Brazilian health authorities rejected domestic cultivation of medical marijuana but agreed to permit the distribution of medicinal cannabis products that have not completed clinical trials, potentially setting up one of the largest import markets in the world.

The new rules, adopted Tuesday, allow bulk imports and sales in pharmacies for the first time.

Tuesday’s decision – involving two draft resolutions – amounts to a temporary scheme, a decision comparable to medical cannabis programs in European countries including Denmark, Ireland, France and Germany.

However, companies eager to capitalize on this opportunity will need to overcome restrictions and obstacles that include:

- A ban on flower.

- Expensive Good Manufacturing Practice (GMP) requirements.

- A ban on the use of the word “medical” – or an equivalent one – with cannabis products.

- A ban on domestic cultivation.

- The need for a special prescription for every cannabis product, including those with minimal or no THC.

- A requirement that THC products above 0.2% THC can be authorized only for terminal and “last resort” patients.

- A reluctance among physicians to prescribe cannabis.

This week’s decision by the collegiate directory of ANVISA – the Brazilian Agência Nacional de Vigilância Sanitária, or National Sanitary Surveillance Agency – in effect rejected a proposal to allow domestic cultivation but created transitional rules to facilitate the commercialization of cannabis products.

The move comes after months of public consultation, political intrigue and intense opposition from high-level officials within the government of President Jair Bolsonaro.

The ANVISA resolution creating the new rules is not yet publicly available but is expected to be published in Brazil’s official Gazette later this week.

The rules take effect 90 days later.

Marijuana Business Daily analyzed the decision based on an official announcement published by ANVISA as well as the transcripts justifying the votes.

The new resolution has a “transitional” validity and will be reviewed in three years.

William Dib, ANVISA’s director-president, told local journalists Tuesday that access to medical cannabis will be improved but added that this is “an experimental phase,” indicating that suppliers should pursue clinical trials to generate evidence.

ANVISA is calling the new framework a “regulated transition” and calls on companies to not abandon research to demonstrate the efficacy and safety of MMJ products.

GW Pharmaceuticals’ Sativex is currently the only registered cannabis medicine in Brazil, but the new rules will allow a separate registration of “cannabis products” that have not undergone clinical trials. Also, doctors will be able to prescribe medical cannabis, though the products will not have official “medicines” status.

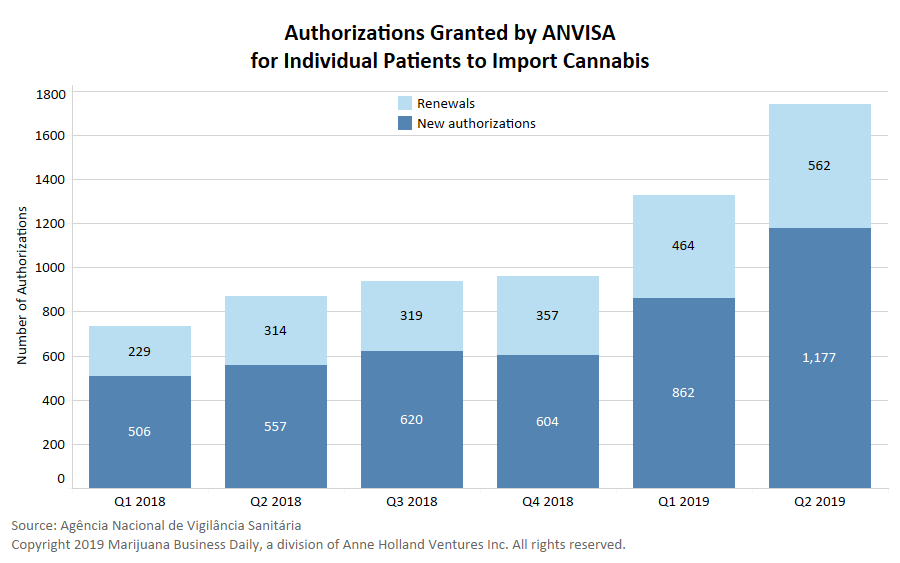

ANVISA already allows imports of nonregistered medical marijuana products on a case-by-case basis. Despite the restrictive framework, the country has the largest commercial medical cannabis market in Latin America.

With commercial cultivation off the table for now, the only way to legally grow medical marijuana in Brazil is to obtain a special permit through the country’s judicial system.

The new rules

Contrary to the original draft proposal, the adopted transitional framework will not require a minimum of Phase 2 of clinical trials to demonstrate a product’s efficacy.

Authorities had originally proposed to allow the registration of medical cannabis products under a more lenient process than other medicines.

However, they modified the text to instead create a separate category for “cannabis products,” establishing certain quality requirements for their registration and prohibiting labeling the products as “medicines” or an equivalent.

Companies will be allowed to import extracts as raw materials for further processing in Brazil.

The importation of plant material or its parts won’t be allowed, meaning patients will not have access to flower.

Manufacturers must have GMP production standards certified by ANVISA. The agency may recognize GMP certifications from other PIC/S members such as Australia and the European Union.

Good distribution and storage practices will also be required.

To register products, companies must provide technical documentation justifying the quality, formulations and routes of administration.

Companies will be required to have the ability to monitor adverse effects on patients in the Brazilian market. Each unit sold will be recorded in a national database that monitors the sale of specially controlled medicines throughout the whole supply chain.

Product labels must include a large warning sign with a black background indicating that the medicine can be sold only under prescription. Companies will not be allowed to cite any therapeutic indication for their products.

If the product has more than 0.2% THC, the package must also include a dependency warning.

Prescriptions

Regardless of THC content, products can be sold only to patients who have a special, numerated prescription controlled by local sanitary agencies.

This makes doctors the gatekeepers for the market, and according to Brazilian newspaper O Globo, the Federal Council of Medicine (Conselho Federal de Medicina) already has said it’s “concerned” about the approval of the new rules for cannabis medicines and is “happy” cultivation was not allowed.

Products with more than 0.2% THC will be sold only to terminal patients or as a last resort to other patients.

Only pharmacies will be able to sell to patients.

Unlike countries such as Colombia, where compounding pharmacies are a necessary step in the supply chain, Brazil’s pharmacies will not be able to manipulate the product. They will sell it only to patients.

Veterinary use, cosmetics and food supplements are not included in the new regulations and are not permitted by current ANVISA regulation.

How the new rules arrived at this point

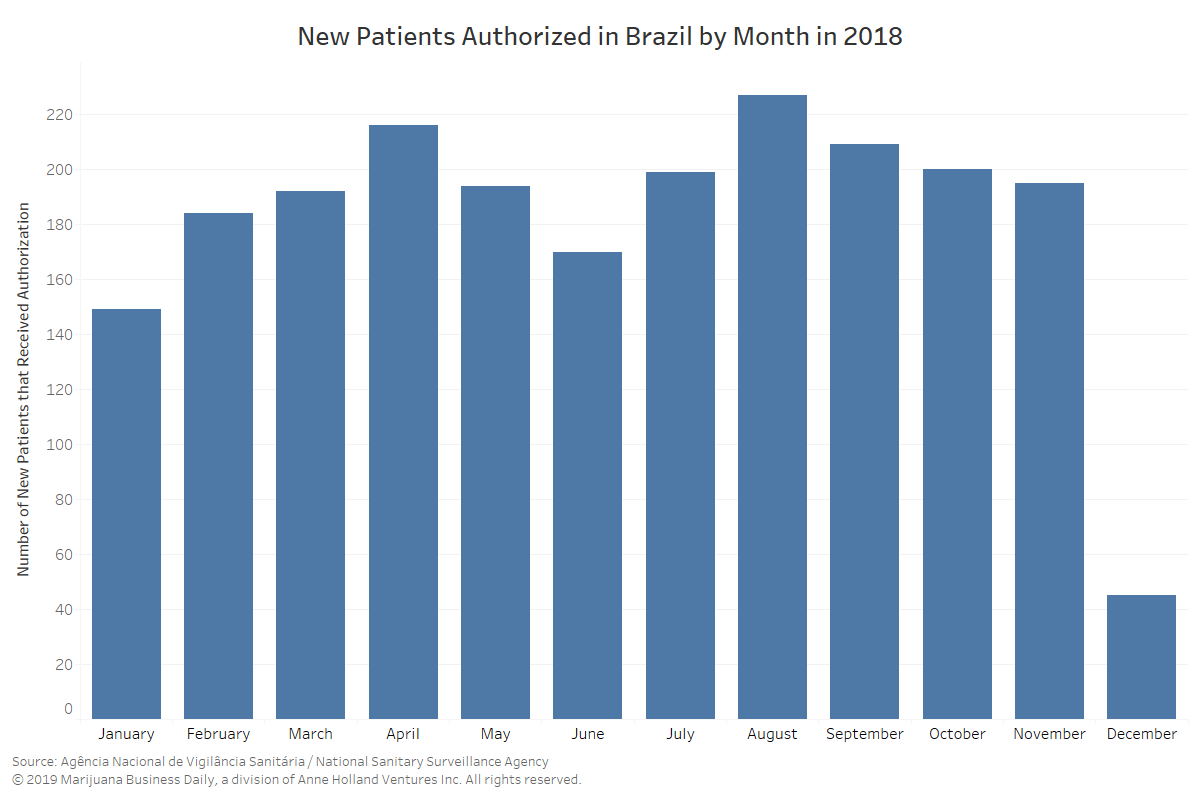

- January 2019: The growing number of case-by-case authorizations is seen as unsustainable in the long term, a sign that major changes were ahead.

- April 2019: Individual authorizations grew exponentially during the first quarter of 2019.

- June 2019: ANVISA published the groundbreaking proposals for public consultation.

- August 2019: The proposals faced heavy opposition from high-level government authorities.

- August 2019: While the proposals were debated, the number of individual authorizations reached 10,000.

- Oct. 4, 2019: The proposals faced internal challenges.

- Oct. 7, 2019: Voting on the proposals was postponed.

- Oct. 15, 2019: Voting was postponed again, and subsequent further postponements raised serious doubts over the chances of approval.

Alfredo Pascual can be reached at alfredop@mjbizdaily.com