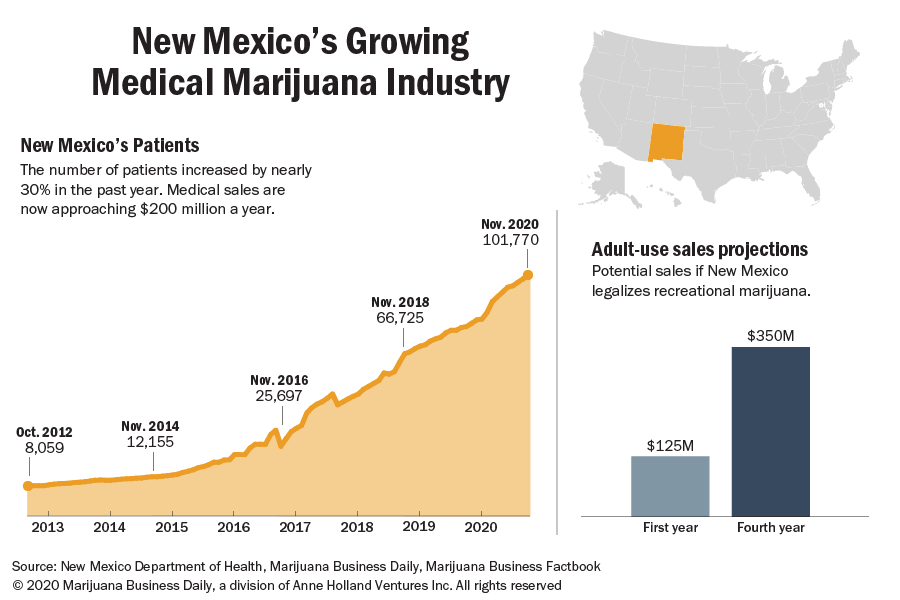

New Mexico’s medical marijuana sales have nearly doubled in the past two years despite strict plant-count limits, and the state might be better positioned to legalize recreational cannabis after neighboring Arizona did so last month.

Marijuana Business Daily projects an adult-use cannabis market in New Mexico could generate $350 million in annual store sales by its fourth year of operation.

The state’s MMJ sales, meanwhile, are rising. Fueled by the coronavirus pandemic and patient growth, sales are on pace to reach around $200 million this year.

New Mexico’s MMJ sales totaled $130 million in 2019, according to the Marijuana Business Factbook.

The sparsely populated Southwest state recently exceeded the 100,000 milestone in registered patients. The patient count has increased nearly fourfold since 2016.

“Sales are definitely up. We’ve seen a significant uptick – as much as 100% growth over last year – which I would attribute to the pandemic,” said William Ford, founder and chair of R. Greenleaf Organics, which has eight dispensaries in New Mexico.

Industry experts see New Mexico as a likely candidate to legalize adult use next year through its Legislature, in part because its more conservative neighbor to the west, Arizona, did so in November through a ballot initiative.

Without legalization, Arizona’s recreational market could attract New Mexico residents across the border and depress MMJ sales in that state.

Also, recreational marijuana sales could help New Mexico’s budget, which, like other states, has been hurt by the economic cost of the pandemic.

New Mexico is one of the states “ripe” for recreational marijuana legalization, Steve Hawkins, executive director of Washington DC-based Marijuana Policy Project, said in a recent interview.

However, adult-use legalization bills in New Mexico have failed in the past two years, and the state Senate has previously been the biggest obstacle.

Several competing legalization bills are in the works.

The state’s medical cannabis market posted sales of $147 million in the first nine months of 2020 – including $55 million in a sizzling third quarter – according to figures obtained by Ultra Health, the state’s largest MMJ operator.

That puts the state in line to reach around $200 million in sales this year.

New Mexico has 34 licensed nonprofit vertically integrated MMJ operators, with 123 dispensaries in operation statewide, according to the most recent state data.

Post-traumatic stress disorder is the No. 1 patient qualifying condition, followed by severe chronic pain, state Department of Health data shows.

Onerous plant-count limits

The top challenge to an even more robust MMJ market and a quick transition to adult use is the state’s strict plant-count limits, said Duke Rodriguez, CEO of Ultra Health, which has 24 dispensaries across the state.

“We are at a huge disadvantage when it comes to having an adequate supply,” Rodriguez said.

Medical marijuana operators in New Mexico have been in litigation over the plant-count limits for years. In 2018, a judge ruled that a then-limit of 450 plants per cultivator was arbitrary and too limiting.

The state responded by increasing that number to 1,750.

But the operators sued again.

Although the move to 1,750 seemed like a large increase, Rodriguez noted that the number of patients has increased in the meantime and the plant count remains equivalent to roughly half a plant per patient.

By comparison, neighboring Arizona and Oklahoma don’t have plant limits, and Colorado’s is equivalent to roughly nine plants per patient cardholder, he said.

Colorado has 85,000 registered MMJ patients – 15,000 fewer than New Mexico – yet is projected to reach $380 million in MMJ sales this year, according to the Marijuana Business Factbook.

That’s around double New Mexico’s projected sales.

“We’ve gotten a nice bump from the COVID impact, but we still lag other medical programs of comparable size,” Rodriguez noted.

New Mexico’s MMJ retail prices also remain higher than in neighboring states, he said.

The state’s 34 licensed MMJ operators are permitted to cultivate a combined 59,500 plants.

But Rodriguez estimates that the state would need to cultivate as many as 600,000 plants if an adult-use program is launched.

“We clearly don’t have the infrastructure to meet what a robust legalization market would require,” he said.

Ford of R. Greenleaf Organics disagrees that the plant-count limit is an issue for the state’s MMJ program.

“However, I think New Mexico has yet to really mature as a market … that is, embracing technology and advanced methods in cultivation,” Ford said.

“I think if people were utilizing new technology, they’d have no problems meeting the needs of the market.”

But Ford agrees the plant-count limit would need to be increased if marijuana is legalized for adult use.

An advisory board recommended this week that New Mexico MMJ regulators consider increasing the plant count, based on concerns about high product costs and the dearth of variety, the Associated Press reported.

Legalization prospects bright

Gov. Michelle Lujan Grisham has embraced recreational cannabis legalization, seeing it as a way to strengthen and broaden the state’s economy, which is heavily reliant on oil and gas.

Industry officials said a bill earlier this year was too focused on special interests such as a labor peace provision and also came during a short session.

The Nov. 3 election saw progressives gain seats in the state Legislature, brightening legalization prospects.

Ford advocates for a bill that would protect the state’s medical marijuana program and create a separate general “wellness program” in which sales are taxed at 15%-25%.

According to the draft bill, a “wellness” patient wouldn’t need a doctor’s recommendation but would have to register with the state and be older than 25.

“My concern is that New Mexico has different challenges in terms of substance abuse, addiction,” he said.

State Rep. Javier Martinez told a panel of lawmakers in November that he will introduce legislation in 2021 aimed at preserving the state’s 13-year-old MMJ program and creating business opportunities for minority and low-income communities adversely affected by the war on drugs and the criminalization of marijuana.

Ultra Health said it supports a model that would:

- Enable existing MMJ operators to have a head start of about six months before other licensees.

- Have an unlimited plant count and unlimited licensing, with an emphasis on microbusinesses.

- Impose a sales tax rate of 15%-20%.

Rodriguez said he believes an adult-use market could be launched as soon as July 2021, but it’s unclear how the state would handle supply issues if plant-count limits remain intact.

He said Ultra Health’s model shows that adult use could generate $800 million in sales a year based on unlimited licensing.

The model, he said, estimates that a staggering 40% of sales could come from Texans, many of whom come across the border to ski and enjoy other tourist attractions. Texas currently offers only a limited MMJ program to its residents.

Public sentiment for adult-use legalization is strong, “so naturally the belief would be that this is a no-brainer,” Rodriguez said, “but historically we’ve shown a special ability to fail at the obvious.”

Jeff Smith can be reached at jeffs@mjbizdaily.com