Iowa’s 2-year-old medical marijuana program is struggling to become financially viable, constrained by low THC levels, high prices, minimal physician participation – and more.

While most marijuana markets across the country have experienced robust demand during the coronavirus pandemic, Iowa’s MMJ sales have been weak.

Patients have struggled to renew and register their MMJ cards because of complications related to the pandemic, and two of five dispensaries have shuttered their doors.

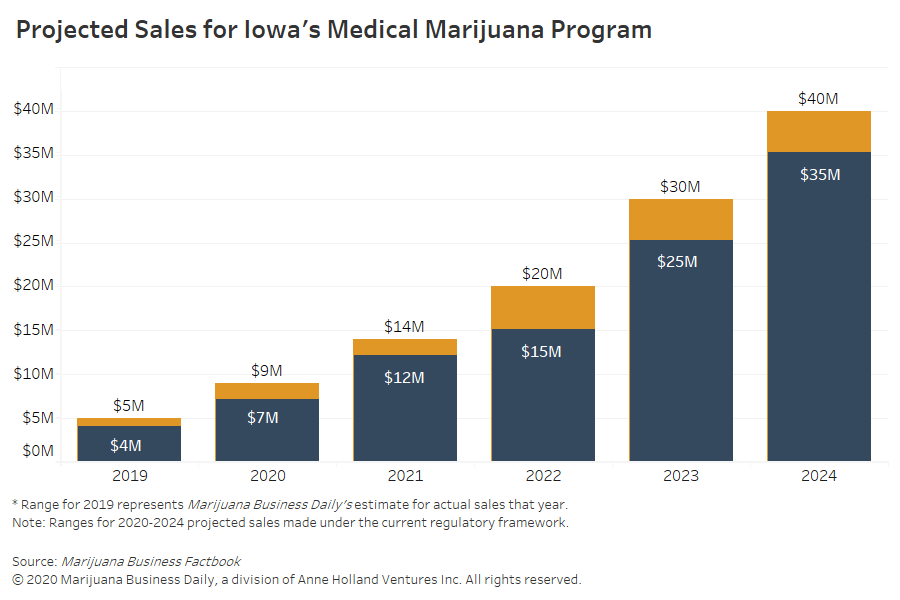

Sales are on pace to reach only $3.2 million this year, according to state data through July, compared with a recent Marijuana Business Factbook projection of $7 million-$9 million.

Iowa, which launched its program in November 2018, has a law that’s more business-friendly than some low-THC programs but is still an example of how not to structure an MMJ program, Karen O’Keefe, director of state policies for the Marijuana Policy Project (MPP), wrote in an email to Marijuana Business Daily.

“The overall lesson is that highly restrictive programs are less viable, and tend to result in losses,” O’Keefe wrote.

Reflecting concerns about the program’s viability, two multistate operators (MSOs) in recent months exited the market:

- Washington state-based MSO Have a Heart closed its dispensaries in Davenport and Council Bluffs in March, leaving Iowa with three dispensaries. At the time, Have a Heart was in the process of being acquired by Arizona-based Harvest Health & Recreation.

- New York-based MSO Acreage Holdings closed its Iowa Relief cultivation/processing operation in June, leaving the state with one cultivator/processor.

Aaron Boshart, director of operations for Iowa Cannabis, which has a dispensary in Waterloo, agreed it’s tough sledding in the market.

“It’s really a compassionate-use market putting patients before profit,” Boshart said. “It’s obviously a challenging market in terms of lack of profitability.”

Lessons keep coming

The Iowa market offers several lessons, according to MPP’s O’Keefe:

- Allowing only extracts drives up prices and makes products less competitive. “We’ve also seen that in Minnesota and Louisiana,” O’Keefe wrote.

- Medical cannabis programs should not limit THC. “Doing so means many patients don’t get the product that would work best for them,” and that also results in higher prices, she noted.

- Medical cannabis programs should not have overly restrictive lists of qualifying conditions. Iowa has approved only 14 qualifying conditions. The list does include chronic pain, which accounts for nearly three-quarters of the 4,297 active patient cardholders as of the end of July. Many states have more extensive lists or liberal policies, such as Oklahoma, which allows physician discretion in recommending MMJ.

Boshart identified two other challenges:

- Physicians must certify a patient’s qualifying condition, but many are reluctant to do so. Iowa, he said, is home to two large health-care systems, both of which discourage doctors from participating in the MMJ program.

- The Iowa MMJ market now relies on just one processor – yet another reason for high prices.

Boshart said he and Iowa Cannabis CEO Tate Kapple knew the market would be difficult to make a profit in, based on its regulatory structure and the conservative attitudes in the state.

But “this is our home state,” Boshart said. “We’re committed to the Iowa market long term and prepared to forgo profitability to provide access to patients of Iowa. … We feel responsible that this program succeeds at whatever the cost.”

In addition to owning Iowa Cannabis, Kapple also owns three recreational marijuana stores called Cannabis & Glass in the Spokane, Washington, area, providing him some financial cushion. He also has an adult-use store under construction in Oregon.

The state’s only other current operator is Des Moines-based MedPharm Iowa, which now is the sole cultivator/processor and also operates dispensaries in Sioux City and Windsor Heights under the MedPharm Iowa brand.

MedPharm Iowa is affiliated with Denver-based MedPharm Holdings.

“That’s a huge problem, there’s no price competition,” Boshart said of having only one product manufacturer in the state. “We’re extremely frustrated with the pricing structures we’ve seen for our patients.”

For example, he said, Iowa Cannabis sells a 30-unit bottle of 20:1 THC/CBD capsules for $130.

That’s two to three times more expensive than the cost per milligram of similar products in Washington state, Boshart noted.

MedPharm Iowa didn’t respond to inquiries for comment.

But after Acreage pulled out in June, MedPharm Iowa General Manager Lucas Nelson told The Gazette in Cedar Rapids that the exit was a “big blow” to the program.

“We can’t quite seem to get our footing in the program,” Nelson said.

Pandemics sales anemic

The coronavirus pandemic dealt a blow to Iowa’s program as well.

Dispensary visits and sales dropped off between April and June, according to the health department’s July update.

While state regulators allowed curbside pickup, delivery remains prohibited.

But the bigger issue appeared to be a decline in active patient cardholders and the closure of two dispensaries.

Patient renewals and new patient registrations fell sharply between April and June as residents struggled to see their doctors or visit state drivers’ license stations to pick up the cards.

Registrations and renewals picked up in July, as the Iowa health department took over the card-issuing process.

New THC formula could provide boost

In June, Gov. Kim Reynolds signed legislation into law that replaced the 3% THC cap with a 4.5-gram THC cap per 90 days.

The law also removed THC limits for terminally ill patients and provided discretion to doctors to recommend additional THC to their patients.

Still, industry officials expect only a moderate boost from the THC formula change.

“I believe it will help marginally,” Boshart said.

“It’s a more scientific way to approach things,” he said, adding Iowa Cannabis hopes to see an expansion of products as a result.

In the meantime, Iowa regulators have moved to fill the abandoned licenses.

Applications were taken for the two vacant dispensary licenses, with Sept. 7 as the scheduled date to award the permits.

Have a Heart’s dispensaries weren’t in ideal locations, industry experts noted.

For example, the company’s Davenport dispensary was near the Illinois border, so customers could easily cross over and buy a range of less expensive products, including flower, in the neighboring state – even though it’s illegal to return to Iowa with a purchase.

Boshart said Iowa Cannabis applied for licenses in the Iowa City and Cedar Rapids areas, which he characterized as the state’s two largest underserved areas.

MedPharm Iowa reportedly also applied for a dispensary permit near Iowa City.

It’s unclear how many applications Iowa received for the two dispensary vacancies, but 18 letters of intent were submitted before the application deadline.

Iowa MMJ regulators haven’t yet put out a request for applications for the vacant cultivator/processor license but say they will do so.

Boshart said Acreage edged out Iowa Cannabis for that license in the previous round. But he indicated Iowa Cannabis hasn’t decided whether it will apply because of the challenge of making a profit.

He said Iowa Cannabis welcomes additional participation in the market but noted that entrants need to be prepared for low margins and a difficult road to profitability.

If a business enters the market thinking limited competition will enable it to capitalize on or even monopolize certain areas, Boshart said, “that’s a flawed strategy at this point.”

Jeff Smith can be reached at jeffs@mjbizdaily.com