(You can have cannabis finance content such as this delivered directly to your inbox. Simply sign up here for our weekly MJBizFinance newsletter.)

Deal of the Week / In partnership with Viridian Capital Advisors

Bring on cannabis leveraged buyouts?

Multistate operator Curaleaf Holdings (CSE: CURA; OTCQB: CURLF) on Dec. 28 announced the acquisition of Bloom Dispensaries, a private, integrated Arizona marijuana operator, in a deal valued at $211 million.

Here are the basics:

- Bloom has four retail dispensaries, in Phoenix, Tucson, Peoria and Sedona, and two adjacent cultivation and processing facilities totaling approximately 63,500 square feet.

- The total consideration of $211 million will be paid using $51 million in cash and $160 million in notes, which are recourse only to the assets and equity of Bloom without any guarantee from Massachusetts-based Curaleaf.

- The notes are structured in three series, with $50 million, $50 million and $60 million due on the transaction’s first, second and third anniversaries, respectively.

- The purchase price represents 3.2X Bloom’s estimated 2021 revenue and roughly 8.0X estimate EBITDA. (Bloom has 40%+ EBITDA margins, according to a news release.)

What’s so interesting about this deal? Leverage!

This acquisition should be viewed as a leveraged buyout (LBO), one of the first in the cannabis industry.

The $160 million debt represents roughly 6X Bloom’s EBITDA (depending on how much over 40% margins the company has), an almost-unheard-of amount of leverage on a cannabis company. Debt around 3.3X EBIDTA is more typical.

It is interesting to think about other ways Bloom’s owners could have proceeded.

For example, could they have just gone out and borrowed $160 million (since they are lending it to Curaleaf, anyway) and just paid themselves the cash?

That would be called a leveraged recap, and if it were possible, it would have one interesting feature: Bloom would still own 100% of the company (although, in theory, the equity would be worth $160 million less).

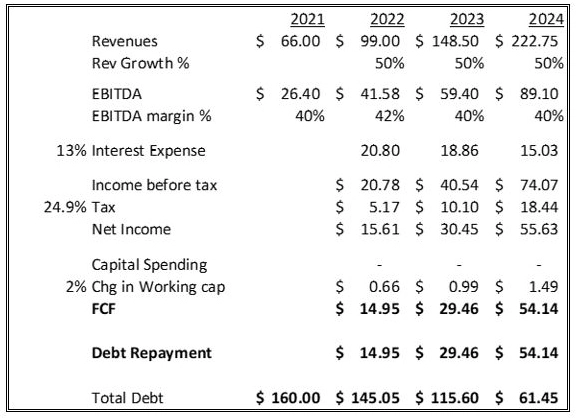

Below is an indicative sketch of what that might look like. Note: we have no special knowledge of Bloom, so this is just a sketch, not an actual projection.

We have employed what we think are relatively aggressive assumptions:

- Revenue growth at a 50% rate for the next three years.

- Margins remain at 40%+.

- Taxes are calculated as though all expenses are deductible (no 280E!).

- No capital spending.

The results show that the company would repay only about $100 million in the first three years and would require another year or two to repay the debt, but at the end of the period, the shareholders would have pocketed the $160 million and still own the company.

It is unlikely the company could do the transaction as outlined.

It probably doesn’t have sufficient hard assets to collateralize a loan of that size, and the sketch above shows that the repayment period would have to be stretched.

But, certainly, a somewhat smaller recap would be possible.

Bottom line: Curaleaf is likely to have to kick in more cash instead of just funding the note repayments from Bloom’s cash flow.

The Bloom-Curaleaf deal highlights several significant trends:

- Valuations continue to drift downward.

- Debt is getting cheaper and more readily available.

These factors will inevitably lead to more leverage being employed, and we believe more companies will begin to consider leveraged recaps as an alternative to selling at low multiples.

As more major MSOs such as Curaleaf can incur nondilutive debt at sub-8% levels, look for more LBOs in the cannabis space.

Are you a social equity cannabis license holder or applicant?

The MJBizCon team is now accepting 2023 Social Equity Scholarship Program applications.

The mission of this program is to provide social equity cannabis license holders or applicants access to the #1 global cannabis industry conference + tradeshow in Las Vegas.

Who can apply?

- Students currently enrolled in a cannabis-related program at an accredited university or college.

- Cannabis executives at licensed social equity cultivation, extraction/processing, retail, manufacturing/brand businesses (or awaiting application approval).

Don’t miss out on this potentially life-changing opportunity.

Apply to attend MJBizCon today – The application period will close on July 24!

Hot time in the city

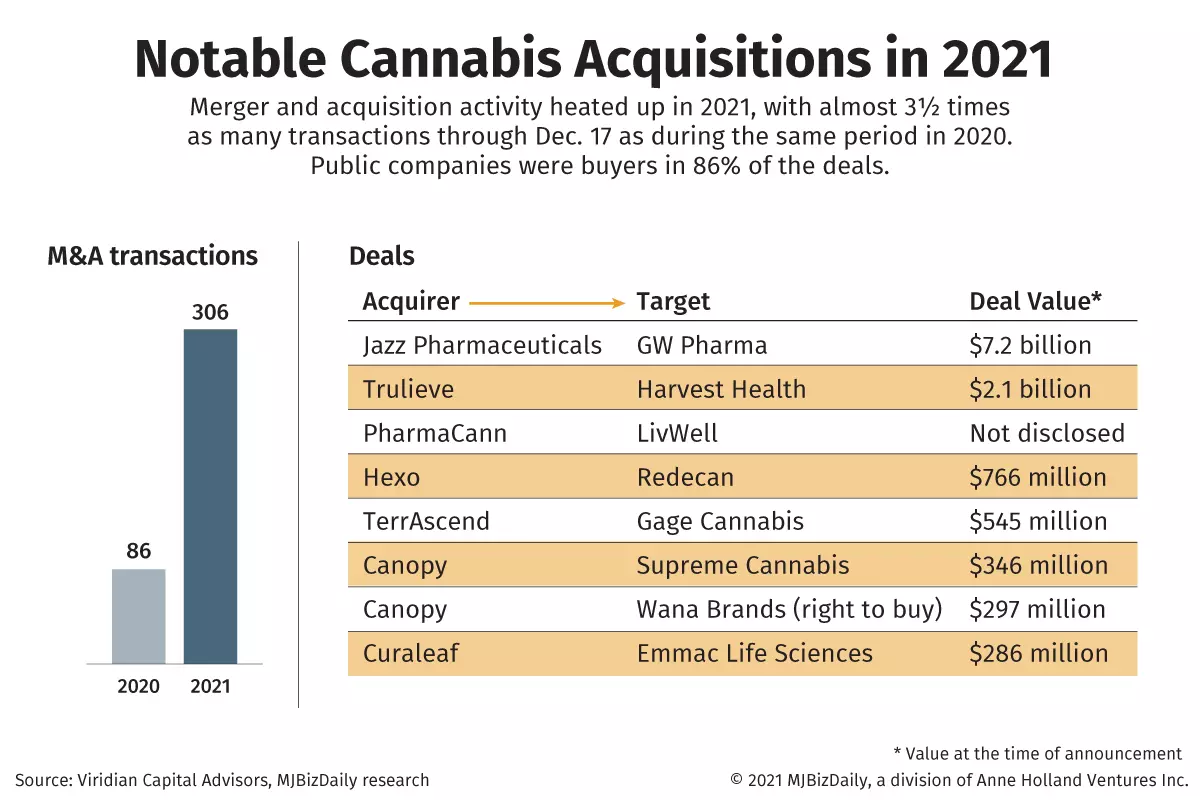

New York-based Viridian Capital Advisors counted 306 M&A transactions through Dec. 17.

That is more than three times the number of deals cut in the same period of 2020.

What does that mean if you are looking to sell?

Focus your strategy on:

- Market share: Large, public companies are willing to invest to get the best market position in advance of federal banking or legalization changes. That might entail keeping a winning hold on a given state or on being a top brand in a specific service or product.

- Cannabis acquisition: Notwithstanding Jazz Pharmaceuticals’ $7.2 billion acquisition of GW Pharmaceuticals, most of the 2021 deals were cannabis businesses buying other cannabis businesses, not mainstream companies stepping in. Talk the talk and network mainly in cannabis if you have a short-term exit plan.