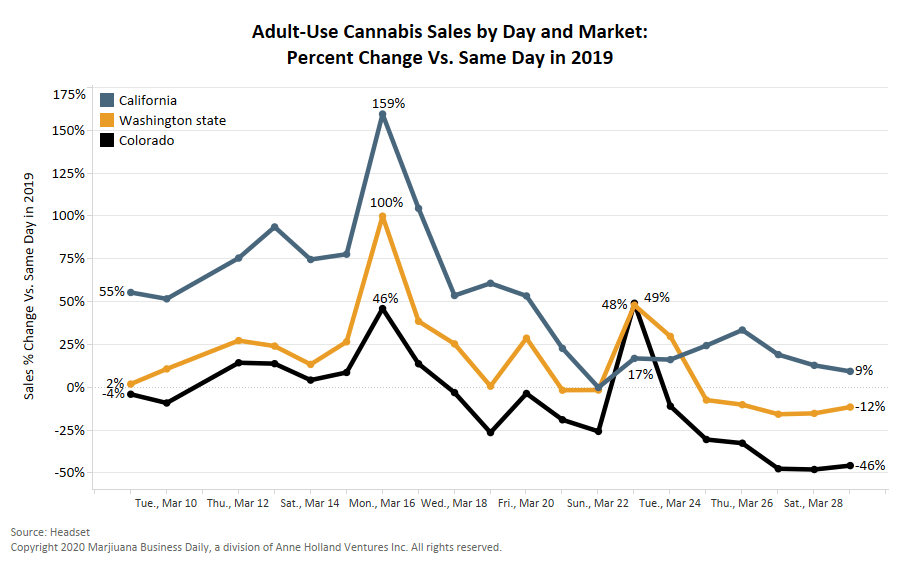

Despite a couple of temporary sales spikes in recent weeks, adult-use cannabis sales in California, Colorado and Washington state are all suffering from the economic fallout surrounding the coronavirus pandemic.

Until now, none of the three adult-use cannabis markets tracked by Headset have experienced declining sales over such an extended period of time.

The latest drops underscore that the coronavirus pandemic has thrust the cannabis industry into uncharted waters, including the growing likelihood of a painful recession.

The slump has been particularly pronounced in Colorado. Sales over the past weekend (Friday, March 27-Sunday, March 29) were down 47% compared to the same weekend in 2019.

Lisa Gee, director of marketing and corporate social responsibility for Denver-based Lightshade, said several factors are behind Colorado’s slump in marijuana sales, including the fact that tourists who typically flock to the state for spring break didn’t show up because of the coronavirus pandemic.

“The entire tourism industry shut down,” she said. “The ski areas officially closed three weeks ago. This would have been spring break, so you’re removing an entire sector.”

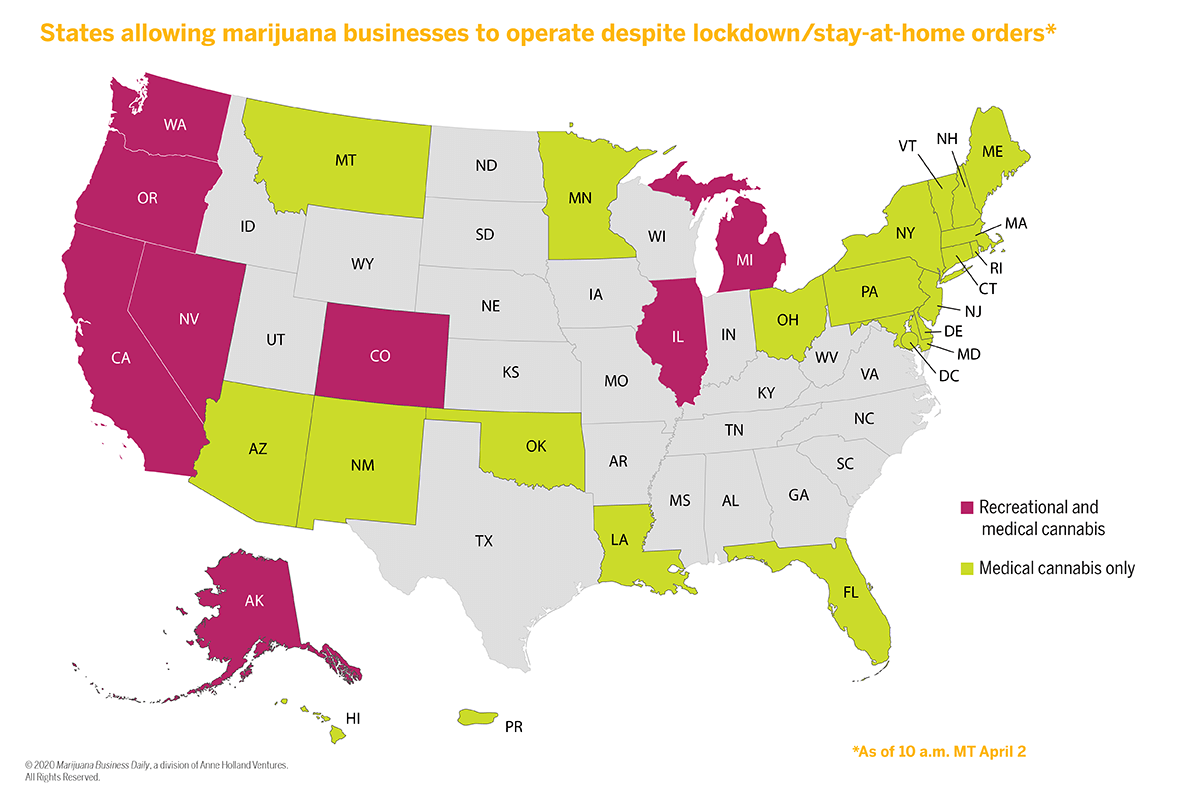

She added that many Denver cannabis consumers briefly stocked up when Mayor Michael Hancock issued a stay-at-home order for the city on March 23 and deemed recreational marijuana businesses nonessential – a decision he reversed a couple of hours later after panicked customers lined up outside cannabis shops.

It’s also likely that people who were laid off are carefully choosing where they spend their money, Gee noted.

“A lot of our customers probably got laid off or they’re worried about their paychecks – or they’re just not spending money right now when their rent is due or their mortgages are due,” Gee said.

Last weekend’s sales were down 14% in Washington state from the same weekend in 2019, a less dramatic decline than what was seen in Colorado but a worrisome figure nonetheless.

“People are coming far less often,” said Anna Shreeve, managing partner of The Bakeréé, which operates two retail marijuana stores in Seattle.

“People are attempting to stock up for two weeks at a time, but it’s difficult because of the limits on cannabis.”

And while sales in California’s market have largely been outpacing 2019 sales throughout the coronavirus crisis, the amount by which they’re exceeding 2019 sales has narrowed significantly from earlier in the year.

For each weekend in January and February 2020, the average amount by which California sales in 2020 surpassed those of 2019 was 68%. Last weekend’s sales in California beat sales for the same weekend in 2019 by 14%.

Sales at Oakland, California-based Harborside have remained steady, said Pedro Fonseca, general manager of the company’s marijuana stores.

As with any retail sector, Fonseca said, there is a J curve in the cannabis industry in which an initial loss is followed by exponential growth, as the data has shown in recent weeks.

“People stocked up, and now they’re waiting a two- or three-week cycle and then they’ll be back shopping,” Fonseca said. “They’ll have to come back to restock. We’ll see a little bit of an uptick but not that panic buying like when this news first broke.”

What remains to be seen, however, is if the current sales downturn will persist for the foreseeable future or if consumers are changing the way they shop for cannabis.

That might involve making fewer trips but spending more each trip in order to minimize time spent in the store.

“We’ve had an increase in delivery and curbside pickups,” Fonseca said.

Eli McVey can be reached at elim@mjbizdaily.com

Margaret Jackson can be reached at margaretj@mjbizdaily.com

For more of Marijuana Business Daily’s ongoing coverage of the coronavirus pandemic and its effects on the cannabis industry, click here.