Since we last looked at the performance of U.S. and Canadian operators on July 10, publicly traded cannabis companies have seen some interesting stock price trends as candidates running for the top offices in the U.S. take positions on marijuana reform.

For a week in October, sentiment improved and cannabis stocks rallied on four words uttered by Democratic candidate Sen. Kamala Harris in the vice-presidential debate: “We will decriminalize marijuana.”

From a financial standpoint, decriminalization would benefit U.S. plant-touching companies much more than it would Canadian operators, yet the Canadian companies also rallied after the statement.

Those firms remain at similar or even higher valuations than the U.S. operators despite a less attractive investment backdrop.

The 9% revenue miss and 20% decline at Canada’s Aphria on Oct. 15 highlighted the differences in the fundamental narratives: The U.S. remains higher margin and higher growth with more upside from legalization catalysts, while Canada’s federally legal market remains smaller, lower margin and oversupplied – all while facing strong price pressure.

But U.S. operators need to meet expectations of elevated estimates and stock prices, even as any incremental steps toward legalization likely will take longer than expected.

Earnings: US stocks up, valuations down

Stocks of U.S.-focused operators with consensus estimates have risen 51% on average since July 10, while those of the major Canadian operators declined 20%.

This mirrored rising estimates, with the U.S. operators seeing 2021 revenue estimates increase by 15% and earnings before interest, taxes, deduction and amortization (EBITDA) margin estimates expand by 1.6 percentage points to 31.1%.

In contrast, Canadian stock prices declined 20%, as the 2021 revenue estimates declined 6% and the EBITDA margin estimates compressed 2 percentage points to -4.7%.

This mirrors the fundamentals of the two separate narratives: the stronger margins and growth in the U.S. markets compared to managing through the pricing pressure, overcapacity and distribution challenges in Canada.

| Stock Price Change | 2021 Sales Estimate Change | EBITDA Margin Change | EBITDA Margin | |

| July 10-Oct. 16 (%) | July 10-Oct. 16 (%) | July 10-Oct. 16 (percentage point) |

Oct. 16, 2020 | |

| 4Front Ventures Corp. | 31% | 18% | 0.80 | 30.50% |

| Columbia Care | 33% | 5% | 2.40 | 21.40% |

| Cresco Labs | 54% | 8% | 1.50 | 27.60% |

| Curaleaf Holdings | 30% | 30% | -0.30 | 31.90% |

| Green Thumb Industries | 36% | 8% | 2.80 | 32.30% |

| Harvest Health & Recreation | 48% | 2% | 1.70 | 20.70% |

| Planet 13 Holdings | 134% | 28% | 1.00 | 26.20% |

| Trulieve Cannabis Corp. | 44% | 23% | 1.00 | 43.90% |

| Average – US-Focused Operators | 51% | 15% | 1.60% | 31.10% |

| Aphria | 5% | 3% | -1.40% | 9.60% |

| Aurora Cannabis | -67% | -22% | -0.60% | 0.80% |

| Canopy Growth Corp. | 2% | -1% | -3.20% | -18.10% |

| Cronos Group | -14% | -3% | -0.10% | -63.80% |

| The Green Organic Dutchman Holdings | -30% | -6% | -3.30% | -0.10% |

| Hexo Corp. | -3% | 2% | -1.10% | -1.80% |

| Organigram Holdings | -25% | 17% | -6.50% | 16.80% |

| Tilray | -31% | -10% | 0.70% | 3.00% |

| Average – Canada-Focused Operators | -20% | -6% | -2.00% | -4.70% |

‘We will decriminalize’ drives overall rally despite limited direct benefit

But the stock returns outlined above were hardly a straight line for both sectors.

As noted, the entire sector rallied in response to the vice-presidential debate on Oct. 7 after Sen. Harris stated, “We will decriminalize marijuana, and we will expunge the records of those who have been convicted of marijuana.”

U.S. operators rallied an average of 14%, while Canadian operators rallied an average of 9%, erasing nearly half the quarter’s previous loss. Many of the Canadian companies outpaced the U.S. stocks.

While we do not know exactly what “decriminalization” entails under a potential Biden-Harris administration, the market has run with the comment, anticipating that such a move would lead to improved chances of broader reform such as passage of the SAFE Banking Act, the STATES Act or the MORE Act.

While we do not know exactly what “decriminalization” entails under a potential Biden-Harris administration, the market has run with the comment, anticipating that such a move would lead to improved chances of broader reform such as passage of the SAFE Banking Act, the STATES Act or the MORE Act.

Should such legislation pass, the financial improvements would impact the U.S. plant-touching companies more than the Canadian operators.

The two major financial burdens faced only by U.S. plant-touching companies because of federal illegality are limited access to traditional banking and institutional capital and the federal 280E tax issue.

Many U.S. plant-touching companies can’t get loans at normal rates from large banks or access institutional capital markets, resulting in a higher cost of capital.

The SAFE Banking Act would resolve this and potentially could lead to a flow of institutional funds out of Canada into the United States.

That legislation would enable financial institutions to serve cannabis-related businesses without fear of federal punishment.

Eliminating Section 280E of the IRS tax code, which can drive effective tax rates to well over 50%, would lead to an immediate increase in after-tax profit and cash flow.

In contrast, federal legalization in the U.S. would open a new and competitive market for Canadian operators.

Of course, even with a Democratic sweep of Congress and the White House, how long it takes to change the laws and what shape they takes remains to be seen.

Earnings and fundamentals will drive stocks near term

Aphria’s third-quarter earnings announcement reminded investors of the fundamentals in Canada.

The Canadian cannabis producer’s report:

- Missed consensus revenue expectations by 9%.

- Showed continued price pressure with the introduction of more value products.

- Cut back production for the upcoming quarter.

- Disappointed some speculators expecting a sale of the company.

The question for the remaining third-quarter earnings reports in Canada is how will companies navigate the supply pressure, while U.S. operators will have to continue to live up elevated expectations of both the increasing estimates and the rally on decriminalization.

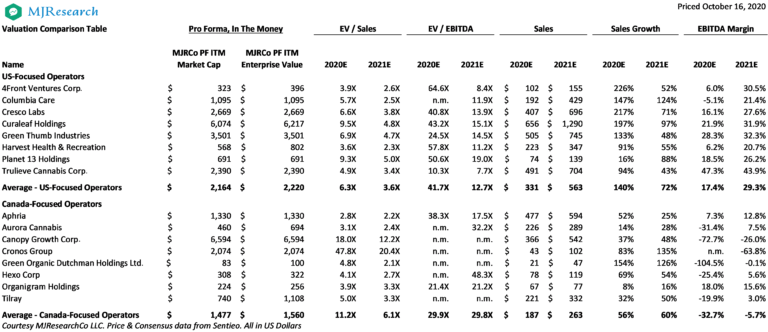

Multiples still lower in US than Canada

Despite the much larger benefit from potential decriminalization to U.S. operators, multiples in the U.S. are still lower than those in Canada.

As shown in the comp table below (it fully dilutes only for in-the-money warrants, options and convertible debt), the Canadian operators still trade at nearly twice the enterprise value to sales multiples as the U.S. operators.

This is despite the higher EBITDA margins in the U.S. and the benefits of potential decriminalization.

Remember also that both enterprise value/sales and enterprise value/EBITDA valuation multiples are on pretax metrics that ultimately are shorthand proxies for what investors ultimately care about: after-tax profit.

Since 280E can double or triple the effective tax rate, removing it through legalization would increase the after-tax profit and make the multiples of U.S. operators even lower than they currently appear.

Mike Regan is the founder of MJResearchCo and a regular contributor to Marijuana Business Daily. He can be reached through his LinkedIn page or at info@mjresearchco.com.

Earnings details from some publicly traded companies in the cannabis industry are available here.