A new report from a branch of the U.S. Treasury Department confirms the Internal Revenue Service is preparing to launch an increase in marijuana industry audits nationwide, but it also offers a possible way for cannabis companies to dodge millions in federal taxes, according to industry experts.

The report corroborates what cannabis industry tax and legal experts have warned about for months – that the IRS is closely watching the marijuana industry and intends to target companies that have failed to pay their full federal tax obligations.

In other words, the agency plans to enforce the collection of those taxes.

The report – written by the Treasury Inspector General for Tax Administration (TIGTA) – found there are likely hundreds of millions of dollars in unpaid taxes owed by the marijuana industry under Section 280E of the Internal Revenue Code, which prohibits standard business deductions by companies that traffic in federally illegal drugs, including marijuana.

“Without a national (program) to address this high-risk industry, the IRS will be unable to accurately determine the overall noncompliance risk associated with taxpayers within this industry, let alone the accuracy of their reporting compliance with the limitations of … 280E,” the report stresses.

But the report also found there could be a major loophole tucked inside a Republican tax bill from 2017, the Tax Cuts and Jobs Act, that might allow marijuana companies to escape the burdens of 280E altogether.

The problem: It will likely take years of litigation before any legal clarity is reached. But the potential loophole still offers a silver lining for the industry.

The more immediate concern for the cannabis industry will likely include an onslaught of IRS audits, two longtime tax experts said.

“The tsunami is about to begin,” Nick Richards, a Denver-based tax attorney and former IRS trial lawyer, wrote in an email to Marijuana Business Daily.

San Francisco-based attorney Henry Wykowski, a former federal prosecutor who has represented marijuana businesses in IRS fights for years, said his message to the industry is simple:

“Buckle up. We’ve been expecting something like this.”

In 2019, Richards predicted such an increase, and now it’s in the works, according to the report.

The only question is when it will begin. Barring any coronavirus-related delays, it will probably start this year, both experts agreed.

Report’s findings

The report, based on an audit of cannabis companies in California, Oregon and Washington state for the 2016 tax year, found a “high rate of noncompliance” with 280E:

- 59% of marijuana company tax returns had “likely” underpaid the federal government under 280E.

- There was an estimated $48.5 million in unpaid taxes from marijuana companies in those three states.

- Projected forward five years, the agency calculated $242.6 million in unpaid taxes from marijuana businesses.

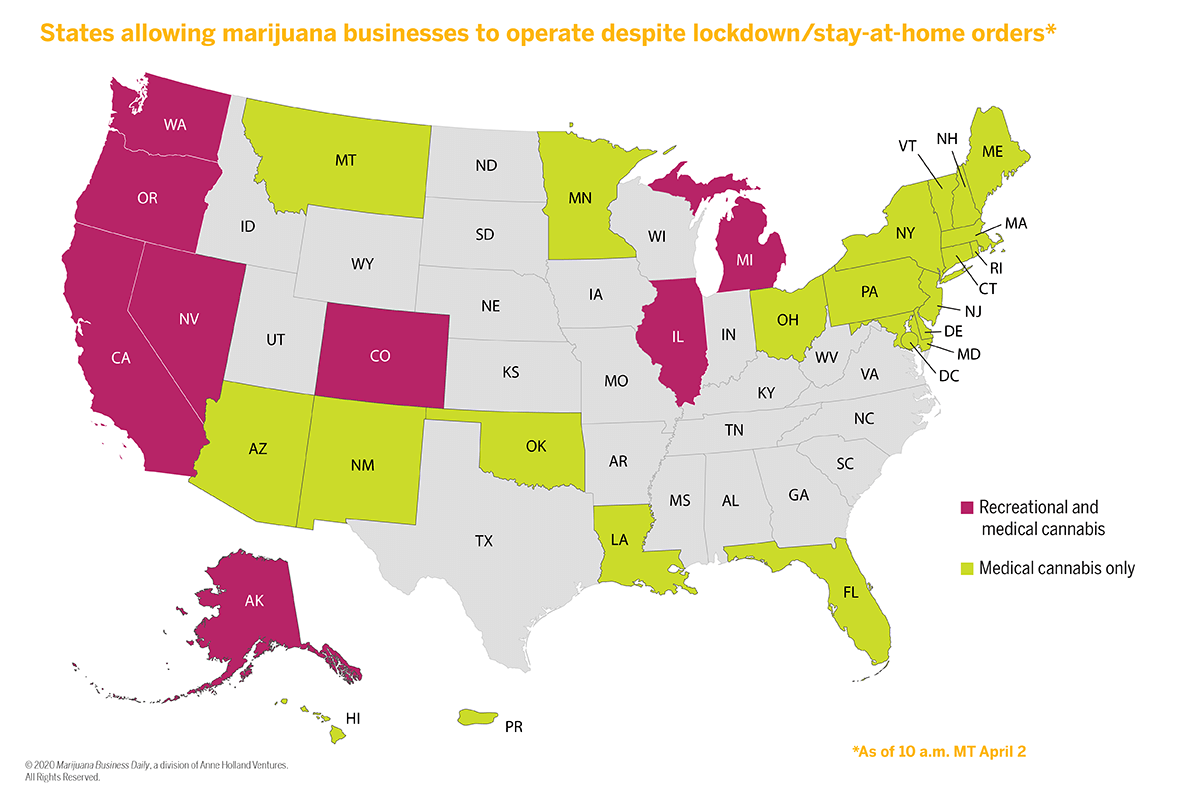

“This forecast represents only a portion of the tax noncompliance related to … 280E in that it only includes three out of 33 states and the District of Columbia,” the TIGTA report reads, referring to the number of states that have legalized marijuana commerce, along with Washington DC.

That means over the long haul the industry could find itself on the hook for hundreds of millions of dollars in federal taxes, Richards said.

“I don’t see that as unreasonable” to conclude, he added. “TIGTA definitely has influence over the IRS, and the IRS is driven by dollars.

“They’ll look at this and say, ‘We have to do more cannabis audits.’”

The report further outlined that the IRS has been going to great lengths to monitor marijuana companies nationwide, with internal programs called Compliance Initiative Projects (CIPs).

Also, the agency has been distributing among its ranks a “Participant Guide” that “provides (IRS) agents with guidelines on how to audit marijuana businesses.”

The document has not been made public, TIGTA noted in its report, despite its own recommendation that the IRS release it.

The CIPs began in 2016 in Colorado and then expanded across the country, with marijuana-related CIP trainings performed for IRS agents in “Seattle, Portland, Northern California, Nevada, Phoenix and Detroit,” according to the report.

TIGTA recommended the CIPs be expanded nationally, and its report indicates that’s what the IRS plans to do.

“The objective of the national CIP should focus on creating a comprehensive compliance approach to identify noncompliant taxpayers in this industry,” the report notes. “The IRS agreed with this recommendation.”

The loophole

The bright side of the TIGTA report focuses on an obscure federal law, Section 471(c) of the 2017 Republican tax reform bill, which could let marijuana companies with less than $25 million in gross receipts escape 280E completely.

According to the report, “Under this new provision, marijuana businesses could argue they are entitled to use a method of accounting that includes all expenses in cost of goods sold to potentially avoid the impact of … 280E.”

But the report also emphasized that “the potential tax impact of … 471(c) for marijuana businesses will be based on how the IRS applies and administers this new statute as well as, potentially, how the courts interpret it.”

That means some cannabis company is going to have to test the waters with a federal tax return and see how the IRS – and likely the U.S. Tax Court – responds. That process would likely take a year or longer, Wykowski and Richards agreed.

“I haven’t come to a conclusion in my head whether I would advise people to take the position that 280E doesn’t apply at all. But boy – it’s tempting,” Richards said.

Wykowski was more circumspect, saying his read of 471(c) is that it “could be significantly helpful, but you have to look at it on a case-by-case basis” for each company that would be filing a tax return.

Critiques of IRS and policy recommendations

The report also was critical of the IRS’ handling of the marijuana industry and 280E – specifically its lack of communication to the industry on 280E applications and parameters – and its recommendations to the IRS include:

- To make the “Participant Guide” for auditors public information, so that marijuana companies can better prepare to follow federal tax law.

- To “develop guidance specific to the marijuana industry” and publish it online.

- To compile “specific guidance on the application of … 471(c) in conjunction with” 280E and to make it public.

- To leverage more state data on licensed marijuana companies “to identify nonfilers and unreported income in the marijuana industry.”

- To increase outreach to the industry, particularly to heighten awareness of possible relief from tax penalties related to cash payments, given the lack of banking options for marijuana businesses.

John Schroyer can be reached at johns@mjbizdaily.com