Maine is inching toward launching a projected $300 million-a-year recreational marijuana market perhaps by the fall, nearly four years after residents voted to legalize adult use.

Former Gov. Paul LePage, an adult-use cannabis opponent, stifled early efforts to implement the program.

And now the coronavirus crisis is further delaying the program’s rollout, particularly decisions by municipalities on whether to allow the industry within their borders.

The delays have proved costly. Some cannabis businesses have spent tens of thousands of dollars to secure locations and pay rent while waiting for the market to open.

Here’s where the program stands:

- Fewer than 10% of the state’s nearly 500 municipalities have opted in so far.

- Maine’s largest city, Portland, recently capped retail store licenses at 20 and adopted stricter buffer rules on where retailers can be located.

- Litigation surrounds residency issues both on the state level and in Portland.

- The recreational market was slated to launch in the spring. State officials haven’t announced a new date, but businesses expect program sales could start by the fall.

“You already had folks paying rent. … They followed all these rules and now are being told they might not be able to open,” cannabis consultant Amanda Melnick said, referring to Portland’s evolving rules over the past 18 months.

‘“It doesn’t feel right to cap the market like this when so many people have put their life into creating these businesses and looking forward to being able to have a store in Maine.”

Despite setbacks, bullish signs emerge

But there’s optimism, too.

The municipalities that have opted into the adult-use program include the largest cities in the state: Portland, Lewiston, Bangor, South Portland and Auburn.

Demand is expected to be robust, and businesses believe they’ll be able to compete favorably with neighboring Massachusetts to the south.

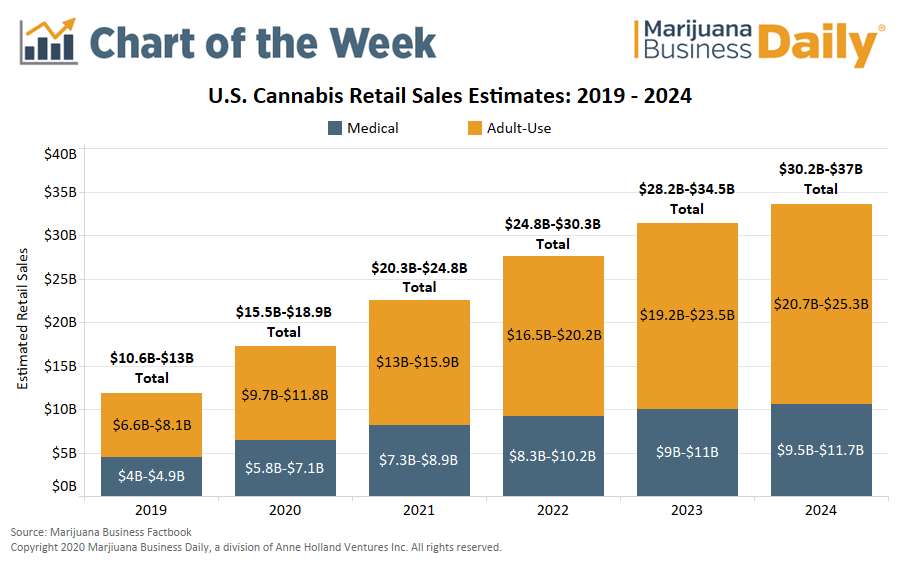

Marijuana Business Daily projects the market will reach $275 million to $325 million a year in sales by 2024, but it’s not an easy market to predict given launch delays, opt-outs and other factors.

In-state customers are estimated to range from 190,000 to 230,000, with stores also expected to benefit hugely from a state tourism industry that, before the coronavirus outbreak, attracted more than 35 million visitors a year.

David Heidrich, spokesman for the Maine Office of Marijuana Policy, told MJBizDaily that the state will identify a retail sales launch date “when it’s clear that we’ll have a testing facility online to support the new industry” and when public health experts deem a market opening is appropriate.

He noted the state recently launched its track-and-trace training for conditional licensees.

A provision allowing licensed growers to move plants from the medical marijuana program to the recreational sector could make things go quickly once the market’s launch date is known.

Portland cap deemed onerous by some

In Portland, many potential cannabis business owners secured their locations months ago in preparation to enter the state’s biggest market and busy tourist center, which is highlighted by cruise ship stopovers and throngs of out-of-state visitors.

But Portland, whose residents overwhelmingly supported legalization in 2016, threw a wrench into the plans by capping retail stores at 20 and enacting a buffer of 250 feet between adult-use outlets or medical marijuana dispensaries.

“Everyone expected that Portland was going to be very open when it came to cannabis,” said Melnick, owner of Maine Cannabis Consultants. “We believed that this was really going to be the hub of the market.”

A group is in the process of collecting signatures to try to eliminate Portland’s license cap through a November ballot referendum.

The public database operated by Maine’s Office of Marijuana Policy shows that 17 store locations in Portland already have conditional state approvals.

Another 15 stores at locations “to be determined” have received state conditional approvals. Many of those business owners have set their sights on Portland, according to industry watchers, meaning the number interested in that city combined with conditional state approvals already exceeds the cap.

Portland’s scoring system favors applicants who have a retail location secured though ownership or a long-term lease, on top of at least $150,000 in liquid assets. That makes it difficult for small players.

“Towns like Portland want to see $150,000 in escrow, and small operators just don’t have that,” said consultant David Boyer, formerly with the Marijuana Policy Project.

“You’re almost asking folks to take on investment capital. It definitely hurts those (recreational-only) folks who aren’t selling medical marijuana now.”

Boyer said some entrepreneurs are sitting on real estate, waiting on applications and battling it out with reluctant municipalities – and “all of this costs money and takes time.”

“The ripple effects are felt, but because Maine has had a slow-to-market approach, I don’t know if it hurts us as much as maybe other states.”

Residency remains a thorny legal issue

The state had implemented a residency requirement but then eliminated the provision after concluding it probably wouldn’t prevail in a legal challenge by Wellness Connection, the state’s largest medical marijuana operator and an affiliate of New York-based multistate operator Acreage Holdings.

A coalition of Maine cannabis businesses is now suing the state to retain the residency requirement.

Then came Portland’s decision to put in place a scoring system that awards additional points to applicants that have been residents for at least five years. Wellness Connection now is challenging that scoring system.

Businesses believe that Maine will have certain advantages once it does launch its adult-use program.

Joel Pepin, co-owner of Jar Co., has been selling medical marijuana at several locations in Maine.

His company now has conditional state approvals for two adult-use cultivation facilities and several retail locations in southern and western Maine, including near the Sunday River ski and golf resort.

“I’m very optimistic about the adult-use market in Maine,” Pepin said. “We already have a robust infrastructure of operators in lots of towns, focusing on different niches, certain strains, good extraction artists.”

Maine, one of the country’s oldest medical marijuana markets, is unusual in that it’s home to literally thousands of caregivers licensed to grow medical cannabis.

Based on taxes paid to the state, Maine MMJ sales exceeded $110 million in 2019 – but as much as 80% of that was due to caregivers.

Pepin noted that Maine has relatively low business costs so he predicts that rec marijuana operators will be able to offer high-quality products at more affordable prices than in Massachusetts, which launched an adult-use market in late 2018.

“I think the challenge for Maine operators is scaling their business,” Pepin said.

As far as Portland is concerned, Pepin said the company has leased retail space that he’s “excited about, a great location.”

But now, because of the cap, “it’s a little bit of a gamble.”

Jeff Smith can be reached at jeffs@mjbizdaily.com