(This story has been updated to correct the spelling of Kiamichi Skies.)

So many medical marijuana dispensaries have opened in Oklahoma that many stores are slashing prices to stay competitive.

The downward pressure on cannabis pricing has some dispensaries fearing for their future even as they brace for yet more possible business challenges that could result if the state enacts more cannabis regulations related to testing and labeling.

Here’s what you need to know about the Oklahoma medical marijuana market:

- At its height, the wholesale price of marijuana flower was about $4,000 a pound on average, which has dropped to between $1,000 and $2,800 a pound today, according to Oklahoma industry insiders.

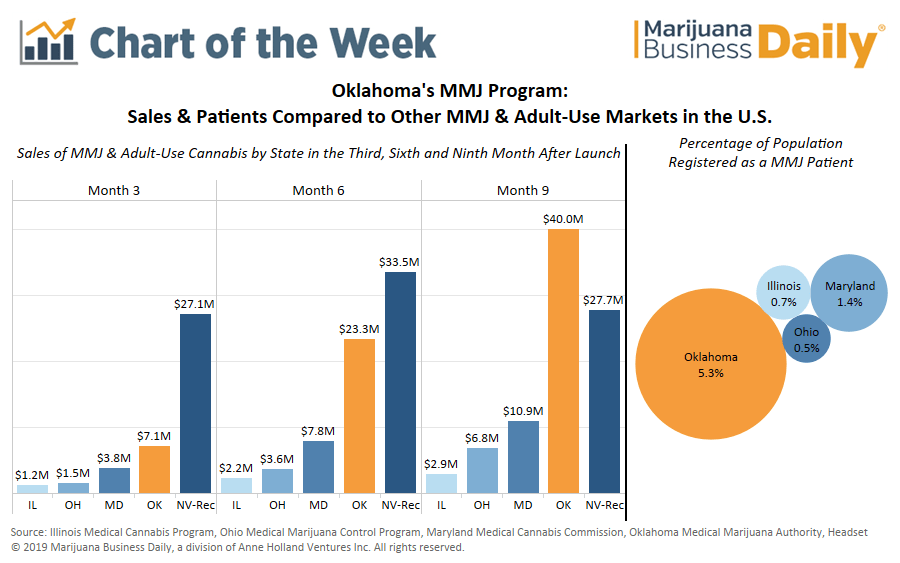

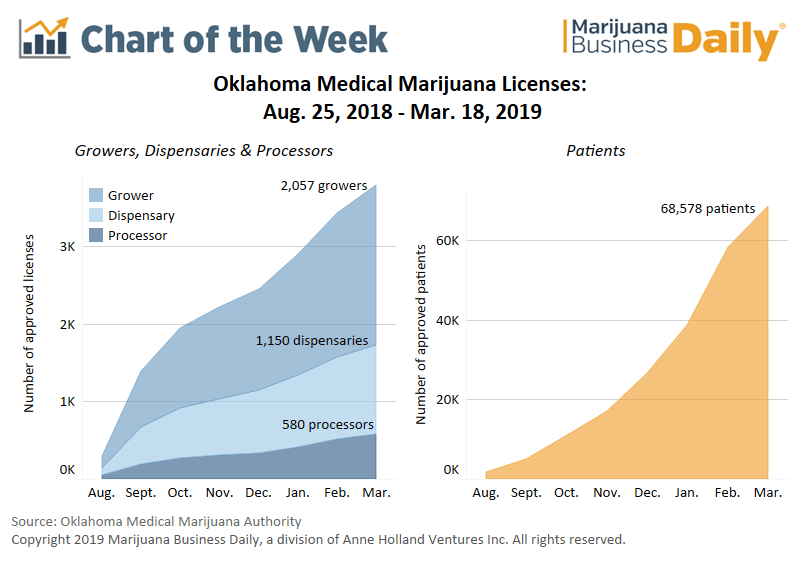

- Oklahoma’s medical marijuana market launched in October 2018, only a few months after voters approved MMJ sales.

- Marijuana Business Daily estimates MMJ sales in the state were $345 million last year.

- Under Oklahoma’s liberal licensing policy, the state has issued more than 2,000 dispensary business permits. The retailers serve nearly 240,000 patients across the state.

- No caps exist on the number of licenses the state awards, and municipalities cannot enact zoning restrictions to prevent dispensaries from opening.

“It’s going to be survival of the fittest,” said Jay Czarkowski, founding partner of Canna Advisors, a Boulder, Colorado-based cannabis consulting firm.

“People get into cannabis because they think it’s going to be instant riches, but the reality is, it’s competitive.

“If you’re a dispensary, one of the big things you have to do is stay engaged with your patients and delight your patients, provide good customer service and good product at a good price.”

As medical marijuana programs mature, state regulations evolve with them, Czarkowski said.

There generally are more regulations, additional testing requirements, more stringent labeling and packaging requirements and increased financial pressure – all while dispensaries are fighting for market share and paying rent, employees and licensing fees.

Last fall, the Oklahoma Medical Marijuana Authority implemented new rules that could curb the proliferation of dispensaries in the state, including proof of residency for at least two years or five continuous years in the 25 years before the application date.

All businesses also are required to submit a certificate of compliance from the political subdivision that has jurisdiction over their locations.

Standing out

“The prices are going down and dispensaries are trying to come up with unique ways that are legal to lure patients,” Oklahoma City attorney Sarah Lee Gossett Parrish said.

“We’re starting to see some of the dispensaries that were opened by people who weren’t business savvy surrendering their licenses or not renewing them.”

Discounts on quality products seem to do the trick for Edmond, Oklahoma-based Red River Cannabis Coalition, said Lynn Dunlap, co-owner and managing member of the vertically integrated marijuana business.

“We can put a discount on Weedmaps or send an instant message about specials and increase our foot traffic by 20% to 25%,” Dunlap said. “It’s amazing what a 25- to 50-cent price drop will do to your floor traffic.

“We don’t mind running loss leaders every now and then to get people in to buy our products.”

Those deals include $115 ounces of small buds, happy hour specials such as $10 grams or buy-one-get-one-half-off edibles.

“Edibles really get people in the door when you do specials on them,” Dunlap said. “A free pre-roll doesn’t bring the traffic in because the quality isn’t very good anyway.”

Dispensaries are still opening, but many smaller operations are closing, said Nerio Guerrero, vice president of operations for Red River.

That’s partly because many of the licenses the state originally awarded are up for renewal and the owners have decided the $2,500 application fee to keep them current isn’t worth it. An application fee is not refunded if the license is denied.

Location matters

Eric Dangler, CEO of Tulsa-based Eufloria, said price wars are more pronounced in Oklahoma City than in other communities because there are no restrictions on how far apart dispensaries are required to be.

Dangler stays abreast of the rules municipalities across the state implement so he can properly counsel the people he sells his Eufloria franchise businesses to. Municipalities in Oklahoma establish their own regulations for marijuana businesses.

Even so, Dangler estimates prices in Tulsa have dropped 25% since the state’s medical marijuana program was implemented in October 2018.

“We stay about $2 a gram less than everybody else because we’re a franchise and have multiple locations, so we can negotiate prices for several stores at a time,” Dangler said. “It’s just the free market working.

“(Oklahoma doesn’t) have price controls, which is the American way of doing things. People with better products are going to survive.”

As price wars escalated, the quality of the products available improved, said Dangler, who opened the first Eufloria franchise store Sept. 1.

“The stuff we’ve got now is so much better than what we initially got,” he said.

Dangler said that some of the growers he’s worked with lowered their prices from the outset to cultivate a relationship with Eufloria, and the company is still working with them.

“We know who was trying to take advantage of us at the beginning and who worked with us,” Dangler said.

“If I treated the customers on Day One as if that’s the only day I’m going to see them, then I wouldn’t have any customers today, and that’s what the growers were doing.”

At least one Oklahoma grower refuses to sell flower by the pound.

Paul Grayson, owner and manager of Kiamichi Skies about four miles south of Clayton, Oklahoma, said his farm packages all its flower in smaller packages so it gets to maintain its brand. Kiamichi Skies is also more focused on concentrates and edibles.

“We turn down orders for pounds of our product,” Grayson said. “When you sell a pound, the dispensary puts it in little jars with their brand, so you get no branding. You also run into price competition.”

Grayson lamented the early days of Oklahoma’s medical marijuana industry, when crops commanded higher prices.

“When we had our first small harvest, you could sell it for $3,000 a pound. Now we’re hearing you’re lucky if you can get $2,000, and it’s increasingly common for it to go for $1,000 or less, particularly if you’re growing outdoors.

“Indoor is more in demand because it’s prettier. It’s come down to a beauty contest.”

Margaret Jackson can be reached at margaretj@mjbizdaily.com