The growing number of medical cannabis brands and products available to patients in Germany indicates that companies wanting to enter and succeed in that market need to think beyond simply offering a consistent supply of products.

Marijuana Business Daily analyzed dozens of available cultivars, their pricing and other data through the week ended Nov. 15. The data shows the flower category becoming increasingly competitive.

Given the increasing competition, it’s important for overseas exporters to have a strong sales team on the ground and to provide customer service to German doctors and pharmacists, experts said.

Exporting to Germany remains one of the most attractive international revenue opportunities for cannabis producers with a global vision.

But today’s German flower market isn’t as supply-constrained as it has been in previous years.

Moreover, with prices declining, exporters should no longer expect to receive premiums that previously had been achieved in the German market.

Most of the flower continues to come from producers in Canada and the Netherlands, with Portugal starting to account for a small portion in 2019 and Spain entering the picture in 2020.

Looking ahead, cultivators in other countries – such as Australia, Denmark and Israel – are expected to start exporting flower to Germany for commercial purposes soon, and more Canadian products are likely to be available to patients in the near term.

But companies planning to export large quantities of flower to Germany in the future might find it challenging to compete with established brands in a market that is seeing slowing growth.

Newcomers could reduce the risk of oversupply and increase their chances of successfully entering the market by offering differentiated products such as extracts.

The data for this story comes from an MJBizDaily price survey of pharmacies. Leading exporters to Germany or wholesalers provided additional information.

Because of the dynamic nature of the flower market, availability and prices should be considered a snapshot of the situation as of last week.

Patients in Germany can currently choose from almost 50 different flower varieties, according to the MJBizDaily analysis.

While not all cultivars are consistently available, most have been obtainable throughout 2020.

Flower still represents about half the reimbursed market in Germany and an even larger proportion when considering private prescriptions.

Increasing competition

More brands are competing in a flower market that isn’t growing as rapidly as in previous years:

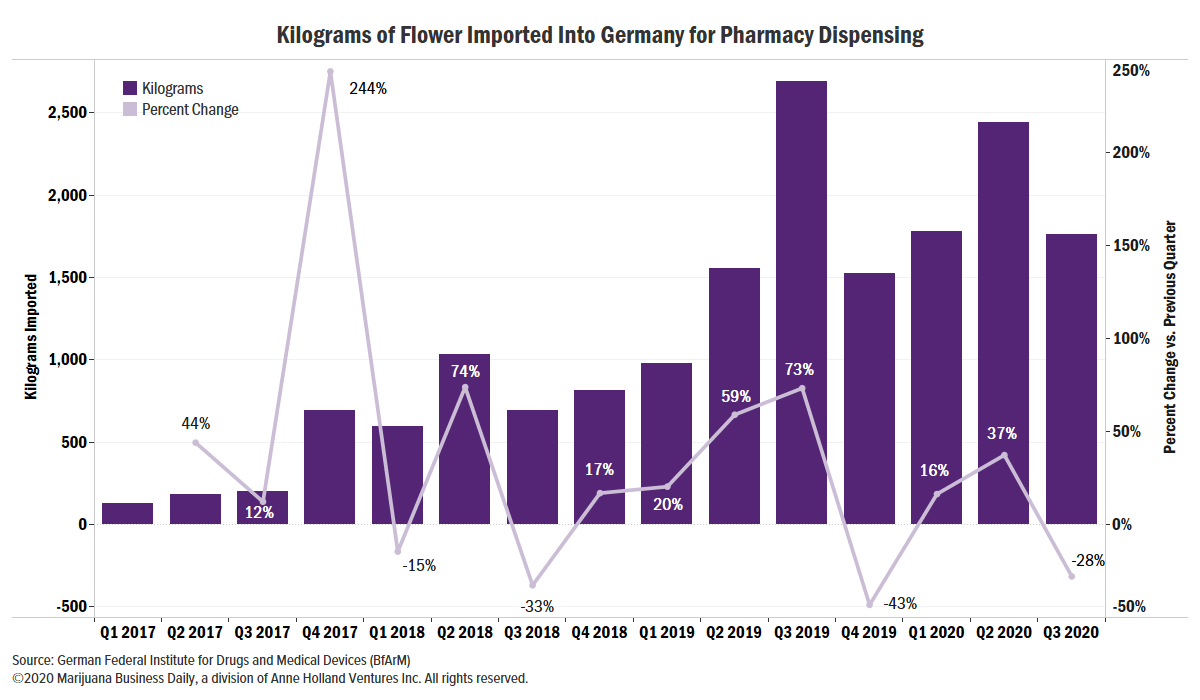

- The latest flower import data shows almost 6,000 kilograms (13,228 pounds) were imported in the January-September period, representing a 15% growth from the same time frame a year ago.

- The latest reimbursement data shows the flower market decreased quarter-over-quarter both in euros reimbursed and the number of prescriptions that were issued, with extracts slightly improving in the same period. Dronabinol dominates the extracts category.

A competitive market means newcomers might struggle without a strong distribution infrastructure and presence on the ground to make doctors aware of their offerings.

Canada-based Aphria produces the flower product that became available to patients this month.

The flower is grown in Canada and distributed in Germany by Aphria’s German subsidiary, CC Pharma.

CC Pharma, being a distributor of pharmaceutical products, “provides an advantageous platform for Aphria in Germany,” Hendrik Knopp, the company’s managing director in the country, told Marijuana Business Daily.

“At CC Pharma, we have a team dedicated to do sales and provide customer service to pharmacies and another team dedicated to do the same thing with doctors,” Knopp added, underscoring the importance of having boots on the ground.

The German subsidiaries of Canadian producers Aphria and Aurora Cannabis, along with Germany-based Demecan, are expected to start supplying the German market with domestically produced flower early next year, possibly bringing more downward price pressure to the market.

High-THC market

About 10 flower brands are effectively available to patients.

Companies with the most SKUs in their portfolios available to patients include Germany-based importer and wholesaler Cannamedical Pharma as well as the German subsidiaries of Canadian producers Aurora, Canopy Growth and Tilray.

Cannamedical-branded products currently available in German pharmacies have been imported from Canada and Portugal.

In terms of cannabinoid concentrations:

- More than half the almost 50 cultivars MJBizDaily determined were available have high-THC content – defined here as 17% or more – and less than 1% CBD.

- Roughly a dozen have medium- or low-THC concentration with no meaningful CBD.

- Six cultivars have balanced THC and CBD concentrations.

- Only three have significant CBD content and less than 1% THC.

Stefan Fritsch, founder of Grünhorn, a pharmacy in Leipzig, told MJBizDaily that “out of the over 40 strains that we have in stock, the five that have 22% THC or more represent over a third of our sales.”

Price

Pharmacies typically calculate price differently depending on whether the flower prescription is reimbursed by statutory health insurers or paid by patients out of pocket.

In the first case, rules changed a few months ago with the price per gram depending on the size of the prescription.

Most cases fall in the range of 16-23 euros ($19-$27) per gram.

For private prescriptions, pharmacies are expected to continue imposing a roughly 100% markup.

But some pharmacies that have specialized in selling medical cannabis offer much lower prices.

In Marijuana Business Daily‘s analytical snapshot, almost all cultivars could be found in a price range of 11-14 euros per gram in certain pharmacies.

That price doesn’t include the narcotics fee of 4.26 euros that is added for each sale. Postage cost for delivery also is excluded.

Fixed fees and shipping costs make sales involving larger quantities more appealing for certain patients paying out of pocket.

Country of origin

The number of countries effectively supplying Germany with flower has not changed much in recent quarters, even though exporting to Germany underpins the business plans of dozens of companies.

While companies in Canada, the Netherlands and Portugal account for the bulk of the flower, two new developments highlight 2020:

- Uruguayan-grown flower ended up in Germany, but not before being batch released in Portugal by Tilray.

- Spanish licensed producer Linneo Health started exporting flower to Germany, currently available under different brands.

Several companies have either announced – or are expected to soon begin – sales of Linneo’s Spanish product, but only the IMC and CanPharma brands were available in the pharmacies that MJBizDaily surveyed.

Linneo’s white-label strategy has so far also included exports to the United Kingdom to supply Khiron Life Sciences and to IMC in Israel.

The MJBizDaily-compiled list of currently available cultivars – as well as details such as country of production, brand, cannabinoid content and lowest retail price found for each product – is available here.

Alfredo Pascual can be reached at alfredop@mjbizdaily.com