(You can have cannabis finance content such as this delivered directly to your inbox. Simply sign up here for our weekly MJBizFinance newsletter.)

Use caution with cannabis crowdfunding

Crowdfunding has become ubiquitous, used for everything from launching a new business idea or paying medical bills.

But it also requires “full and honest disclosure” from companies using it to cast a wide net for investors, Gurbir S. Grewal, director of the U.S. Securities and Exchange Commission’s Division of Enforcement, noted in a statement related to charges filed against three individuals involved in cannabis real estate deals.

According to the SEC’s complaint, the individuals failed to register the fundraising effort with the agency and ultimately pocketed the nearly $2 million they collected.

Robert Shumake, Nicole Birch and Willard Jackson made the offerings through two cannabis and hemp companies, Transatlantic Real Estate and 420 Real Estate.

TruCrowd, the fundraising platform that hosted the offering, has also come under fire for failing to “address red flags” associated with the effort.

Under current SEC rules, crowdfunding by established businesses (as opposed to new ventures) is allowed, but this new case highlights that the agency is checking for compliance.

Here are the key things you need to know if you want to use crowdfunding for your company:

- Know your limits: Money raised via crowdfunding cannot exceed $5 million.

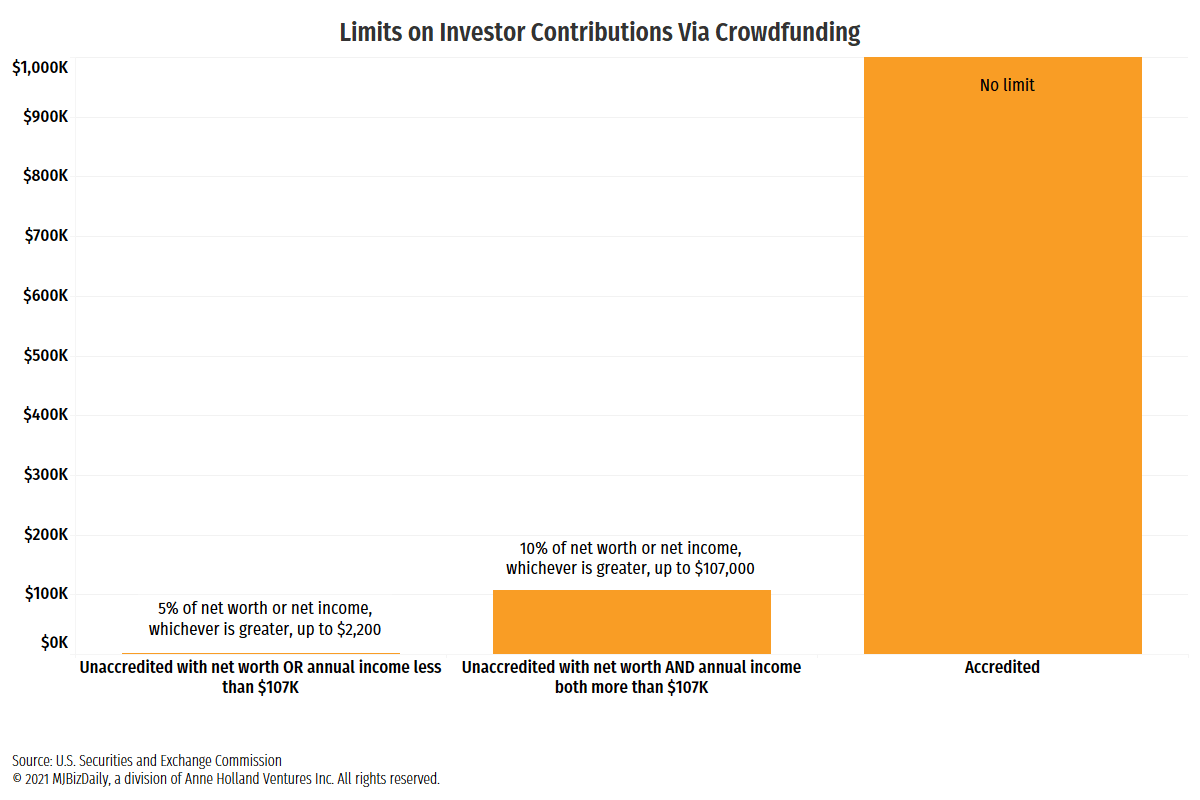

- Know investors’ limits: One of the benefits of crowdfunding is that it provides access to nontraditional investors. However, the SEC places limits on how much an unaccredited investor can add to your pool. Have a mechanism in place to ensure compliance.

- Register your efforts: Companies must disclose to the SEC the name of the company, where it is located and the names of any officers and/or directors associated with the business.

And most importantly, use the funds for their designated purpose. Don’t just pocket the money and go about your merry way.

– Jenel Stelton-Holtmeier

Deal of the Week / In partnership with Viridian Capital Advisors

Glass House Brands preps for future of cannabis cultivation

On Sept. 15, Glass House Brands (NEO: GALAS.A.U; OTCQX: GLASF), a rapidly growing vertically integrated cannabis company, closed its acquisition of a 5.5-million-square-foot greenhouse facility in Southern California.

The deal is part of a strategic vision to provide “indoor-quality flower at very close to outdoor quality cannabis cost,” which aligns with trends that Viridian Capital Advisors expects to intensify over the next few years:

- The move toward greenhouse growing anticipates conditions expected after federal legalization. In a world with interstate commerce for cannabis, high-energy-cost indoor cultivation in less-productive agriculture locations will become disadvantaged. The newer, high-tech greenhouses can provide climate-controlled conditions at significantly lower costs and nearly equivalent quality.

- California is coming to grips with its massive under-penetration of retail locations. The growth that will come from fixing this problem will allow companies such as Glass House to use scale advantages. Ironically, this wave of new greenhouse cultivation comes right after major Canadian companies, including Aurora Cannabis, Canopy Growth and The Green Organic Dutchman, shuttered or sold large greenhouses.

- ESG-based investing is here to stay – and there is no “E” in indoor cannabis cultivation. Concerns about climate change will only accelerate, resulting in eventual movement toward less energy-intensive production techniques.

Deal structure

Total consideration for the property was about $233 million ($158 million without earnouts), including:

- $93 million upfront cash, reduced from $118 million to preserve funds for build-out.

- $65 million in stock (6.5 million shares valued at $10 a share).

- $75 million in earnouts (based on performance for the 12 months commencing 30 months after capital expenditures are completed at the facility).

The facility includes 5.5 million square feet of space across six greenhouses. The capex plan is divided into two phases:

- Phase 1, which will total about 1.7 million square feet and is expected to be completed in the first quarter of 2022, is projected to produce more than 180,000 dry pounds of cannabis, expanding the company’s capacity by 300%.

- Phase 2 will add 2 million square feet and is expected in 2023.

Ambitious growth plans

Glass House Brands became a public company on June 29 when Mercer Park Brand Acquisition Corp. completed a de-SPAC transaction.

The company currently operates 500,000 square feet of greenhouse space in Santa Barbara county. This acquisition will expand that canopy tenfold when the facility is fully built out.

In addition, Glass House now operates four dispensaries and plans to have 23 stores operational by the second half of 2022.

The Glass House Farms brand has a No. 2 market share for flower in California, and the company hopes to continue building on that momentum.

Missteps and corrections

With such a massive expansion plan, some mistakes are unavoidable. But Glass House is taking the approach of full disclosure on the effect of these missteps.

Several examples were highlighted on the company’s second-quarter conference call:

- The company opted to save $1 million-$1.5 million by not replacing the heating system at its Padaro facility near Santa Barbara, which ultimately resulted in reduced yields and higher costs.

- The roof material chosen for the Padaro facility had lower-than-planned light transmission, requiring roof replacement in five greenhouses.