(You can have cannabis finance content such as this delivered directly to your inbox. Simply sign up here for our weekly MJBizFinance newsletter.)

Average daily trading volumes for U.S. cannabis operators appear to be bottoming out at about $80 million per day, a level not seen since October 2020. Trading volumes have declined 75% since peaking in February.

Despite the drop, the volume remains nearly triple the levels seen for the third quarter of 2019 through the third of quarter 2020 and averaged $36 million per day. The increased value is justified by growth in market capitalization.

Average daily trading volumes of U.S. cannabis stocks experienced a dramatic rise between October 2020 and February 2021 on legislative optimism and the meme-ification of cannabis stocks, peaking at an average of about $300 million per day.

The chart above shows the 30-day average daily trading volume of U.S. cannabis stocks (including both OTC and Canadian tickers) in blue on the left axis and a market cap-weighted price index in green of the U.S. operators pegging Jan. 1, 2019, at 100 on the right axis.

Optimism on legislative progress after the “Blue Wave” drove volumes to about $100 million per day, on average, in the fourth quarter of 2020, with much of November and December bouncing between $100 million and $200 million per day.

Volume skyrocketed to $400 million on Jan. 6 after the Democrats’ wins in Georgia’s runoff election and Curaleaf Holdings’ $250 million equity offering.

Volume spiked to an all-time high of $652 million on Feb. 10, when Tilray and Sundial Growers’ volumes spiked above mega-caps such as Amazon, Apple and Facebook on meme trends on Reddit and Twitter. Valuations peaked at 8X 2021 sales and 27X 2021 EBITDA in February.

Trading volumes then consistently declined until June, reaching the current level of about $80 million.

Reports of compliance departments forcing sales at institutional investment firms, as well as institutions refusing to custody U.S. cannabis stocks, have driven declines.

Stocks also started a new 17% decline after the release of the Cannabis Administration and Opportunity Act and comments by Sen. Cory Booker, a New Jersey Democrat, favoring comprehensive federal reform over incremental measures such as the SAFE Banking Act.

Bottoming or another drop coming?

Trading volumes for U.S. operators appear to have stabilized since mid-June at about $80 million per day.

Of course, there are more public companies now, so a return to the $36 million per day seen in 2019-20 seems unlikely absent further stock price declines.

As past MJResearchCo analysis has shown, the OTC and Canadian Securities Exchange have much lower trading volume than the Toronto Stock Exchange or the Nasdaq, where cannabis stocks trade 1% and 2.5%-5% of their market capitalization per day, respectively.

With about $40 billion in total market cap for U.S. publicly traded cannabis operators, that implies about $400 million-$2 billion in average daily trading volume if those companies uplisted to those exchanges and institutional investors could return.

This could begin before federal legislation.

It seems compliance departments are re-reviewing cannabis ownership among their clients, with wealth management firm Merrill Lynch loosening regulations on client ownership of cannabis investments.

MJResearchCo expects Merrill Lynch’s peers to follow as demand from their end customers increases.

– Analysis by Mike Regan and Colin Ferrian, MJResearchCo (mikeandcolin@mjresearchco.com)

Deal of the Week / In partnership with Viridian Capital Advisors

Does TerrAscend, Gage deal mark the start of consolidation in Michigan?

On Sept. 1, TerrAscend Corp. (CSE: TER; OTCQX: TRSSF) agreed to acquire Gage Growth Corp. (CSE: GAGE), a leading operator in Michigan with three cultivation facilities, nine contract grow arrangements and 10 retail stores/dispensaries.

Gage also has city and state approvals for 19 Class C cultivation licenses, three processing facilities and 15 retail stores/dispensaries.

As part of the deal, Gage shareholders will receive 0.3001 TerrAscend common shares for each Gage share. This exchange ratio implies a $2.11 share price for Gage, an 18% premium to the preannouncement price. Total consideration at the announcement date was approximately $545 million.

The total consideration represents a 1.8X multiple of consensus 2022 revenues and a 4.3X multiple of consensus 2022 EBITDA, a reasonable price for Gage.

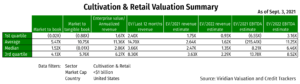

The Viridian Valuation Tracker data pictured below shows average trading multiples of cultivation and retail companies with less than $1 billion market cap to be 1.35X 2022 consensus revenues and 6.46X consensus EBITDA.

The transaction value is understated because TerrAscend also will be purchasing licenses not held by Gage. The total additional amount is not yet known, but this will move the valuation multiples closer to the market multiples.

TerrAscend trades at about 9.2X 2022 EBITDA, enabling Gage to purchase a significantly higher-valued currency. Viridian Capital Advisors has noted this valuation arbitrage previously and believes it is key to understanding the continuing drive for consolidation.

The acquisition positions TerrAscend as the first-mover among major multistate operators in consolidating the Michigan market, the third-largest legal cannabis state in the U.S.

Why Gage?

- Exclusive licensing partnerships in Michigan with Cookies, Slang, Khalifia Kush and others.

- It is a retail leader with average basket sizes of $152 in the second quarter, nearly 80% higher than the state average.

- The company has an efficient “asset-light” operating model utilizing contract growers to supplement company-operated cultivation facilities.

The risk arbitrage spread is reasonable overall, with Sept. 3 closing prices implying a risk arbitrage spread of approximately 12.75% for the transaction.

While the spread appears attractive and suggests a strategy of buying Gage and shorting TerrAscend, the risk of the TerrAscend short is unacceptably high. The contingent ownership position of Canopy Growth in TerrAscend positions Canopy as a potential buyer when the law allows. Similarly, other regulatory developments might have differential impacts on the value of TerrAscend relative to Gage.

The deal is contingent on approval by a majority of disinterested holders. Despite the lockup agreements signed by directors, officers and shareholders representing more than 58.5% of total voting power, the lockups represent only 29.1% of disinterested shareholders for the vote.

The transaction also is subject to approvals by regulators and stock exchanges, but that is not expected to be an issue.

Public acquirer/public target deals to become more common

Year-to-date, Viridian has tracked 156 closed M&A transactions in the U.S., and only 10 of them have been public companies buying public companies.

But this trend is likely to accelerate because:

- Large MSOs continue to have significant cash positions, whereas smaller public companies have had a more difficult time attracting growth capital and much higher capital costs.

- The gap between the valuations of large public companies and small public companies continues to support stock consideration.

- Public companies tend to have better-established accounting, control and operating systems, making them easier to assimilate.