(This is a regular column that delves into the complicated issues surrounding California’s immense cannabis market from the vantage point of Marijuana Business Daily Senior Reporter John Schroyer. Based in Sacramento, he’s written about the cannabis industry since joining MJBizDaily in 2014.)

Significant challenges are likely on the way for California marijuana businesses this year.

Even with all the upheaval of the past two years, ongoing shifts in the market involving tax increases, 280E and the potentials surrounding exporting cannabis from state to state might mean even more added costs for cannabis businesses in California.

The California Department of Tax and Fee Administration, which is responsible for overseeing cannabis tax rates and collection, announced in November that taxes were going up at the start of 2020.

On Jan. 1, the markup rate increased from 60% to 80%, and because the review by the CDTFA happens every half year by state law, it could go up again in a few months.

That’s what Chris Coulombe, the CEO of distribution company Pacific Expeditors, expects.

“Right now, what we have teed up is a small death blow followed by a significant death blow – almost a coup de grâce at this point – and that’s the (tax increase) and the subsequent increase that’ll come in June or July from the CDTFA,” Coulombe said.

“With retailers doing between a 100% and 300% increase in markup, arguably we’re going to see that tax level go above 100%.”

There is a chance that the state Legislature will act before then since a bill already has been introduced to temporarily lower state marijuana tax rates.

But its success is far from certain, since similar measures have failed the past two years.

Beware the bad actors

As the legal market has expanded and more companies have continued to struggle with regulatory compliance, complicated tax bills and more, a parallel expansion has occurred in those willing to take advantage of businesses that are looking for help.

San Francisco Bay Area CPA Dana Borys said she’s seen a lot of companies lose thousands of dollars, if not hundreds of thousands, because they relied on poor advice from other ancillary business professionals who promised to help with various financial burdens and then either didn’t deliver or didn’t stand behind their work.

“There’s some bad service providers in the space, and I think it is something cannabis companies need to be careful of,” Borys warned. “We had a client recently who hired a payroll company … and they ended up taking their tax payments and keeping them and not remitting them to the IRS.

“So now the IRS has come after (my client).”

The same holds true, Borys said, for a lot of supposed tax professionals who promise they’ll be able to help cannabis companies keep more profits while remaining compliant with 280E – the section of the IRS code that bars standard business deductions for any company trafficking in a federally controlled substance.

Only later did the client find out that the tax pro was essentially running a scam.

“They’ll approach our MJ clients and say, ‘We can save you hundreds of thousands of dollars,'” Borys said, noting that the hard truth is there’s no easy way around 280E.

That can lead to a situation where marijuana companies file inaccurate federal tax returns, leaving those companies in a bind. In the meantime, Borys said, those bad actors will have vanished.

“The taxpayer, the one filing the return, they’re the one responsible for what’s on there, so the IRS could disallow all of that and the filer would have no recourse,” Borys said. “Then that CPA is gone or won’t help defend what they said.”

Exporting is ‘the endgame’

Ever since Oregon officials began considering the possibility of figuring out some way to export cannabis to other states, the notion has picked up traction in California, which for decades has produced far more marijuana than its residents consume.

There’s no immediate solution on the horizon, given the federal illegality of marijuana and the resulting prohibition on interstate cannabis commerce.

But what the situation reflects is an easily forgotten reality that California is, at its core, a marijuana export state.

“Eventually, we’ll see a marketplace where there are consuming regions and producing regions. And producing regions will be places like California, Oregon, South America, Asia, places where cannabis comes from,” said Amanda Reiman, vice president of community relations at Mendocino County-based distributor Flow Kana.

That is “the endgame,” she said.

In other words, exporting will be how California operators – especially growers – find a measure of stability, especially given all the lost profits of the past two years during the transition to a newly regulated industry.

“If all of a sudden we were competing with Oregon for market share in Oklahoma, maybe California would change its tune a little bit and they wouldn’t make it so difficult (to sell marijuana legally),” Reiman said.

“I do think (state officials) should be thinking about that, because the reality is that in five years – maybe less, maybe more – this will be an internationally traded commodity, and at that point, California stands to really benefit from the fact that California weed is really popular.”

In the meantime, however, part of the problem for a lot of the small farmers that Flow Kana works with is that there’s arguably already too many legal growers.

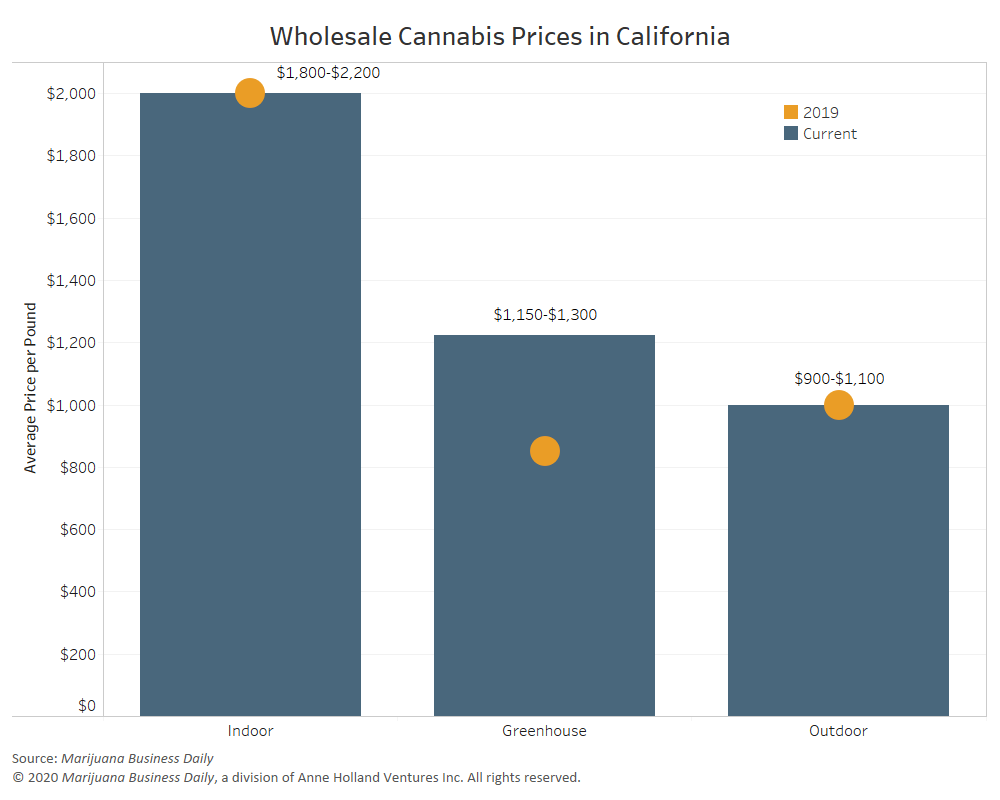

If more keep coming online, then California will be at the same point Oregon was just a few years ago, when an immense supply glut led to wholesale prices crashing to $50 a pound.

So, to relieve that pressure before it gets to a breaking point, insiders such as Reiman are keeping their fingers crossed that perhaps an interstate commerce solution will present itself.

(Click here to read the previous installment of this ongoing column.)

John Schroyer can be reached at johns@mjbizdaily.com