(You can have cannabis finance content such as this delivered directly to your inbox. Simply sign up here for our weekly MJBizFinance newsletter.)

Can cannabis retail survive inflation?

While wholesale cannabis prices have been going up – sometimes as much as 30%, according to a recent MJBizDaily story – retail prices for the consumer haven’t been keeping pace.

“This industry is so averse to raising prices. It’s different from other industries,” Lo Friesen, CEO and chief extractor at Heylo Cannabis in Seattle, told our team.

Instead, retailers have been opting to eat those increases, which ultimately cuts into their profitability – something already challenged by Section 280E tax provisions.

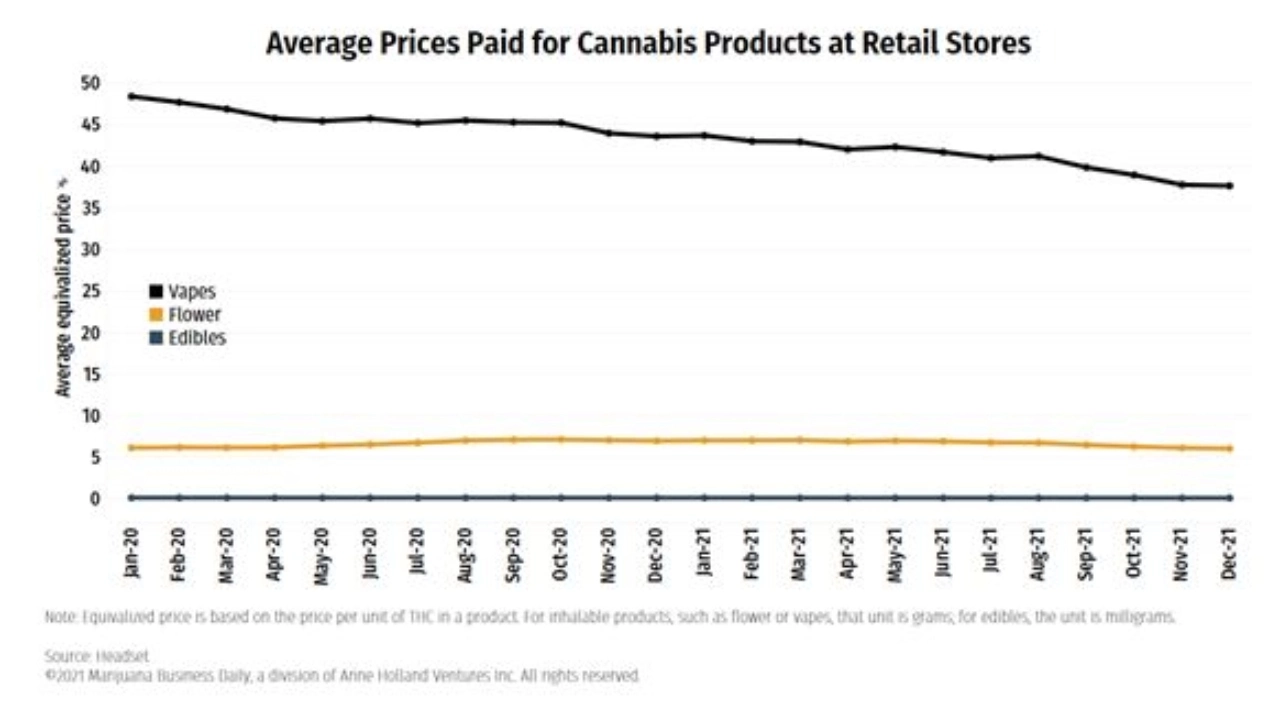

According to Seattle-based data and analytics company Headset, which tracks marijuana sales in 15 markets in the U.S. and Canada, the average price per unit of THC in marijuana flower – the so-called equivalized price – was 1.5% lower this month than in January 2020.

Equivalized THC prices fell even more for vapes (down 21%) and edibles (down 26%) between January 2020 and December 2021 in those states, Headset reported.

The strategy of not raising prices can last only so long before companies start to feel the pinch.

And many economists believe that we’re just at the beginning of an inflationary trend that could last through the next year.

In other words, regardless of how you feel about the competition, you might have to raise prices.

The key is doing it smartly.

“Consumers, right now, everyone knows that inflation is happening,” said Andrew Livingston, director of economics and research at Denver-based cannabis law firm Vicente Sederberg.

“So I think this is a great opportunity to be honest with your consumers.”

If you’ve laid the groundwork to build trust with your customers, they’ll likely trust your position on prices as well.

Talk with your budtenders and marketing teams about what’s driving the price changes so they can, in turn, educate customers about the trends.

And always make sure you’re selling your value.

Prices go up in every industry; cannabis won’t be any different.

Business leaders need reliable industry data and in-depth analysis to make smart investments and informed decisions in these uncertain economic times.

Get your 2023 MJBiz Factbook now!

Featured Inside:

- 200+ pages and 50 charts with key data points

- State-by-state guide to regulations, taxes & opportunities

- Segmented research reports for the marijuana + hemp industries

- Accurate financial forecasts + investment trends

Stay ahead of the curve and avoid costly missteps in the rapidly evolving cannabis industry.

Deal of the Week / In partnership with Viridian Capital Advisors

The ghosts of Christmas past and future

If there’s anything that defines the cannabis industry, it’s change.

And two transactions announced this holiday season highlight how the industry is changing right now.

- The announced divestiture of C3 Cannabinoid Compound Co. by Canopy Growth (TSX: WEED; Nasdaq: CGC).

- The proposed purchase of Arena Pharmaceuticals (Nasdaq: ARNA) by Pfizer (NYSE: PFE).

The Ghost of Christmas Past: Canopy to divest C3

Canopy’s history of poorly thought out and even more poorly executed acquisitions has come back to haunt.

On Dec. 15, the Ontario, Canada-based cannabis producer announced a sale of C3, its German pharmaceutical company, to European pharmaceutical company Dermapharm Holding SE, based in Germany.

C3 manufactures and distributes dronabinol, the first cannabinoid product that German doctors could legally prescribe.

The deal includes an upfront cash payment of 80 million euros ($70.9 million) with potential earnout payments of 42.6 million euros.

The acquisition values C3 at 1.72 times its annualized revenues of $41.3 million (2.6 times if earnouts are included).

These multiples are a significant discount to the 4.0X revenue multiple seen in Viridian Capital Advisors’ database for the 12 biotech/pharma companies with more than $10 million in annualized revenues.

Canopy paid 225.9 million euros ($252.1 million) for C3 in May 2019 and said the move would “allow us to offer more options to physicians across Europe, accelerate our commercial sales and increase our economic footprint on the continent, and drive forward new innovations.”

Now? Canopy believes it can address Europe “by leveraging our existing high-quality supply of Canadian cannabis products to meet patient demand globally.

In other words, by selling the cannabis it can’t sell in its home market to other countries, many of which can better cultivate it themselves.

Excuse us if we are a bit skeptical.

Canopy likely consummated this sale for two reasons:

- C3 requires short-term investment to maintain.

- Canopy is starting to realize it might need cash.

The company had $1.26 billion of cash as of Sept. 30, pro forma for its recent Wana Brands acquisition.

However, in the last-12-month (LTM) period, the company has had a negative free cash flow of $632 million (funded by a net addition of $645 million of debt and $122 million of equity).

Median analysts’ estimates show a reduction in negative free cash flow to only $211 million, negative for fiscal 2023.

However, the company has missed analyst expectations in 12 of its past 20 quarters, and cumulative downside misses have significantly exceeded upside misses.

Canopy’s sales trends do not inspire confidence.

Without acquisitions, the company had a 13% revenue decline in its most recent quarter and again pushed out the date for EBITDA positive.

Viridian analysts have become skeptical that the company can achieve positive cash flow at all.

Look for a string of more asset sales as the company maintains liquidity to continue accessing the capital markets.

The Ghost of Christmas Future: Are Pfizer and Big Pharma betting on medical cannabis?

On Dec. 13, Pfizer agreed to acquire San Diego-based Arena Pharmaceuticals in an all-cash deal worth $6.7 billion.

That equals $100 per share, a nearly 100% premium to Arena’s trading price before the announcement.

The acquisition is a small step for Pfizer, which had nearly $30 billion of cash on its Sept. 30 balance sheet.

Arena is the second major acquisition of a cannabis-related pharma company, following Jazz Pharmaceuticals’ February purchase of U.K.-based GW Pharmaceuticals.

Viridian believes the medical cannabis market will migrate toward a pharmaceutical model with branded and patented treatments for various conditions and increased ownership by large multinational pharmaceutical companies.

And this deal is just another step in that direction.