For investors, it is critical to know the details of how a cannabis company in this hypergrowth industry plans to bridge the gap between its current money-losing reality and the vision of a profitable future.

The “lose money now, make money in the future” operating model is not unusual for a relatively new industry. Companies are spending tremendous amounts of money to establish first- or early mover advantage, win market share, establish brands and expand geography.

The journey to profit will require operating model leverage (profit margin expansion), and investors need to know where that leverage will come from.

A simple way to think about operating leverage is the ratio of fixed costs to variable costs of a business. Said another way, it’s the relationship between the expenses that will remain relatively stable as sales rise (fixed costs) and the expenses that will likely rise as sales rise (variable costs).

For example, think of a retail dispensary that pays employees a high base salary and no sales commission. The salaries, rent and utilities are high fixed costs incurred regardless of the amount of sales generated.

Once those fixed costs are covered, more of the incremental sales dollars flow to the profit line (high leverage).

Compare that to a dispensary that pays lower fixed salaries plus sales-based commission. Even after fixed costs are covered, commission expenses will continue to rise as sales rise (low leverage).

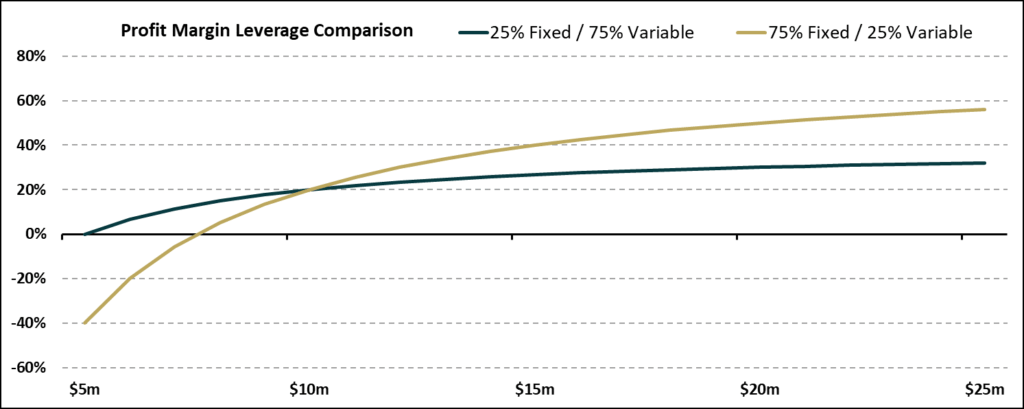

The graph below shows profit margins for two hypothetical companies as sales range from $5 million to $25 million.

Both companies have a 20% profit margin at $10 million in sales. However, one company has a cost mix of 25% fixed and 75% variable, while the other is 75% fixed and 25% variable.

Both companies have the same profit margin at $10 million of sales, but as sales rise to $25 million, the higher-fixed-cost model produces nearly 60% margins; the higher-variable-cost model produces roughly 30% margins.

But there is always a trade-off.

If sales fall to $5 million, the high-fixed-cost model has massive downside potential to lose money at -40% margins. The higher-variable-cost model carries less downside risk as margins compress only to break-even, 0%.

That example clearly demonstrates why it’s critical to know management’s target operating model and determine how conservative or aggressive the margin leverage goal is given the cost structure of the business.

As part of our expanded product, we will analyze companies’ current and target operating models, their fixed- and variable-cost structures and the expense line items that offer the opportunity for margin leverage as the company grows.

Our goal is to provide you with valuable insight that will help you identify investment opportunities in the cannabis industry and how to capitalize on them.

Craig Behnke can be reached at craigb@mjbizdaily.com