(You can have cannabis finance content such as this delivered directly to your inbox. Simply sign up here for our weekly MJBizFinance newsletter.)

Deal of the Week / In partnership with Viridian Capital Advisors

Hydrofarm continues acquisition spree, highlights potential financial benefits of marijuana legalization

Hydrofarm Holdings Group (Nasdaq: HYFM) agreed to acquire Illinois-based Innovative Growers Equipment (IGE), a manufacturer of horticulture benches, racking and LED lighting systems, for a total consideration of $58 million.

Hydrofarm, as a non-plant-touching company, is an excellent example of how much lower the cost of multistate operator debt could go after cannabis is legalized or rescheduled.

The Fairless, Pennsylvania-based company’s 6.5% interest rate is a full 150 basis points lower than the Verano Holdings financing we highlighted last week.

The Viridian Credit Tracker ranks Hydrofarm as the best credit of the 22 agriculture technology companies tracked.

When stacked up against the large MSOs, Hydrofarm places third, ahead of Curaleaf Holdings (CSE: CURA) and Verano (CSE: VRNO), but behind Trulieve Cannabis (CSE: TRUL) and Green Thumb Industries (CSE: GTII).

Despite Hydrofarm’s non-plant-touching status, it still has close ties to the cultivation business, and it doesn’t trade as well as it would if its customers operated in a federally legal industry. It does, however, give us a glimpse of the future of cannabis debt.

Deal details

The Hydrofarm-IGE transaction is another example of the big- versus small-company acquisition arbitrage that Viridian Capital Advisors has discussed all year.

Hydrofarm is trading at 2022 multiples of 2.14X revenues and 14.5X EBITDA, while its target trades at half those multiples.

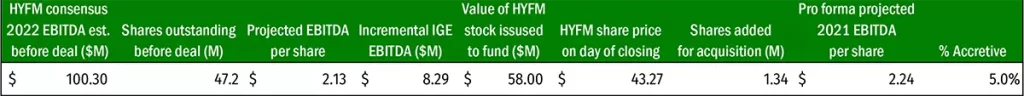

Primarily because of this valuation gap, the IGE deal would be EBITDA-per-share accretive even if entirely funded with equity – assuming IGE’s 2022 EBITDA doesn’t increase from 2021.

The total transaction consideration of $58 million includes $11.6 million in HYFM common stock and $46.4 million in cash.

The transaction price equates to 1.21X IGE’s 2021 estimated sales of $48 million and 7X its 2021 adjusted EBITDA of $8.29 million.

This acquisition is the latest in a string of five acquisitions Hydrofarm has completed in 2021.

Despite these accretive transactions, the company has underperformed the broader cannabis market since the beginning of the year. (See chart above.)

Analysts recently downgraded their 2022 estimates for Hydrofarm based on the impact of a slowdown in cannabis growing activity in California and Canada.

Cost of debt attractive

Viridian expects Hydrofarm to continue to use a high percentage of cash in its acquisitions, and the company’s low debt cost makes this strategy more attractive.

On the same day that Hydrofarm announced the IGE acquisition, the company also said it closed a new $125 million senior secured term loan.

Here are the details of that transaction:

- Interest at either LIBOR (with a 1% floor) plus 5.5% or alternate base rate (with a 2% floor) plus 4.5%.

- Seven-year maturity.

- Proceeds used to repay borrowings under the existing revolver and fund future acquisitions, including the IGE deal.

- JPMorgan acted as the sole arranger and agent.

Business leaders need reliable industry data and in-depth analysis to make smart investments and informed decisions in these uncertain economic times.

Get your 2023 MJBiz Factbook now!

Featured Inside:

- 200+ pages and 50 charts with key data points

- State-by-state guide to regulations, taxes & opportunities

- Segmented research reports for the marijuana + hemp industries

- Accurate financial forecasts + investment trends

Stay ahead of the curve and avoid costly missteps in the rapidly evolving cannabis industry.

Financial firms back off cannabis; what does it mean for you?

Even as the cannabis industry moves toward the mainstream, many banks and financial firms are backing away from the risks they see.

Just this week, JPMorgan Chase & Co. advised its brokerage clients they’ll no longer be allowed to purchase cannabis-related stocks and securities starting Nov. 8.

The pivot follows a similar move earlier this year by global investment firm Credit Suisse Group, which told clients it was calling off all transactions involving marijuana-related companies in the United States.

Even firms that are staying involved, such as Cowen, are increasing conditions related to these trades, such as cash margin requirements.

The impact on investor participation is clear, but what’s the impact to cannabis operators? Well, it limits their access to outside capital as well.

At the MJBizFinance Forum in Las Vegas last month as part of MJBizCon, several speakers noted that funding is scarce partially because the pool of funders is limited.

This move by mainstream financial firms limits access even more.

As a result, competition for available funds will be even fiercer.

Make sure your company is prepared to prove why it’s a good investment – and that you’re prepared to deploy funding effectively.