(This is the second installment in an occasional series on profits, losses and the burgeoning Canadian cannabis industry. Part 1 is available here.)

The Ontario Cannabis Store said Tuesday it is conducting “a holistic review” of its approach to pricing – including the markup it imposes on private marijuana companies – after MJBizDaily estimated the government-owned wholesaler is the most profitable cannabis business in Canada.

The move comes as some industry sources have complained governments are skimming too much from cannabis producers and retailers in margins and levies, effectively leaving little on the table for anyone else in the supply chain.

In announcing a review of its pricing practices, the OCS cited the need to win over consumers from the illicit cannabis market while providing greater price transparency and a “meaningful return” for the provincial government.

“As Ontario’s retail marketplace continues to grow, the OCS is undertaking a holistic review of its approach to pricing, from structure to margin, to assess whether changes are needed to support illegal market capture objectives, provide licensed producers with greater transparency, and ensure the corporation continues to provide a meaningful return to the province,” the OCS said in a statement to MJBizDaily.

“The OCS is committed to continuing to work with its industry partners to enable a vibrant legal cannabis marketplace in Ontario.”

Late Friday, the OCS announced that its profit more than doubled year-over-year to 184.4 million Canadian dollars ($133 million) for the financial year ended March 31, 2022.

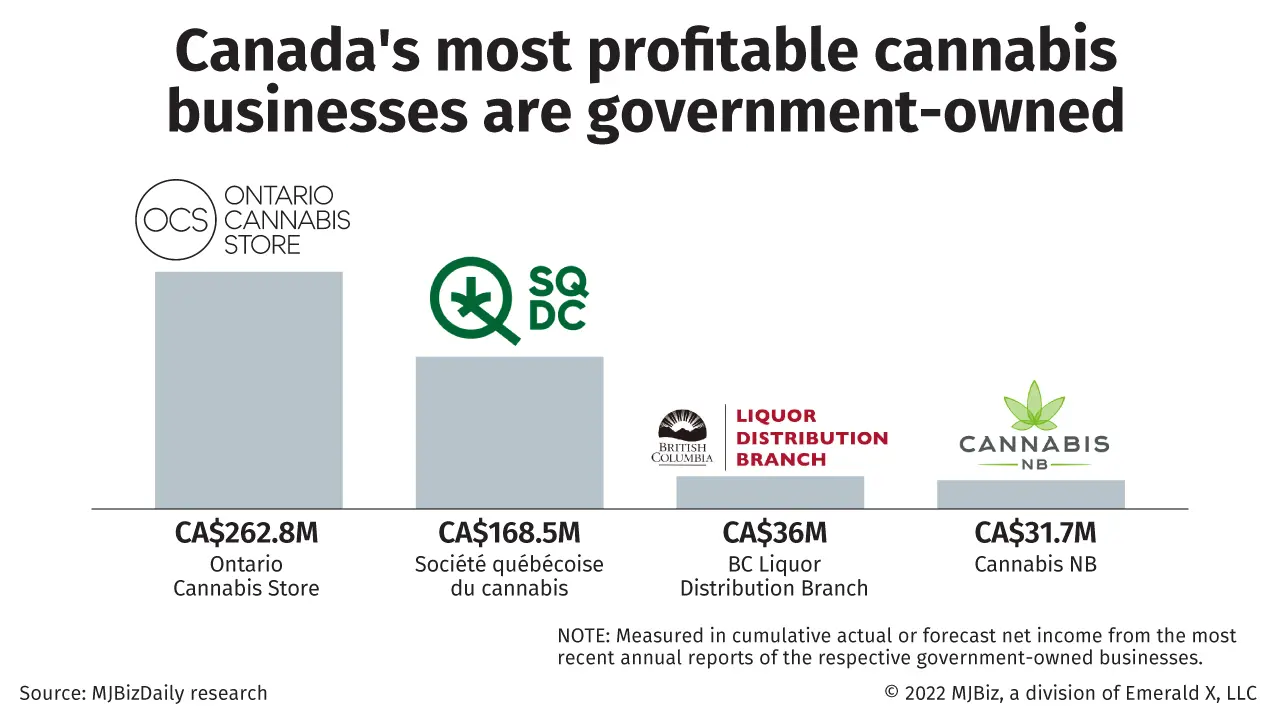

That makes it the most profitable cannabis corporation in Canada since legalization, MJBizDaily previously estimated, using the government’s forecast for the most recent fiscal year.

By contrast, private sector profits have been scarce.

The actual annual income of the Toronto-headquartered monopoly wholesaler easily topped the predicted CA$174 million amid calls from industry stakeholders for the OCS to reconsider the markup the provincial corporation imposes on private cannabis producers and retailers.

Brock University associate business professor Michael Armstrong welcomed the OCS pricing review.

“I think it’s great the OCS is reviewing its pricing policy, and that they are promising to provide more transparency,” he said.

“But I hope the transparency will not just be for producers but for retailers and the general public, on whose behalf the OCS operates as a government agency.”

Growing profits

The OCS’ own profits over the past three fiscal years amounted to CA$273.2 million.

In addition to income generated by the OCS, Ontario has collected, or anticipates collecting, approximately CA$554 million from its portion of the Federal Cannabis Excise Duty from 2018-19 through 2021-22.

The CA$184.4 million in comprehensive income for 2021-22 was the third consecutive annual profit for the Ontario Cannabis Store.

The OCS reported comprehensive income of:

- CA$18.6 million in 2019-20.

- CA$70.2 million in 2020-21.

The OCS reported a small loss in 2018-19.

Overall revenue for the most recent year was CA$1.2 billion, almost double the CA$651.7 million that the OCS brought in during 2020-21.

That also makes the OCS the biggest cannabis business in Canada by revenue.

Wholesale revenue more than doubled versus the previous year to CA$1.1 billion, as the number of stores expanded rapidly in 2021-22.

Sales generated by the Ontario Cannabis Store’s online channel almost halved to CA$72.7 million in the year ended March 31, compared with CA$133 million last year.

The OCS had cash at the end of the fiscal year of CA$386 million, up from CA$166.4 million one year earlier.

Inventory write-downs in 2021-22 amounted to CA$4 million, a relatively small figure considering the OCS paid CA$890.2 million for inventory that year.

Ontario accounted for 40% of Canadian cannabis sales in July, according to the most recent Statistics Canada data.

Growing margins

The OCS does not disclose the markup it applies to purchases from cannabis producers and sells to retailers.

However, Armstrong estimates the OCS markup was approximately 28% last year, rising to 31% this year, after taking the OCS’ online retail unit into account.

The Brock business professor estimates the OCS could charge a markup of approximately 10% if it wanted, just to break even.

“You could charge one-third as much of a markup, and the OCS would still cover its cost,” Armstrong said.

Is the OCS markup too high?

Armstrong said that comes down to business versus public-policy interests.

“If your policy priority is, ‘Hey, we want to make money for the province so the provincial treasury can pay for health care, education or tax cuts,’ then (this is) one way to raise that revenue,” he said.

“On the other hand, if you’re a cannabis retailer or consumer, you might look at the number and ask, ‘Why are they charging so much to provide a service (wholesale) when they could provide the same service for one-third the cost,” he said, noting that retailers and producers are struggling to make ends meet.

Armstrong said the OCS should stop charging a markup on farm-gate sales, adding, “There’s no justification for charging a fee for a service you don’t provide, and the OCS only gets away with it because they have a monopoly power.”

He also suggested the markup applied to cannabis products could be reduced.

Staffing increases

The OCS employed 263 people and enlisted 13 contractors as of the end of March 2022, according to a government filing.

That’s slightly more than the previous year.

However, the OCS anticipates a hiring spree this year will add almost 100 employees, bringing its projected workforce to 360 people next year, in addition to 18 contractors.

The biggest selling, general and administrative (SG&A) expense at the OCS is salaries and benefits, which jumped 16% year-over-year to CA$33 million for the year ended March 31, 2022.

Of that, the OCS said that “key management personnel” accounted for CA$3.5 million, comprising salaries and benefits, director per diems and other short-term benefits.

Matt Lamers can be reached at matt.lamers@mjbizdaily.com.