Marijuana businesses have paid higher taxes than mainstream companies for years thanks to Section 280E of the Internal Revenue Code, and now cannabis operators – especially retailers – might face an even bigger tax bill from Uncle Sam as well as some states.

Two noteworthy developments could boost marijuana firm taxes:

- President Joe Biden’s $2 billion infrastructure plan proposes raising the federal corporate tax rate from 21% to 28%.

- States legalizing recreational marijuana programs increasingly are limiting vertical integration to small operators, or microbusinesses. By contrast, stand-alone marijuana retailers face a higher federal tax burden than vertical operations given the limited number of deductions retailers can take, tax experts say.

The prospect of such a one-two punch has raised alarm bells among cannabis tax experts.

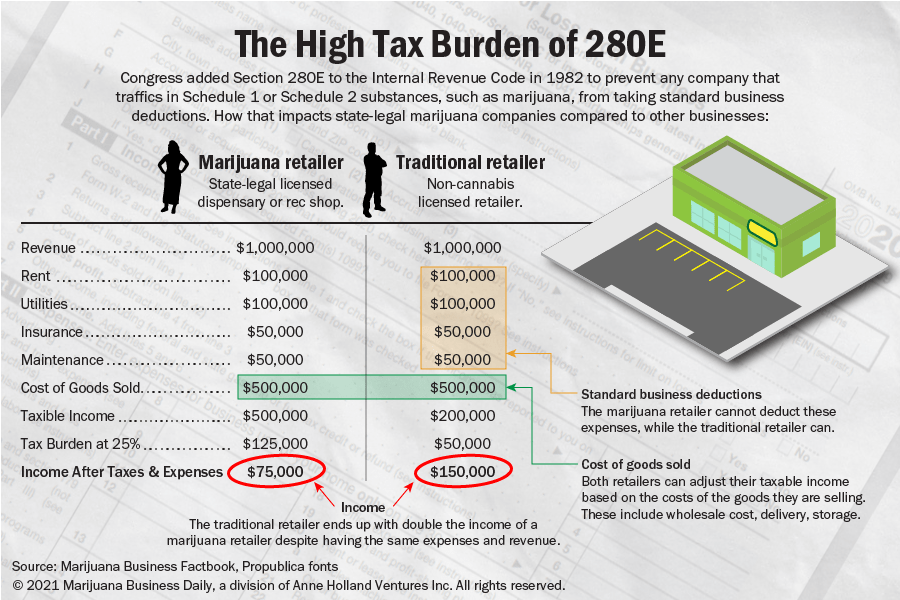

For starters, Section 280E already bars marijuana companies from deducting ordinary business expenses – including operators in states that have legalized the plant.

“To layer a higher corporate tax rate on top of 280E – it’s going to be a steep mountain to climb,” said Ryan Brandt, a senior manager in New Jersey for the tax advisory firm Withum.

As a result, “they will have that (corporate tax rate) increase on their gross profit, not their bottom-line earnings,” added Stuart McCallum, a partner at Withum’s Orlando, Florida, office.

“Seven percent (higher tax) on their gross profit could be a big swing.”

Nick Richards, a tax specialist and partner at Denver-based law firm Greenspoon Marder agreed: “Yes, it is a concern for the cannabis industry. A lot of companies converted or set up as C corps and would be subject to the increase in tax if the rate is changed.”

Granted, the corporate tax rate was even higher – 35% – before former President Trump pushed through his tax cut in late 2017.

Tax fallout for retailers

280E hits medical marijuana dispensaries and adult-use retailers particularly hard because they are able to deduct only the wholesale purchase price of the cannabis they bought from a grower to sell to consumers, Brandt said.

The IRS, for its part, has issued guidance that allows a business that sells legal marijuana to reduce its gross receipts or revenue only by the costs of acquiring or producing the cannabis it sells – a reference to the cost of goods sold, or COGS.

However, retailers cannot deduct ordinary business expenses such as advertising, selling or other general and administrative expenses.

“They don’t have a way to diversify their tax structure,” McCallum said.

That’s not the case for vertically integrated businesses that grow and sell the marijuana they produced.

Vertical operations are taxed as a producer, Richards said, “and more expenses are allowed” to be deducted under COGS.

Producers, for example, can take deductions for capital expenditures and depreciation on equipment, Brandt noted.

“The key to minimizing the 280E tax effect is to have a vertically integrated structure where your tax savings will trickle down from your cultivation operation to your retail dispensary,” Brandt said.

Richards concurred.

“A vertically integrated business is better for taxes and for margins,” Richards said.

A retail operation, Richards explained, has a “really bad tax problem,” because it can’t even deduct expenses for state-mandated inventory-security requirements such as cameras, safes and other equipment and processes.

“That (inventory security) can be a big part of a retail store’s expense,” Richards said, even accounting for 10% to 30% of a store’s expenses.

But a vertical operation can “shield” some of that tax problem, since it can deduct so many other expenses such as the depreciation of its equipment, packaging costs, even inventory management.

“In fact, we saw a lot of stand-alone grows close down here in Colorado because the market was flooded with growers and the price was lower than many could grow it for,” Richards said.

“Meanwhile, when prices are high and growers are doing well, stand-alone retailers cannot make a profit because they have to compete with vertically integrated stores” that are able to better to absorb costs in part through lower taxes.

Consequences in New York

Jennifer Benda, a cannabis tax specialist and partner at Oklahoma-based law firm Hall Estill, indicated that those dynamics will play out in even starker terms in New York under the state’s recently enacted recreational marijuana law.

“New York’s recent move toward adult-use cannabis legalization is good for the movement and hopefully another step forward in national, federal legalization,” Benda wrote in an email distributed to reporters.

“However, New York’s regulatory structure includes a major hurdle from a tax and profitability standpoint.”

That’s because, Benda wrote, the law will limit vertical integration for most new adult-use entrants.

The exception will be microbusinesses and the state’s 10 existing medical marijuana operators, which already have vertical operations.

Adult-use legalization measures recently passed in New Jersey, New Mexico and Virginia also generally will limit vertical integration for new entrants except microbusinesses.

“The impact of the federal tax provisions is particularly harsh for marijuana businesses that are retailers and are not vertically integrated,” Benda wrote.

In addition, she added, New York hasn’t updated its tax laws yet to permit adult-use marijuana businesses to deduct the expenses for state income tax purposes, “adding more pain to the equation.”

Benda wrote that until Section 280E is repealed for the marijuana industry or courts give marijuana retailers more leeway in deducting inventory-related costs, the “profitability of marijuana retailers could be limited.”

Reform needed, but when?

Congressional lawmakers over the years have introduced legislation to eliminate 280E for state-legal marijuana companies.

The prevailing view, though, is that it’s more likely to be eliminated through comprehensive reform – rescheduling or descheduling marijuana – so a national tax on marijuana can offset the 280E revenue the federal government would lose.

But the importance of fighting for the elimination of 280E can’t be underestimated, industry experts said.

Nathaniel Gurien, CEO of New York-based Fincann, which provides cannabis banking services, noted as much when commenting recently about New York’s legalization of an adult-use market.

He wrote that New York, “as the financial capital of the world,” would put pressure on lawmakers to push for cannabis banking reform and, more importantly, federal legalization.

But Gurien noted, and many experts agree, that legalization might not happen until the latter part of Biden’s administration, perhaps 2023.

In the meantime, Gurien wrote, “legislators should not be focusing on the SAFE Banking Act, but rather implementing changes to the 280(E) tax law.”

Jeff Smith can be reached at jeff.smith@mjbizdaily.com.