(You can have cannabis finance content such as this delivered directly to your inbox. Simply sign up here for our weekly MJBizFinance newsletter.)

As long as cannabis is federally illegal in the U.S., there will be little in the way of formal protections for financial institutions that choose to work with operators in the industry.

But that doesn’t appear to be stopping every institution.

According to statistics from the Financial Crimes Enforcement Network (FinCEN), 684 financial institutions were actively involved with cannabis-related businesses (CRBs) as of Dec. 31, 2020.

Those estimates are based on suspicious activity report (SAR) filings, which banks are required to file for a variety of reasons, including suspected involvement in federally illegal activity.

As a result, some of these SARs might have been generated on genuine suspicious activity rather than on a transaction with a known cannabis customer.

While more banking institutions are offering services to CRBs than ever before, CRBs often still struggle to:

- Find an institution willing to offer services.

- Build and maintain a compliance regime that will be acceptable to that institution.

- Afford the services, given the high fees associated with these types of accounts.

The gap between the need for banking and the financial service providers’ sparse and expensive offerings to the sector have created an opportunity for third-party firms to intervene and provide a compliance structure that will satisfy the needs of the financial institutions.

These third-party firms perform extensive Bank Secrecy Act-compliant due diligence on applicants to ensure potential customers are following FinCEN guidance required to receive banking services.

After the completion of due diligence, they connect the CRBs with financial institutions that are willing to do business with CRBs and provide checking/savings accounts, check-writing capability and merchant processor accounts.

These firms often also provide additional services such as armored car and cash-vaulting services.

One such firm, Safe Harbor Private Banking, started as a project implemented by the CEO of Partners Credit Union in Denver, who set out to design a cannabis banking program.

The program has since expanded into other states that have legalized cannabis. Other operators include Dama Financial and Naturepay.

While these services offer hope for many CRBs, the downside is that the costs of compliance are still high, pricing some small operators out of the market.

Is digital currency an answer?

Another option might be digital currency, or cryptocurrency, a medium of exchange that utilizes a decentralized ledger to record transactions, otherwise known as a blockchain.

Blockchain technology offers CRBs a transparent and immutable audit trail for business and financial transactions. Several cannabis-specific cryptocurrencies have sprung up in the past several years, including PotCoin, CannabisCoin and DopeCoin.

In July 2019, Arizona approved cryptocurrency startup Alta to offer services to the state’s medical cannabis operators.

Alta members purchase digital tokens to pay other members using a proprietary blockchain-based system.

The tokens are redeemable for U.S. dollars at a stable rate of 1:1, and CRBs do not need a bank account to participate in the Alta program.

Similarly, Nevada recently contracted with Multichain Ventures to supply a digital currency solution to the state’s cannabis industry.

Nevada Assembly Bill 466 requires the state create a pilot program to design a “closed loop” system such as Venmo in an effort to reduce cash transactions in the cannabis sector.

Like Alta, Nevada’s proposed system will convert cash to tokens that can then be transacted between system participants.

While both proposals are promising for Arizona and Nevada CRBs, the timeline as to when, or if, these offerings will come online is unknown.

Action on cannabis reform at the federal level might render these options moot.

– Paula Durham, associate director for global consulting firm J.S. Held

Deal of the Week / In partnership with Viridian Capital Advisors

Hexo closes successful capital raise, so why is its stock falling?

Last week, Canadian cannabis grower Hexo Corp. (TSX: HEXO; Nasdaq: HEXO) closed its underwritten public offering of 49.0 million units at $2.95 per unit for gross proceeds of $144.8 million.

Each unit included one common share and one-half share of warrants with a $3.45 exercise price (17% premium) and five-year life.

Viridian Capital Advisors values the warrants at approximately 31 cents per unit, producing a net share price of $2.64, a 23.25% discount to the preannouncement price.

Then, on Aug. 30, Hexo shareholders overwhelmingly approved the Redecan acquisition in which Hexo will pay $400 million in cash and issue 69.7 million shares for the cannabis producer.

The cash payment will be funded by combining last week’s equity issue and the proceeds of a previously sold $360 million senior convertible notes issue.

Since the announcement of the equity transaction, Hexo’s stock has fallen about 30%.

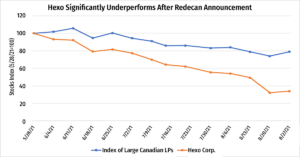

As shown in the graph below, Hexo is down more than 60% since the Redecan deal was announced May 28, significantly worse than the 20% decline of the index of large Canadian licensed producers (which includes Aurora Cannabis, Canopy Growth, Cronos Group, Organigram, Sundial, Tilray and Village Farms International).

Why is Hexo down so much?

- Investors were surprised by the size of the equity issue. After all, Hexo’s recently raised convertible debt should have paid the bulk of the $400 million required for Redecan. Hexo also said the proceeds would be used for “expenditures in relation to the company’s U.S. expansion plans,” which conjures images of dead capital to Viridian’s analysts.

- The Canadian market increasingly resembles a competitive dogfight between desperate, aimless and cash flow-negative competitors, many of which lack observable paths toward profitability. It has become increasingly clear that Hexo can justify its valuation only through substantial revenue increases, which are unlikely without access to the American THC market – a development we believe is years in the future. Furthermore, Viridian is not convinced that Redecan could successfully compete against the likes of Sublime in the U.S. pre-roll market even if they were allowed.

- Investors are still rightfully concerned about Hexo’s ability to integrate the acquisitions it has made (including 48North, Redecan and Zenabis) without any significant hiccups.

Perhaps most importantly, Viridian’s analysts have become more concerned about Hexo’s long-term viability.

The converts from the $360 million note mature in two years, and those will either convert at a relatively low price of $3.75 per share or need to be refinanced with a more dilutive equity issuance – if the market will buy Hexo stock at that point.

Hexo has an unbroken 15-quarter streak of negative cash flow from operations, and, unlike other cannabis firms, Hexo has no sugar daddy to keep it afloat.

The Viridian Credit Tracker model uses 11 financial and market variables to measure liquidity, leverage, profitability and size. The model synthesizes these factors to arrive at an overall credit ranking within a peer group.

Viridian now ranks Hexo as having the worst credit quality of all Canadian licensed producers with more than a $200 million market cap, narrowly edging out Aurora for the bottom position.