A recreational cannabis market in Montana could generate sales of more than $200 million in its first year of operation in 2022, according to a new study from the University of Montana’s Bureau of Business and Economic Research.

The first barrier, however, is getting Montana voters to approve a ballot initiative on Nov. 3 that would legalize the cultivation and sale of recreational marijuana.

In addition, existing medical marijuana businesses would get first crack at the new licenses during the initial 12 months.

But if the state’s medical marijuana program is an indicator, the wait might be worth it for entrepreneurs hoping to open new adult-use businesses.

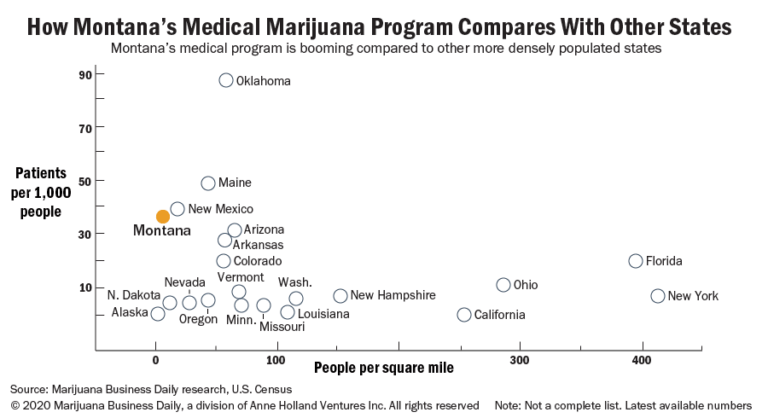

While Montana is one of the least populous states, its medical marijuana program is booming compared to other markets.

Forty out of every 1,000 Montanans are patients in the state’s MMJ program, whereas Alaska and North Dakota report less than five out of 1,000.

The lower ratio is also the case for more populous states such as Florida and New York.

Montana adults also use cannabis more than the national average.

The 2019 National Survey of Drug Use and Health reported that 14.3% of the state’s adults used marijuana in the previous month, compared with the national average of 9.3%.

How Montana would compare

The University of Montana’s 2022 projection of $217 million in adult-use sales would put the state at about the same level as Alaska’s projected 2020 sales of both recreational and medical cannabis, according to the 2020 Marijuana Business Factbook.

The recently released Factbook also projects adult-use marijuana retailers in the more populous state of Illinois will ring up sales of $500 million to $600 million during the first full year of that recreational market – or a bit more than twice the level projected for Montana.

The University of Montana’s study projects the state could bring in $260 million in sales by 2026.

It also predicts that growth will come mostly from tourism dollars, as sales to local residents are expected to slow as the market matures and prices drop.

Nonresident companies and investors might still have hope.

A 2019 Reason Foundation report on residency requirements found that rules often change as new markets start to need capital, and the initial reasons for the requirements – such as local protectionism, illicit-market diversion and federal oversight – change. The foundation describes itself as a libertarian think tank.

Colorado, which had strict requirements at its market launch, changed the rules in 2016 with Senate Bill 40, which allowed out-of-state individuals to take ownership roles in licensed marijuana companies.

Oregon also repealed its residency requirements in 2016.

Moreover, there has been legal pressure in other markets.

A Washington state company recently filed a federal lawsuit against Oklahoma, which requires a two-year residency and restricts ownership up to 25% of a medical cannabis business.

West Virginia eliminated its residency requirement for medical cannabis business licenses after a 2019 U.S. Supreme Court decision ruled that Tennessee violated the Commerce Clause by requiring retail liquor store applicants to be residents for two years and forcing corporation stakeholders to be the same.

Maine also dropped its requirements earlier this year after large medical marijuana company Wellness Connection filed a lawsuit the state said it was unlikely to win.

And the battle is not only at the state level.

A federal judge ruled in August that Portland, Maine, can’t enforce scoring criteria that would give preference to locally owned marijuana businesses.

Andrew Long can be reached at andrew.long@mjbizdaily.com