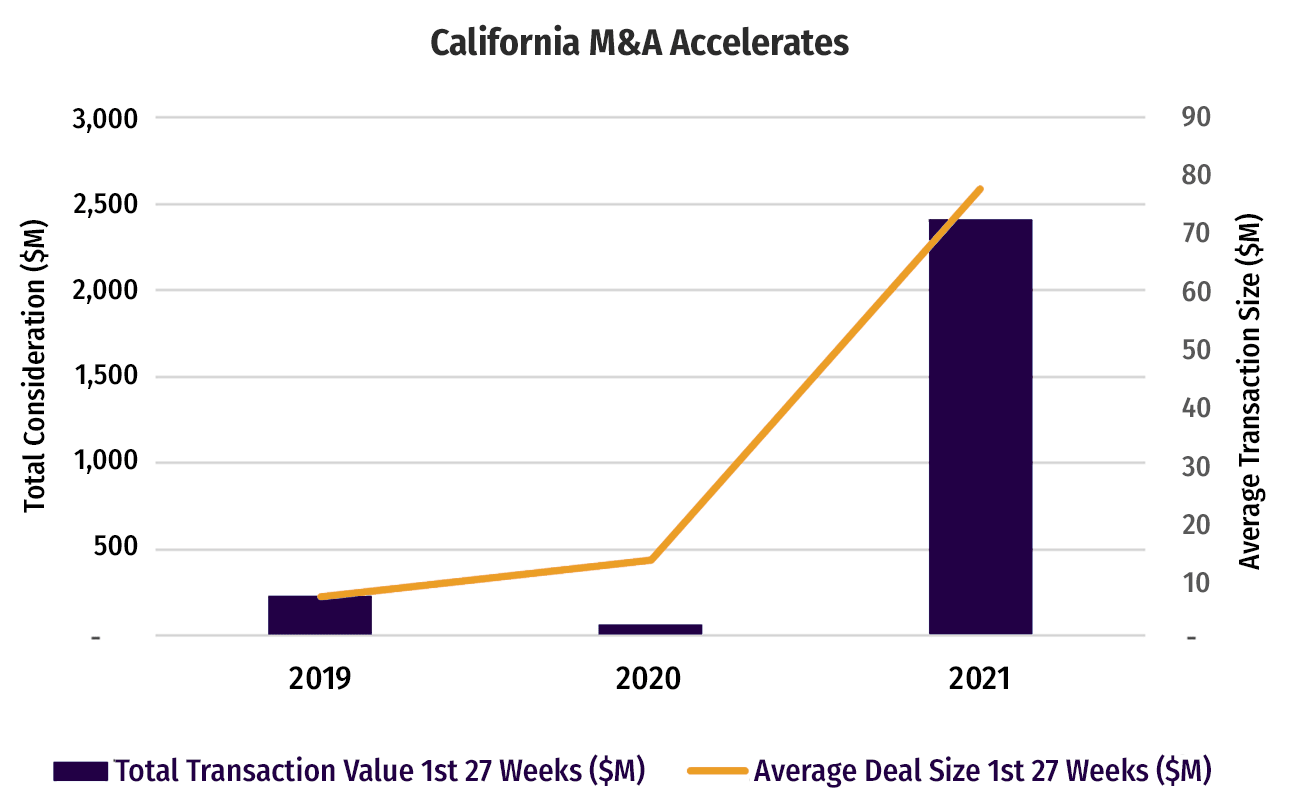

The transaction also is further evidence of the acceleration of California targeted M&As we have observed, as shown in the graph above.

Cannabis companies have munchies for debt but few options

Cannabis is booming. Legal consumer demand is outpacing even the rosiest of projections, and the race to gain market share is happening at breakneck speed.

But the lack of debt capital available to fund projects is curtailing expansion. Commercial banks, with the exception of state-chartered banks, have been hesitant to lend, while traditional debt funds have shied away from the sector because of their investors’ policies.

As long as cannabis remains federally illegal, finding institutional debt capital to support the sector will remain challenging.

Luckily, a new class of lenders has emerged to fill the void.

This new class of aggressive and opportunistic investors now leads the biggest financings to the largest multistate operators. But with only a handful of players in the market, is the debt they provide enough?

In traditional debt markets, lenders either lend to the collateral value or base their loan off the entire enterprise value (EV) of the business (cash-flow lenders). To date, asset-based lenders have dominated lending to the sector. Part of this is driven by risk tolerance, but funding mechanisms also play a role.

AFC Gamma (NASDAQ: AFCG), a real estate investment trust (REIT) led by longtime middle-market industry vets, has a structure that allows it to be public and pay out profits like a business development company (BDC).

However, unlike a BDC, a REIT is more collateral-focused and underwrites to the collateral value as opposed to the EV.

In more traditional leveraged buyouts (LBOs), debt can support up to 60%-65% of the purchase price, meaning if a business is worth $100 million (10X $10 million of EBITDA), then the leverage markets would support $60 million-$65 million of the purchase price, with equity filling out the rest of the capital structure.

As the buyouts season, the debt-to-capital ratio comes down through repayment of loan principal and EBITDA expansion. A seasoned buyout three years down the road is probably closer to 40%-50% debt-to-capitalization.

The shortage of debt capital available to public MSOs has resulted in capital stacks long on equity and short on debt. The average debt-to-capitalization is just over 10%, meaning all these businesses have substantial debt capacity to fund their aggressive expansion plans.

The problem, however, is that the cannabis lending market is still playing catch-up. Cannabis lenders are still largely underwriting to collateral value, not enterprise value.

So, while these businesses trade at 20X-30X trailing 12-month EBITDA from an EV perspective, the debt available to support a buyout is limited to the collateral value. Companies need to over-equitize deals since the collateral value (i.e., debt capacity) is well short of 50-60% of the enterprise value.

The good news is that the lending markets will continue to evolve.

The entry of new lenders into the sector has undoubtedly helped fuel its spectacular growth, but institutional capital is needed to support the true enterprise-value lending that is sorely needed.

And as competition steps up, lenders will undoubtedly look to stretch past the collateral value, which over time will inch its way closer to the enterprise value.

– Tom Lesch heads the U.S. Debt Advisory practice at Livingstone Partners and Sharp Capital Advisors.