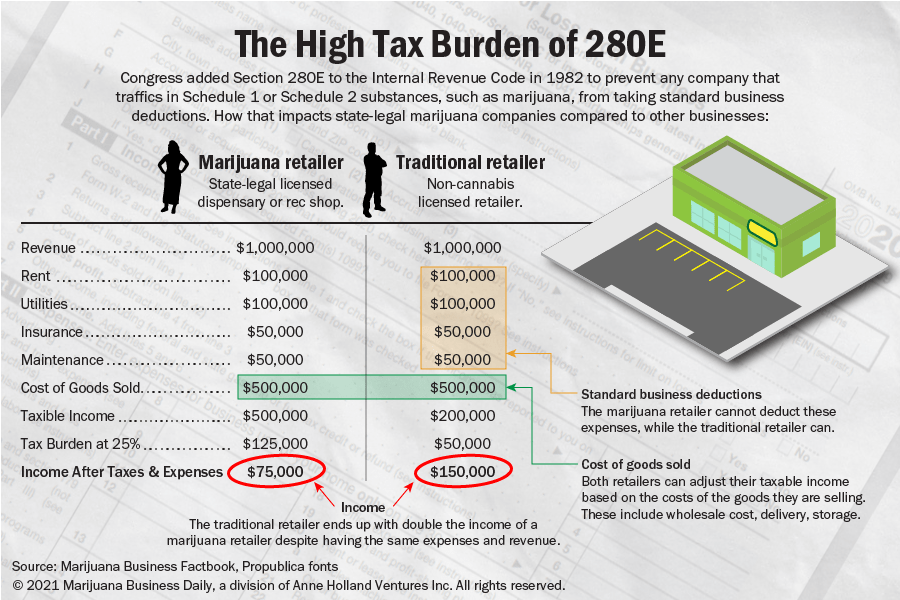

(The “Maintenance” line in the graphic above has been adjusted. The totals did not change.)

(This is the introduction to a special series revealing key elements of more than 200 pages of internal IRS documents obtained by Marijuana Business Daily related to the enforcement of Section 280E of the federal tax code and the cannabis industry. The documents can be accessed here.)

The Internal Revenue Service has been fixated on the state-legal marijuana industry for more than a decade, largely because it’s been extremely lucrative for the federal agency to audit cannabis companies.

IRS audits of marijuana businesses have generated far more in unpaid taxes, or revenue, per hour for the agency than audits of mainstream industries such as automobiles – up to four times more in certain cases.

Tax agents also have become more adept over the past decade at enforcing Section 280E of the Internal Revenue Code, which prohibits the use of standard business deductions by any company that traffics in federally controlled substances.

Section 280E commonly results in state-legal marijuana businesses paying upwards of 80%-90% in federal tax rates and sometimes as much as 100%.

And it appears the IRS is unlikely to alter its stance toward the marijuana industry anytime soon.

As the U.S. Department of Justice made clear in a February legal filing with the U.S. Supreme Court, President Joe Biden’s young administration has no intention of backing off from 280E enforcement.

More in this series

- 280E is a political weapon targeting marijuana companies, but there may be a fix

- Confidential IRS marijuana guide details audit procedures for agents to follow

- Documents reveal how IRS became more adept at evaluating marijuana company taxes

- A primer on marijuana-related IRS terminology

In short, the IRS has studied and refined its methods for examining marijuana industry tax returns – and, in the process, cracked down on tax deductions – such as employee wages – by cannabis businesses the agency believes are prohibited by law under 280E.

That, in turn, has resulted in almost nonexistent profit margins and/or multimillion-dollar federal tax bills for many cannabis companies, a trend that will likely continue until the federal government legalizes marijuana.

That assessment is based on an analysis of 212 pages of internal IRS documents obtained through a Freedom of Information Act (FOIA) request by Marijuana Business Daily.

To get a professional analysis of the documents and their significance, MJBizDaily shared the documents with three attorneys who have extensive cannabis industry and federal tax law experience.

Most of the documents have not been made public until now.

They offer an unprecedented glimpse into the inner workings of the IRS and its cannabis dealings, as well as hints of what marijuana business owners can expect the next time the tax man knocks on their doors.

“It’s a peek behind the curtain,” Denver-based tax attorney Nick Richards, a former IRS lawyer who has worked with marijuana businesses since 2013, said of the documents.

The documents detail how IRS agents have reported for years that auditing marijuana companies is a better return on investment for Uncle Sam than comparable audits involving mainstream industries.

In one series of industry audits in California that concluded in 2015, the IRS found the average cannabis industry audit resulted in $2,788 per hour in taxes owed to Uncle Sam compared with an average of $686 per hour for other businesses that were also considered good audit targets.

“It clearly indicates that the IRS is interested in auditing the cannabis industry. What we see in here, from the results … is they feel like they’re getting good bang for their buck,” Richards said.

In fact, at least two IRS agents suggested in written reports that the tax agency should start a national program to broaden the scope of marijuana industry audits.

The IRS office of public affairs answered certain questions from MJBizDaily for this series but left many others unanswered.

The agency did email the following statement:

“The IRS recognizes the marijuana industry is growing and is assessing the training needs of its employees, determining the appropriate compliance actions, and increasing taxpayer awareness. The IRS wants cannabis business owners to be educated on their tax obligations and provides information for them to be compliant. It’s important to note that federal courts have consistently upheld (IRS) determinations that state compliant marijuana dispensaries have taxable income.”

In the meantime, IRS audits and tax bills remain an ongoing challenge for cannabis businesses. Protracted legal battles have erupted over 280E, with the U.S. Tax Court typically siding with the IRS.

Other highlights

The documents offer a wealth of additional details on how the IRS views and handles both 280E and cannabis industry operators.

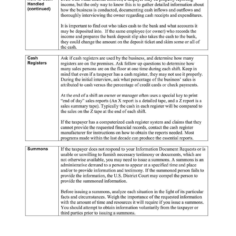

For example, they provide never-before-disclosed information about how the IRS has been training its agents on the ins and outs of the marijuana industry through PowerPoint presentations as well as a previously confidential 30-page Participant Guide that instructs IRS agents on the finer points of auditing cannabis businesses.

The Participant Guide and training materials include suggestions on how to obtain as much information from cannabis business owners before they hire attorneys to represent them during audits.

“The most effective audit technique for obtaining income information is the interview with the taxpayer,” the Participant Guide instructs IRS agents.

“As many taxpayers hire representation after the initial interview, it may be the only chance you have to talk directly with the taxpayer.”

The documents also provide details on at least four extensive marijuana auditing programs, known as Compliance Initiative Projects (CIPs), which began in 2010 and were run by the IRS in California and Colorado.

The first California CIP was even expanded in 2013 to include cannabis companies in Arizona and New Mexico – based on the IRS documents – because both states had operational MMJ dispensaries by that point.

The CIPs focused on marijuana company compliance with 280E.

The release of the documents follows a federal watchdog report by the Department of the Treasury last spring.

That report – written by the Treasury Inspector General for Tax Administration (TIGTA) – foreshadowed a likely uptick in marijuana industry audits by the IRS.

But it also criticized the agency for not making public the Participant Guide obtained by MJBizDaily.

Similar documents, compiled for other mainstream industries – and identified by the IRS as Audit Technique Guides – are commonly shared with the public so taxpayers can more easily comply with their federal tax obligations.

The coronavirus pandemic, meanwhile, might have given the IRS some cover as to why it hasn’t yet released the Participant Guide – or any other written tax policies or guidance – for the industry.

An IRS attorney said in January that written guidance on 280E compliance for cannabis companies has been put on the agency’s back burner for now in light of the ongoing health crisis.

That makes MJBizDaily‘s publication of the documents even more timely for marijuana businesses hoping to avoid running afoul of the IRS.

But it’s worth noting that many of the documents are years-old and don’t necessarily reflect recent legal cases or precedents that have been set by court rulings in cases, such as a California one involving San Jose Wellness in which the subsidiary of Oakland-based Harborside lost a fight against the IRS and was ordered in February to pay $4.2 million in back taxes.

There’s also Harborside’s loss in a 2018 U.S. Tax Court ruling. Yet, that outcome represented a partial victory because the company wasn’t forced to pay $11 million in penalties – despite losing the primary challenge to the constitutionality of 280E.

Another 2018 ruling, from a case started by Alternative Health Care Advocates in California, also reinforced the IRS’ position on 280E.

Alternative Health had attempted to avoid 280E by hiring a management company to run its operations. The result of that case was a broadening of the scope of companies to which 280E applies, aside from only plant-touching businesses.

None of those cases are mentioned or addressed in the documents obtained by MJBizDaily.

“That’s important stuff,” Richards said, noting that the absence of those cases in the documents suggests that the IRS is still likely updating its 280E training and reference materials for agents.

To San Francisco-based attorney Henry Wykowski, who represented Harborside and several other marijuana companies in landmark U.S. Tax Court cases and legal battles with the IRS, the fact that the agency has kept its cannabis industry Participant Guide secret is yet another example of the double standard under which the industry labors.

“Here, once again, we’re being discriminated against,” Wykowski said. “What’s so secret about this?”

IRS still evolving on 280E

Above all, the documents underscore that the IRS has been dedicating significant resources to ensuring that as many cannabis companies as possible pay as much taxes as the agency can require under the legal umbrella of 280E.

They also highlight how the IRS has been evolving over the past decade in the way it approaches and deals with state-legal marijuana companies.

The situation isn’t without irony.

The documents detail an effort by the IRS to compel an industry – one that is illegal under federal law – to obey U.S. tax laws and pay its taxes.

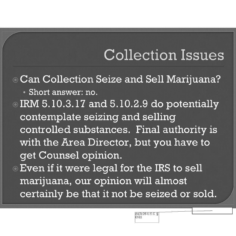

To drive that point home, multiple PowerPoint training documents make clear that IRS attorneys seriously weighed the option of seizing marijuana from companies that were behind on their tax bills.

Although the practice of seizing and selling off assets from tax-delinquent businesses is within the norms of IRS procedures in mainstream industries, it’s likely eye-opening to many in the cannabis sector that federal agents would even consider trafficking in a federally controlled substance.

That possibility was ultimately dismissed, primarily because the IRS wouldn’t be able to sell marijuana it seized.

The training documents also contain suggestions – which Richards and Wykowski said would be seen as absurd to anyone with a working knowledge of the industry – that IRS agents could calculate revenue generated by indoor marijuana grow operations by examining their utility bills.

What that underscores, however, is how federal agents have struggled to figure out the correct balance for dealing with:

- The disconnect between federal law and the many states that have legalized marijuana.

- An industry that historically has been averse to keeping sound financial records for fear such documentation could be used against them.

“This is a good example of that tension between state and federal illegality, that the IRS is struggling to make the best procedures and policies they can,” said Katherine Allen, a tax attorney with Wykowski Law.

The rest of this series will dive into further analysis of the Compliance Initiative Projects, the audit Participant Guide and IRS training materials for its agents – as well as what all of this might portend for the future relationship between the tax agency and state-legal marijuana companies.

Has your cannabis company been audited by the IRS? If so, we’d like to hear about it. Contact John Schroyer at john.schroyer@mjbizdaily.com.

(This series would not have been possible without support from several Marijuana Business Daily staff members, including Roger Fillion, Andrew Long and Jenel Stelton-Holtmeier.)