(Editor’s note: This story is part of a recurring series of commentaries from professionals connected to the cannabis industry. Michael Sampson is a partner at Pittsburgh-based Leech Tishman Fuscaldo & Lampl, where he co-chairs the law firm’s Cannabis Group. Alexander Gase is an associate in the firm’s Corporate Practice Group.)

Make no mistake, the U.S. Internal Revenue Service plays to win. And cannabis companies need to prepare accordingly if they hope to survive federal tax scrutiny.

The IRS, according to MJBizDaily, “has been training its agents for … years in the finer details of auditing marijuana companies.”

Recently released IRS documents, which were obtained by MJBizDaily, show that “the IRS has studied and refined its methods for examining marijuana industry tax returns ….”

Among those documents is a cannabis industry-related “Participant Guide,” which at least one other tax attorney has labeled the IRS’ “playbook.”

In the Participant Guide, the IRS stresses, for example, the importance of initial interviews, because “as many taxpayers hire representation after the initial interview, it may be the only chance (agents) have to talk directly with the taxpayer.”

As such, cannabis-related businesses should proactively develop their own tax/legal game plans.

As is often said, “The best defense is a good offense.”

While relevant tax considerations might vary depending on the structure of a particular company, any business’ “winning plays” should incorporate “best practices,” including, but not necessarily limited to, the following:

1. Understand applicable law.

For example, generally, under Section 162(a) of the Internal Revenue Code, a business may deduct expenses that are “ordinary and necessary” to carrying on its trade or business.

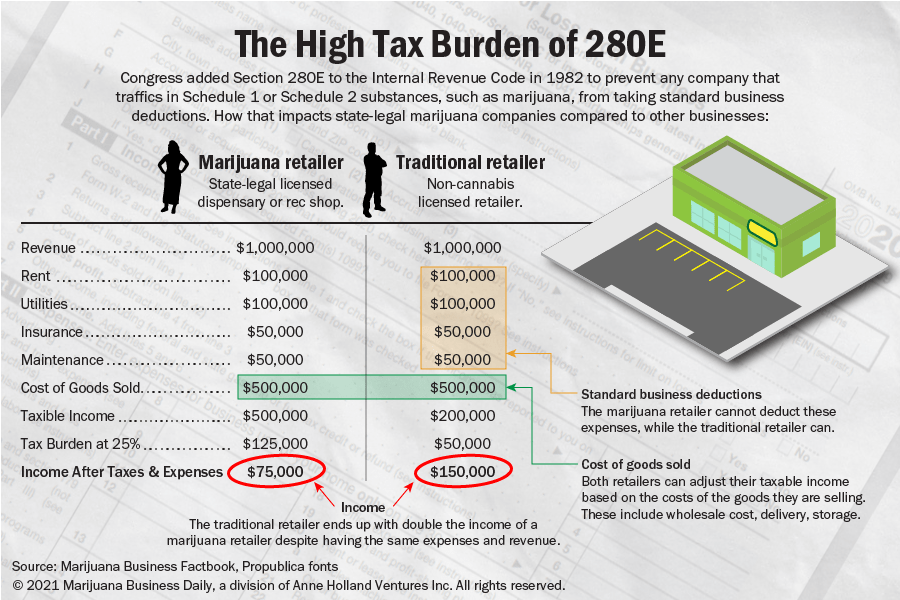

While such deductions generally are not industry specific, they generally are not available to the cannabis industry because of Section 280E of the Code.

2. Review business expenses to ensure correct characterization of costs that might qualify as “cost of goods sold” under Section 471(a) of the Code.

For example, “cost of goods sold” for a retailer, which should constitute a valid exclusion, could include the purchase price of cannabis but not certain indirect costs, such as repairs and maintenance costs.

The U.S. 9th Circuit Court of Appeals recently underscored this point in Patients Mutual Assistance Collective Corp. v. Commissioner of Internal Revenue (Harborside), stating that “just because (the taxpayer) is unentitled to deductions does not necessarily mean it cannot take exclusions for some of the amounts at issue. Section 280E does not purport to deny to those taxpayers within its scope the ability to seek exclusions that are available to other businesses.”

3. Maintain all tax-related documentation for seven years.

While the statute of limitations for an audit is typically three to six years (depending upon the relevant tax-filing date), cannabis-related businesses, out of an abundance of caution, should consider retaining tax-related documents for a longer period.

Tax documentation may include, but is not limited to, tax returns, receipts, correspondence with tax authorities and supporting workpapers.

4. Retain and organize documentation regarding company owners’ personal living expenses and net worth, as the IRS has identified this information as potentially relevant to determining business sales.

As one particular audit technique – the “Net Worth Method” – instructs the IRS to regard an increase in a taxpayer’s net worth during a given taxable year further, adjusted for Section 280E disallowances, as income of the business, it is important to maintain relevant documentation, for among other reasons, to help rebut such treatment.

5. Carefully follow U.S. Tax Court cases and other federal court rulings, U.S. Department of Treasury guidance and IRS bulletins and publications.

Constitutional and other challenges to Section 280E are ongoing. Recently, in the Harborside case, the 9th Circuit declined to find that Section 280E violated the 16th Amendment to the U.S. Constitution.

These challenges are unlikely to end soon, and formal legal/tax guidance will continue to inform and control the industry’s behavior.

6. Utilize IRS prepaid credit cards to pay estimated taxes online.

The IRS has created easier ways for cash-intensive taxpayers to pay their taxes, including the IRS2Go mobile app, which allows taxpayers to put money on prepaid cards (virtually via the mobile app or through a physical card) at one of the agency’s retail partners.

7. Cooperate with IRS agents.

A monetary penalty may be assessed for refusing agents entry into a place of business.

That said, be sure to protect all legal rights, including the right to invoke the Fifth Amendment, if and as necessary and appropriate. Consult with experienced legal counsel as warranted.

8. Be prepared for on-site tours of business and initial interviews, which are common methods employed in audits across this industry.

It is important, in coordination with legal counsel and consistent with all applicable law, to adequately prepare employees to cooperate and be able to assist the IRS in its examination.

Involvement of legal counsel in this process not only can help ensure full preparation but can also – at least under certain circumstances – make discussions with employees subject to the attorney-client privilege.

9. Ensure all correspondence with the IRS is in writing.

Not only does doing so provide a “paper trail” and a solid organizational framework, but it can also afford the taxpayer additional time to gather information and consult with legal counsel.

10. Contact an experienced tax attorney, preferably one with knowledge of the cannabis industry, and/or a qualified accountant if and when the business has been identified for audit.

Having a quarterback to help captain your team across the goal line during an audit can be invaluable. Attorneys and/or accountants, for example, can explain relevant law, direct discussions, identify applicable privileges and set strategy.

To be sure, an IRS audit can be intimidating, but it does not have to be a one-sided contest.

By proactively crafting a playbook and thereafter, in the event of an audit, assembling a strong team that can execute the game plan, cannabis businesses can level the playing field and best protect themselves.

Michael Sampson is a partner at Pittsburgh-based Leech Tishman Fuscaldo & Lampl, where he co-chairs the law firm’s Cannabis Group. Alexander Gase is an associate in the firm’s Corporate Practice Group. They can be reached at 412-261-1600 or msampon@leechtishman.com and agase@leechtishman.com.

The previous installment of this series is available here.

To be considered for publication as a guest columnist, please submit your request here by filling out our form.