Medical cannabis businesses in Florida – many still reeling from the aftereffects of Hurricane Ian – have options to help recover from the costly physical and financial damage caused by the deadly storm.

Property-insurance claims, business-interruption coverage and coverage for extra expenses – such as backup generators, cleanup equipment or facility rentals – should be available to most state operators, experts told MJBizDaily.

In addition, operators whose cultivation operations were damaged can purchase product on a wholesale basis, if needed.

Still, recovering from the fallout won’t be easy.

Cannabis operators should expect pushback from their insurance providers, according to Michael Sampson, a Pittsburgh-based attorney who specializes in insurance issues for marijuana companies and other businesses.

“Insurance companies – unfortunately in my experience, especially when confronted with large, mass-scale losses – will often look for basis to deny coverage,” said Sampson, who represented hotel operators in the aftermath of Hurricane Katrina, which killed more than 1,800 and caused tens of billions of dollars worth of damage to New Orleans and surrounding areas in 2005.

Estimates put the damage caused by Hurricane Ian at $70 billion or more.

Republican Sen. Marco Rubio is asking for a federal emergency aid package of $33 billion.

More than two weeks after the storm, dozens of Florida cannabis businesses remain shuttered or are operating under limited business hours.

Looking ahead, Florida cannabis companies are expected to face steeper premiums and fewer insurance options.

Tips after a natural disaster

Sampson, a partner at Leech Tishman, recommends the following steps cannabis companies should take in Florida or other areas after a natural disaster:

- Review property-insurance coverage, particularly how damages and payments are calculated.

- Provide prompt notice to insurance providers and adhere to other contractual notice requirements.

- Keep detailed financial records and provide visual evidence documenting property damage, inventory/product losses and income losses.

If an insurance company denies a claim, Sampson urges policyholders to fight back and seek legal counsel.

“Insurance companies are banking on policyholders taking no for an answer,” he said.

“It’s really important that policyholders stand up for themselves and make sure they get the full benefit of the coverage they purchased and expected.”

Sampson has seen insurance providers try to deny claims to policyholders simply for being in the cannabis industry, a move with no merit legally or contractually.

“There’s nothing about a cannabis-related business that ought to preclude recovery of insurance,” he said.

Beyond insurance claims, Sampson advises Florida cannabis companies to review their commercial contracts, particularly the bearer of responsibility after an “act of God,” or force majeure, in legal parlance.

Operators should also examine rental agreements, he said, especially if the property was damaged or destroyed.

“It’s possible that a dispensary, if it’s renting space from a landlord, could be included on that landlord’s insurance policy or could have rights under that landlord’s insurance policy,” Sampson said.

A special allowance

In Florida, cannabis cultivators and dispensaries, known as medical marijuana treatment centers (MMTC), have a unique option to recoup product losses after a natural disaster or other significant operational disruption.

If a cannabis company can prove a “harvest failure,” it can establish a product supply agreement with another operator – essentially allowing the impacted business to purchase marijuana on a wholesale basis.

The state defines a harvest failure as a “catastrophic loss of growing plants that presents a substantial risk of severe impact of a MMTC’s ability to supply patients with low-THC or medical cannabis products.”

Florida operates under a vertical-integration model, essentially requiring companies to handle all aspects of the business, from cultivation to retail sale – a definition that effectively nullifies wholesale agreements.

A harvest failure triggers an exception to the rule.

More on Hurricane Ian's impact

- Florida cannabis companies assist employees, residents after Hurricane Ian

- Hurricane Ian forces Florida marijuana companies to close as operators assess fallout

Vijay Choksi, a West Palm Beach, Florida, attorney who represents multistate operators and other MMJ license applicants, is fielding inquiries from suppliers eager to offload product to companies hit by Hurricane Ian.

“I’ve been fielding calls with some, just trying to play matchmaker here,” said Choksi, counsel at Fox Rothschild, which has offices nationwide.

If parties agree on a deal, they file a so-called variance request with the Florida Office of Medical Marijuana Use, the state regulator.

Filers must document losses through tracking software and other records, according to Choksi.

“It’s just an immediate remedy that not a lot of people know about,” he said.

Assessing the damage

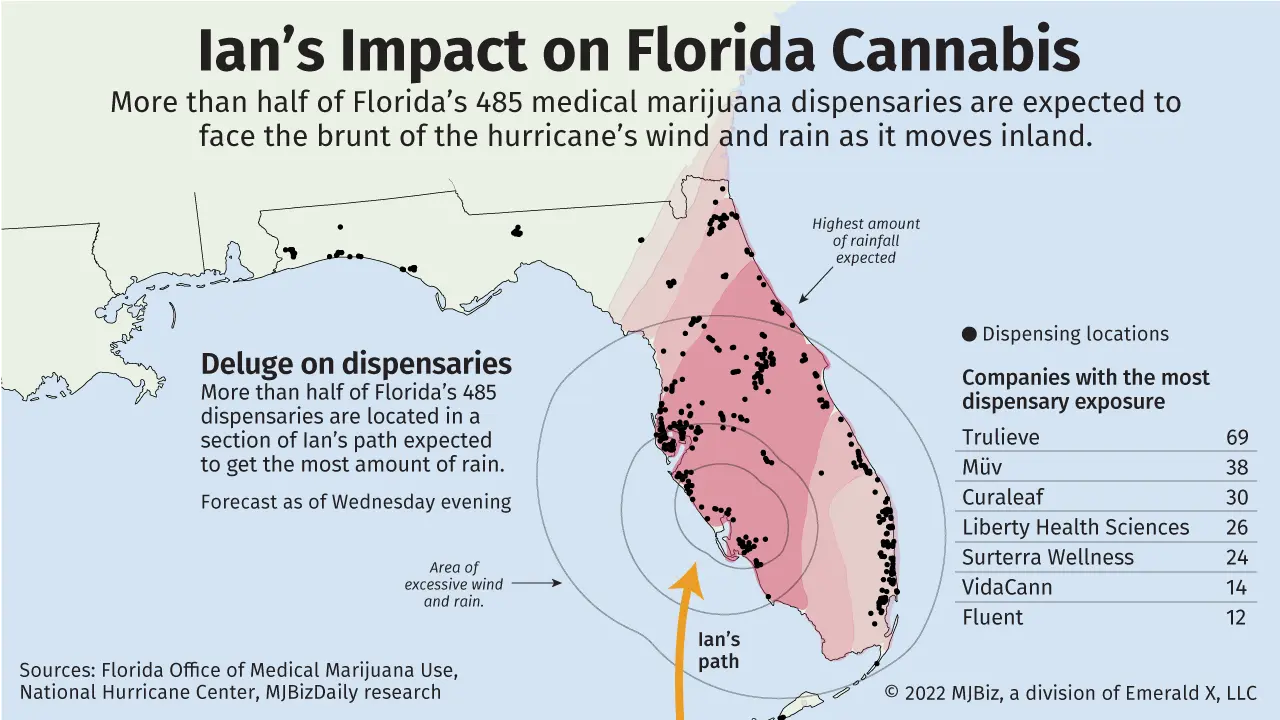

Hurricane Ian wreaked havoc among Florida medical marijuana businesses, and some are still dealing with the fallout.

Liberty Health Sciences, a unit of Miami-based multistate operator Ayr Wellness, announced in a Sept. 30 Twitter post that seven of its stores would remain closed until further notice.

As of Friday, Liberty’s dispensaries in Cape Coral, Port Charlotte and Sebring remained unopened.

During the height of the storm, the company closed 39 of its 51 dispensaries.

MÜV, owned by Illinois-based multistate operator Verano Holdings, has reopened the roughly 30 dispensaries it shuttered, or nearly half its network of 59 stores in Florida.

“Our vertical operations are fully back online,” President John Tipton confirmed.

The hurricane, which decimated large swaths of Florida’s Gulf Coast, delayed manufacturing for Miami-based Fluent and pushed the company to reroute medical marijuana distribution.

The storm also forced the closure of 15 of Fluent’s 28 dispensaries at one point. The company told MJBizDaily on Oct. 14 all of its locations have reopened.

“Through the team’s remarkable resilience, most Fluent stores were able to open quickly and safely, despite complications requiring some locations to operate off the grid with no power or internet,” Fluent CEO Robert Beasley said.

On Sept. 29, the day after Hurricane Ian made landfall in Florida, MJBizDaily reported that more than 100 marijuana businesses in the state were shuttered as operators assessed employee safety, flooding, structural damages and mass power outages.

At their peak, the outages affected 2.6 million residential and business customers.

Less options, higher costs

The destruction of Hurricane Ian, coupled with ongoing regional business dynamics, will likely cause Florida cannabis operators to face higher insurance premiums and fewer coverage options, industry experts told MJBizDaily.

“In places like Florida, it is hard to find good insurance providers for catastrophic risks like hurricanes, because of the intensity and frequency of these events,” said Mauricio Comi, who leads the recently launched insurance division for Dutchie, an Oregon-based technology services provider for the marijuana industry.

“After an event of this scale, insurers lose a lot of money so it is very likely that prices for hurricane and flood insurance will go up.”

Comi provided a checklist for business owners to consider to mitigate risk in endangered areas:

- Location: Coastal and low-lying areas are more susceptible to damages.

- Construction quality: What is a structure’s ability to withstand wind, hail and water?

- Processes: Businesses should have contingency plans to protect their building, employees, inventory and other assets.

- Catastrophic insurance: Though expensive, this coverage can potentially save a business against natural disasters such as earthquakes, floods and hurricanes as well as riots or terrorist attacks.

The decadeslong exodus of property-insurance providers from Florida has left scant options for mainstream businesses, let alone marijuana operators, who face higher regulatory requirements, scrutiny and restrictions.

“No one wants to underwrite here,” Choksi said.

The Florida Legislature in 2002 even created a state-run, nonprofit property insurance agency for property owners who couldn’t secure coverage in the private market.

“It’s like the insurer of last resort,” Choksi said, “and they’re not touching cannabis, of course.”

Chris Casacchia can be reached at chris.casacchia@mjbizdaily.com.