Discounts lead to market-share shift in Florida

Florida, one of the most valuable cannabis markets in the world, is beginning to see competition among the top players – and the state’s patients are reaping the benefits of the undercutting.

Despite the attractive structure of Florida’s limited licensed medical program, described recently in MJBizFinance, few operators have been able to challenge Trulieve’s dominance.

The company has held a greater than 50% average market share since the program began.

However, other top multistate operators are now turning their focus to the state. And according to MJResearchCo’s weekly price checks, the MSOs are undercutting their peers on price while expanding product selection for patients in order to gain market share.

This resulted in a 20% decline in market share for Trulieve and a 29% gain for Curaleaf, Parallel/Surterra Wellness, Verano and Ayr Wellness, collectively.

Liberty Health Sciences, which was recently acquired by Ayr Wellness, gained market share by attracting customers with “flash sales,” and the company plans to keep these patients with consistent quantity and quality across a consumer-friendly platform.

Even without the discounts, many of Ayr’s option are more affordable than those of its peers. Ayr Wellness nearly doubled its market share to 9% this year after averaging approximately 5% in 2020.

Similarly, Curaleaf is repositioning its products through price and selection, while using discounting to attract consumers.

The company has run a storewide, 40%-off sale since early June, among other incentives. This has shifted Curaleaf’s product base from near the average price of peers to the affordable end of the price spectrum.

Additionally, Curaleaf in 2021 established one of the widest product offerings of vaporizers and concentrates in the market. The combined pricing and selection strategy allowed the company to capture a 13% market share average in June versus 9% in the first quarter of 2021 and 11.5% in Q2.

While the sustainability of the discount-driven sales for these companies is not yet proven, it highlights the early signs of price-based competition in Florida. This has resulted in the most meaningful change in market-share distribution by operators since the program’s beginning.

The winners of this strategy are the Florida patients, who benefit from lower prices on a growing number of products.

Those at risk from this strategy are the operators in the Florida market, especially leaders such as Trulieve, which will be forced to sacrifice margin to match the lower, discounted prices of its competitors – unless the company can find another compelling value proposition for its customers.

– Analysis by Mike Regan and Colin Ferrian, MJResearchCo (mikeandcolin@mjresearchco.com)

Deal of the Week / In partnership with Viridian Capital Advisors

Hydrofarm continues its acquisition spree

On July 1, Hydrofarm Holdings Group (Nasdaq: HYFM) announced the closing of its acquisition of Aurora Innovations and its organic nutrients and grow media operations.

Hydrofarm utilized a mix of $135 million in cash, $26 million in newly issued Hydrofarm common stock and $21 million of potential earnout to fund the acquisition, bringing the total purchase price to $182 million.

2021 has been the year of acquisition growth for Hydrofarm, as year-to-date acquisitions total approximately $385.1 million, comprised of:

- $323 million in cash

- $38.5 million in stock

- $23.5 million in earnout

Hydrofarm funded these acquisitions with proceeds from a public offering in May 2021. The company has now spent all but $3 million of the $326 million raised.

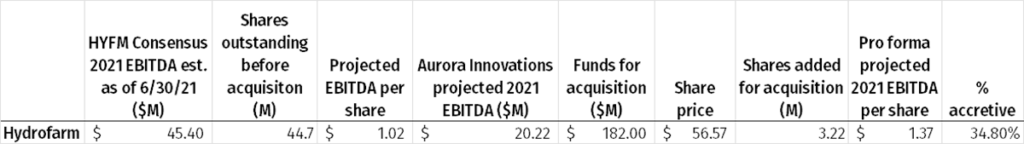

- The purchase price for Aurora Innovation represents approximately 3X the company’s projected 2021 sales and 9X projected 2021 adjusted EBITDA. The chart below analyzes the transaction as though the equity raise that funded the cash portion of the acquisition and the acquisition occurred simultaneously.

- This acquisition is 34.8% accretive to the company based on the pro forma EBITDA per share metric, giving further justification for Hydrofarm’s aggressive acquisition pace. We previously analyzed their last acquisition as 46% accretive to shareholders.

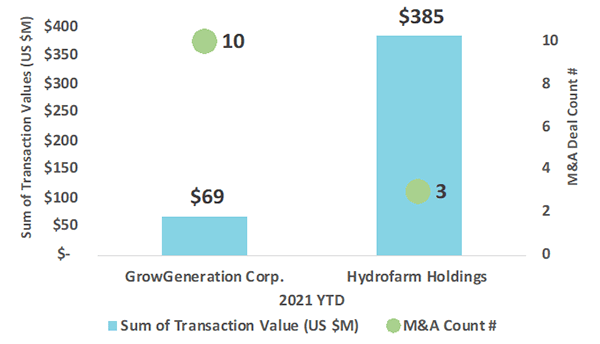

This acquisition adds another tally to what seems to be an acquisition race between Hydrofarm and GrowGeneration. This acquisition represents Hydrofarm’s third in 2021. GrowGeneration completed 10 of the total 14 ag-tech segment deals so far this year.

Although it might seem as if GrowGeneration is leading the acquisition charge, Hydrofarm’s year-to-date aggregate consideration dwarfs GrowGeneration’s year-to-date purchases.

Eight of the 10 purchase prices disclosed in GrowGeneration’s most recent 10Q totaled a mere $68.55 million compared with Hydrofarm’s three acquisitions totaling $385.1 million.

Eight of the 10 purchase prices disclosed in GrowGeneration’s most recent 10Q totaled a mere $68.55 million compared with Hydrofarm’s three acquisitions totaling $385.1 million.

Hydrofarm has utilized a surprisingly high 84% of cash as acquisition consideration in 2021, leaving it with a pro forma cash balance of approximately $65 million a company.

We would not be surprised to see Hydrofarm back in the equity market soon for another load of fuel for its acquisition machine.