Marijuana merger and acquisition activity proceeded at a torrid pace in 2021 – and could accelerate in 2022 – thanks to lower interest costs and pressure on larger companies to expand their footprints and boost revenue.

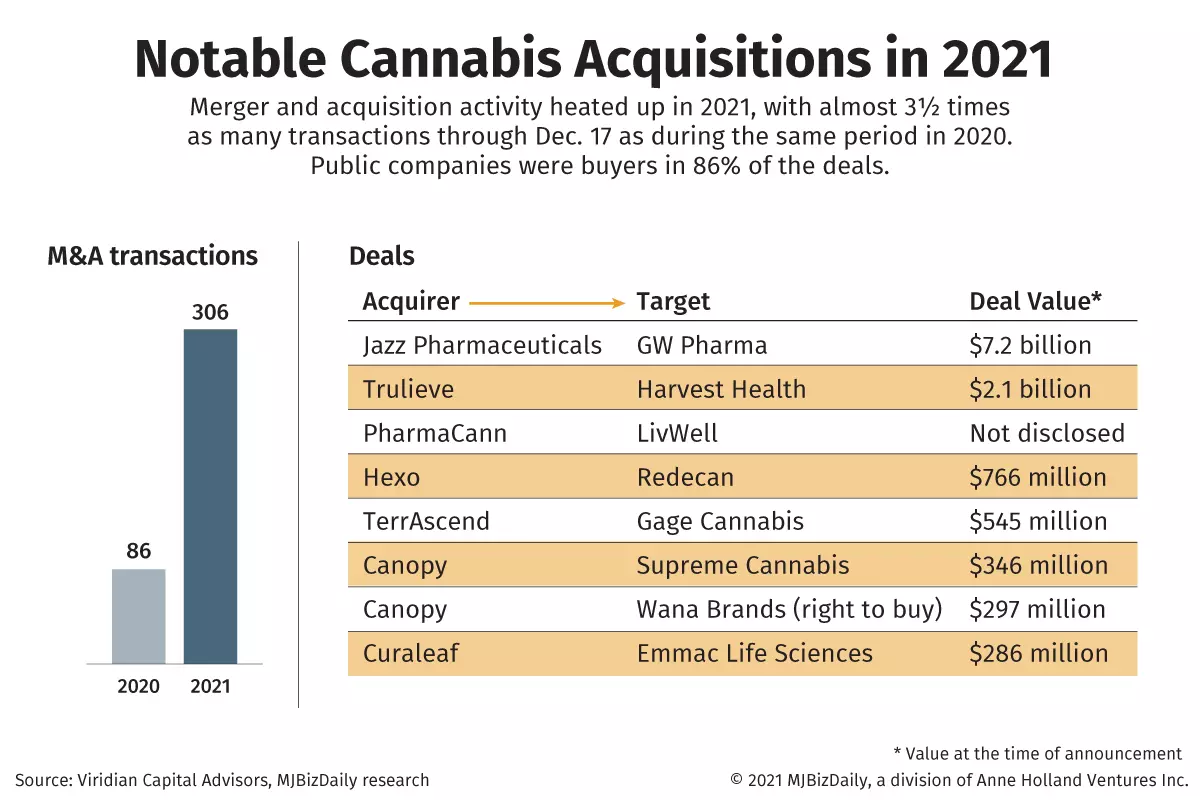

New York-based Viridian Capital Advisors counted 306 M&A transactions through Dec. 17, up well over threefold from the 86 recorded for the same period of 2020.

That included 209 in the U.S. totaling $10.1 billion in value – with both the numbers and amount exceeding what was recorded in 2019 and 2020 combined.

The year included a couple of blockbuster, multibillion-dollar deals:

- Dublin-based global pharma company Jazz Pharmaceuticals agreed to buy United Kingdom-based GW Pharmaceuticals, one of the largest medical cannabinoid companies in the world, for $7.2 billion.

- Florida-based multistate marijuana operator Trulieve Cannabis acquired Arizona-based Harvest Health & Recreation in a deal initially valued at $2.1 billion.

This year’s figures don’t include the multibillion-dollar merger of the Canadian cannabis producers Tilray and Aphria, which was announced in late 2020 but completed in 2021.

Viridian and other industry experts point to the combination of two key factors driving M&A activity:

- Inexpensive debt. Most large multistate operators are able to raise debt financing for acquisitions at annual interest rates of 8%-10%, among the lowest ever for the industry.

- A valuation gap between acquirers and targets. While the stocks of big MSOs are down year-to-date, “their targets are down even more, and the acquisition logic remains intact,” according to a recent Viridian report.

In addition, natural industry consolidation is fully underway, as is investor pressure on public MSOs to increase sales and expand markets.

There’s no indication the activity is going to abate anytime soon.

Acquisitions will “noticeably accelerate,” MJBiz CEO Chris Walsh predicted while addressing the general session at MJBizCon in Las Vegas in October.

“You’re going to see some of the biggest companies coming together.”

One big deal scrapped

Not all deals got done, however.

The most notable merger collapse of the year involved the proposed $1.9 billion combination involving music mogul “Scooter” Braun’s Ceres Acquisition Corp and chewing gum heir William “Beau” Wrigley Jr.’s marijuana MSO Parallel.

The companies didn’t say why they scrapped the deal, which would have enabled the merged business to go public by taking Ceres’ listing on Canada’s NEO Exchange.

The learning curve for entering the cannabis industry is steep. Start with the fundamentals.

MJBiz Cannabis 101 Email Course

A 10-part email course designed to educate new hires and aspiring professionals on the key fundamental areas of the legal cannabis industry, including:

- History of legal cannabis in America

- Overview of plant-touching + ancillary business sectors

- Cannabis finance and investing

- Cannabis marketing and brand building

- Employment + hiring opportunities

- And much more!

Gain a comprehensive understanding of this complex industry with this free resource.

But Reuters – citing anonymous sources – reported that “several investors had lost confidence in Parallel’s ability to deliver on lofty financial projections” made when the merger was announced.

For the most part, though, it was full steam ahead on the acquisition front.

In acquiring Harvest, Trulieve positioned itself to rival Massachusetts-based Curaleaf Holdings as the largest marijuana company in the U.S. based on revenue.

Trulieve inherited Harvest’s industry-leading position in Arizona’s marijuana market, including 320,000 square feet of cultivation and processing facilities, 16 retail outlets, three additional licenses and an option on a 20th license.

Trulieve also enhanced its leading position in Florida’s massive medical cannabis market.

St. Louis-based investment research firm Stifel GMP wrote in September that, in Florida, “Trulieve can immediately absorb Harvest’s 12 open stores and additional production to increase productivity and efficiency, further defending its 45-50% market share.”

The Harvest acquisition overall, Stifel wrote, opens additional M&A opportunities for Trulieve to fill gaps in three hubs across the U.S.: the Southeast, Southwest and Northeast.

Smaller M&A deals in 2021 were noteworthy, too, as emerging MSOs acquired additional assets in high-growth markets.

Miami-based Ayr Wellness was a prominent example.

The company raised $150 million in capital to help support acquisitions, which included acquiring assets in Illinois, Nevada, New Jersey and Pennsylvania as well as a brand of cannabis-infused seltzers and tinctures.

Pablo Zuanic, an analyst for New York-based investment banking firm Cantor Fitzgerald, recently wrote that Ayr likely will benefit from New Jersey starting recreational sales in the first half of 2022.

But he also noted the potential downside of aggressive expansion on multiple fronts.

Ayr, he wrote, “is juggling several plates, and both regulatory uncertainty as well as supply chain issues could impact the company’s top line” in 2022.

Sizzling M&A to continue

A number of industry experts are predicting strong M&A activity in 2022 as well.

As one of its 10 predictions for 2022, Viridian wrote earlier this month that “debt becomes cheaper for even smaller operators” and capital will continue to fuel growth and M&A activity.

That activity won’t be just in new and emerging recreational markets but also in California, Viridian predicted.

“Expect California to be a target for M&A as large operators see value in challenged operators and seek a hedge on future interstate sales,” Viridian wrote.

The investment firm said it expects MSOs to target distressed outdoor-cultivation assets in California.

The positioning for future interstate sales that will come with eventual federal legalization won’t stop there.

Viridian also predicted that MSOs could buy hemp-oriented cultivation facilities in Kentucky, North Carolina, South Carolina and Tennessee “in hopes of being able to support future operations in the Northeast and Midwest where cultivation is challenging and expensive.”

New York investment banking firm JMP Securities wrote in an industry update earlier this year that it expects Canadian licensed producers to become larger players in the U.S. over time as well.

Canadian LPs have scale and access to capital, JMP noted, and as a result, “we anticipate some of these firms will look for growth opportunities in the U.S. market through investments or strategic M&A.”

JMP specifically noted Cronos Group earlier this year investing $110 million for a 10.5% stake in Illinois-based PharmaCann, a privately held MSO.

Other cross-border deals have been struck as well, including Tilray acquiring the majority of the debt of Los Angeles-based MSO MedMen Enterprises.

Like Viridian and others, JMP predicted that M&A activity is only going to increase in the future as a driver of “longer-term growth and strategic expansion.”

JMP wrote that “more efficient capital markets and lower cost of capital will support much greater activity in the future, particularly as we view many parts of the market at the moment as fragmented, and opportunities should exist for both horizontal and vertical consolidation over time.”

Jeff Smith can be reached at jeff.smith@mjbizdaily.com.