(This is Part Three of a special series revealing key elements of more than 200 pages of internal IRS documents obtained by Marijuana Business Daily related to the enforcement of Section 280E of the federal tax code and the cannabis industry. The previous installment is available here. And the documents can be accessed here.)

The IRS has been training its agents for at least eight years in the finer details of auditing marijuana companies, using PowerPoint presentations that outline everything from legal precedents to questions that should be asked during interviews with business owners.

Those are among the insights gleaned from a trove of documents Marijuana Business Daily obtained from the IRS, including seven PowerPoint presentations.

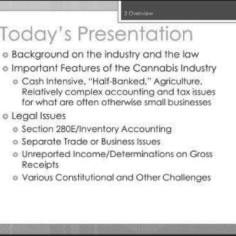

Many of the training materials focus on industry fundamentals – such as explaining Section 280E of the Internal Revenue Code or discussing decades-old legal precedents.

But the PowerPoints contain numerous revealing nuggets of information that offer cannabis business owners insights into how the IRS trains its agents to deal with the marijuana industry.

Compiled by agents in Colorado and Michigan, the presentations underscore how the IRS’ approaches to 280E and tax compliance evolve over time.

The first presentation was likely created in 2013 and the most recent in 2017.

In short, the agency is constantly adding to its already-lengthy armory of legal precedents, audit procedures and, of course, staff training materials.

“As with any new industry, the IRS is continuing to expend resources to ensure there is tax compliance,” notes one PowerPoint slide from a presentation prepared by two Colorado-based IRS agents.

Though the presentation is undated, the PowerPoint was produced before 2014 because it refers to “commercial marijuana” being “on the horizon in Colorado.” Recreational marijuana sales began in Colorado on Jan. 1, 2014.

“Clearly, they’ve got different agents out there doing training, and they’ve been doing it for a while. And the training is pretty basic,” said Nick Richards, a Denver-based marijuana tax attorney who previously worked as an IRS lawyer.

Richards added that it’s obvious from the presentations the training sessions have “evolved over time” as 280E-related case law has grown – as have the IRS’ dealings with the marijuana industry.

More in this series

- 280E is a political weapon targeting marijuana companies, but there may be a fix

- Confidential IRS marijuana guide details audit procedures for agents to follow

- Documents reveal how IRS became more adept at evaluating marijuana company taxes

- Newly released IRS documents detail efforts to collect taxes from marijuana companies under 280E

- A primer on marijuana-related IRS terminology

“They are getting better at it,” he said, referring to marijuana business audits.

The IRS declined to comment specifically on the PowerPoints or its agent trainings related to 280E.

Asked how many agents had been trained and when, IRS spokeswoman Sarah Maxwell wrote in an email to MJBizDaily that “marijuana training is provided as needed.”

Maxwell also declined to say whether agents assigned to the marijuana industry receive more, less or about the same training as agents tasked to mainstream sectors.

“Training provided for agents working marijuana cases or any other industry is developed at the appropriate level to address potential tax compliance issues,” she wrote.

The IRS has held trainings for agents in “Denver, Seattle, Portland, Northern California, Nevada, Phoenix, and Detroit,” according to a report last year from the Treasury Inspector General for Tax Administration (TIGTA).

Here are some of the business takeaways from the PowerPoints:

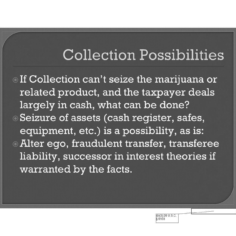

1. The IRS considered – but opted against – the possibility of selling marijuana seized from companies with unpaid tax bills.

An undated presentation, likely from 2013, revealed that the IRS Office of Chief Counsel considered – and ruled out – the possibility of seizing and selling marijuana products from companies behind on their tax bills.

“Can Collection Seize and Sell Marijuana? Short answer: no,” one PowerPoint slide notes.

According to the slide, the IRS manuals “do potentially contemplate seizing and selling controlled substances. Final authority is with the Area Director, but you have to get Counsel opinion.”

“Even if it were legal for the IRS to sell marijuana, our opinion will almost certainly be that it not be seized or sold,” the slide continues.

San Francisco-based attorney Henry Wykowski said seizing and selling assets is common practice for the IRS when the agency deals with mainstream companies that have unpaid tax bills.

“Years ago, I represented … a guy that had a fleet of private jets, and (the IRS) got a deficiency judgment against him, and they went over and took inventory, and two weeks later they auctioned off three of his planes,” said Wykowski, who also has represented numerous marijuana companies.

The same PowerPoint suggests an alternative for IRS agents: Seize other marijuana company assets to sell, such as “cash registers, safes, equipment.”

2. The IRS has maintained a steady focus on separate business divisions within one entity.

Multiple PowerPoints repeatedly raise the question of separate business operations being housed in a single entity.

That was a focus of landmark court cases in 2007 and 2012 – CHAMP and Olive, respectively – which the IRS training materials describe as having “mixed” results.

“Some dispensaries have attempted to allocate expenses to another, separate but related, trade or business,” the presentation points out. It notes that the answer “depends on” several case-by-case questions, such as how closely the two businesses are intertwined operationally.

The same legal question is raised in multiple PowerPoint presentations from 2017, which Richards noted as a fixation within the IRS.

“If anything jumps out at me, it’s the continued focus on the separate business concept in here, with CHAMP and Olive and what constitutes a separate business,” Richards said, referring to the landmark cases.

“That continues to be a big concern of theirs.”

Another 17-page presentation from July 2016 focused on that same topic. It was titled “Separate Trade or Business Issues for Taxpayers Affected by Section 280E.”

That presentation states that “280E does not preclude a taxpayer from deducting expenses attributable to a separate business other than that of illegal trafficking.” It also clarifies that marijuana companies can own separate businesses that focus on selling paraphernalia “such as tee shirts, hats, pipes, vaporizers, cookbooks, etc.”

“It might also involve providing services, such as caregiving,” the slide continues.

The presentation then dissects the legal questions surrounding separate businesses and instructs IRS agents to question company owners closely on how the separate businesses might overlap.

Another presentation with the same title, dated Sept. 19, 2017, was given by Alicia Mazurek, from the Detroit IRS Office of Chief Counsel.

The presentation delved further into legal cases that bolstered the IRS’ long-held positions on 280E, such as Canna Care v. Commissioner and Beck v. Commissioner, both in 2015, as well as Golden State Cooperative v. Commissioner in 2016.

In each case, according to the PowerPoint, the court ruled “there was no separate business” and that 280E precluded the companies from deducting business expenses – though the Golden State Cooperative was allowed to deduct some of its cost of goods sold.

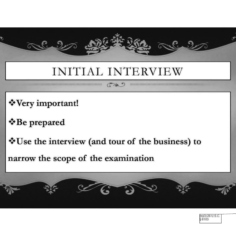

3. The initial interview is crucial.

In a September 2017 PowerPoint, the importance of the “initial interview” with cannabis company owners is again highlighted.

“Very important!” the presentation notes. “Use the interview (and tour of the business) to narrow the scope of the examination.”

Richards singled out that slide as “ridiculous.”

“That’s never the use of the interview or the tour of the business. They always use that to expand the scope of the examination,” Richards said.

“You try to protect your client from having to be interviewed by the IRS, because (agents) almost always use it as a fishing expedition, to find other things to be concerned about.”

4. The IRS is watching the growth of the marijuana industry at home and abroad.

A 2017 PowerPoint training presentation, given by an IRS territory manager for Michigan, dived into the growing number of accountants and attorneys advertising specialization in 280E impact minimization as well as the burgeoning nature of the industry.

The four-year-old presentation noted:

- California-based marijuana delivery company Eaze had recently raised $27 million to fund expansion plans.

- At least one CPA firm was advertising itself as “experts at minimizing the tax impact of IRS (sic) 280E.”

- The development of a medical marijuana market in Israel, an indication the agency is keeping a close eye on the burgeoning global industry.

5. The IRS’ focus has been expanding as more states legalize.

One of the agency’s most recent PowerPoint presentations appears aimed at agents from multiple states, another indication of how the marijuana audit focus has been growing more national.

One slide cautions to “Be aware of your state’s rules” and notes how each U.S. cannabis market has its own regulations.

The presentation also contained lighthearted jokes about the industry being “half-banked (sic)” (a reference to the 1998 marijuana-related comedy film “Half Baked” starring Dave Chappelle) and a photoshopped image of a big-box store called “Weed Mart.”

The same presentation instructed IRS agents that they could use websites such as online dispensary-finder Weedmaps – which the presentation identified by name – as a source of industry data and pricing information.

It also covered many industry topics, ranging from how cannabis companies had been trying to increase their deductions by slotting more of their purchases into cost of goods sold to how some farmers had attempted to exclude unharvested plants from their expenses.

6. IRS cannabis policies continue to evolve.

One PowerPoint presentation revealed another possible cannabis industry-related document that hasn’t yet been made public – if it has even been produced by the IRS: A guidance document regarding “Work in Process,” which refers to plants not yet harvested by the time federal taxes are due.

“It says the (document) is forthcoming, but that was in 2017, and we haven’t seen anything on that since,” said tax attorney Katherine Allen of Wykowski Law in San Francisco.

That’s another example of how the IRS is still adapting and refining its 280E and marijuana business policies over time, particularly as the industry becomes more sophisticated.

Richards said it’s highly likely more PowerPoint presentations and training sessions have been produced since 2017, considering the IRS has evidently been focused on auditing the industry for more than a decade.

There also have been a number of important legal decisions regarding 280E in the past few years.

“The lessons learned in Colorado, those mistakes are being made by professionals in other jurisdictions,” Richards said.

“With every new state coming on board, they have to learn these lessons again.”

Has your cannabis company been audited by the IRS? If so, we’d like to hear about it. Contact John Schroyer at john.schroyer@mjbizdaily.com.

This series would not have been possible without support from several Marijuana Business Daily staff members, including Roger Fillion, Andrew Long and Jenel Stelton-Holtmeier.