Get up-to-date insights on state ballot initiatives and all things Election 2020 for cannabis at MJBizCon. We start with Election Week.

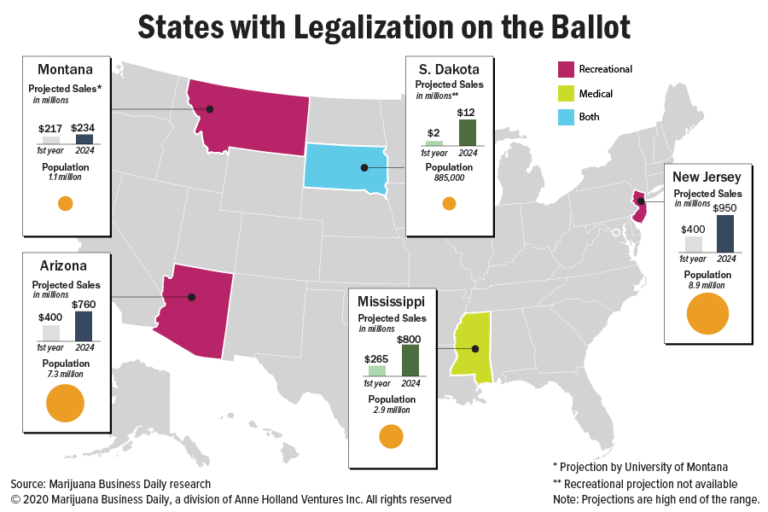

Adult-use marijuana legalization referendums in New Jersey and Arizona headline an election that has the potential to create new state cannabis markets that together could generate more than $2.5 billion in annual sales within a few years.

Also on the general election ballot Tuesday:

- Adult-use cannabis initiatives in Montana and South Dakota.

- Medical marijuana legalization in South Dakota and Mississippi.

“Tuesday’s upcoming election represents a major potential catalyst to the U.S. cannabis industry,” Wall Street investment bank Cowen noted in a research update distributed Oct. 29.

“The most near-term tailwind will come from adult-use ballot initiatives in AZ (Arizona) and NJ (New Jersey), the latter of which has the potential to result in a domino effect of legislatively driven adult-use legalization across the Northeast.”

New Jersey’s adult-use referendum looks almost certain to pass, based on recent polls, while some of the other ballot initiatives could be close.

A business-friendly medical cannabis initiative in Mississippi faces competition from a restrictive referendum placed on the ballot by lawmakers. It also has encountered a last-minute legal challenge that probably won’t be decided until after the election.

Here’s a look at the five states with legalization measures on the ballot Tuesday:

ARIZONA

Background: The state has a pro-industry initiative on the ballot that favors existing medical marijuana licensees. Many are multistate operators that have acquired a presence in Arizona in the past couple of years or expanded their operations aggressively. But some strong independents operate in Arizona as well.

Ballot measure: Proposition 207 (recreational marijuana)

Sponsor: Smart and Safe Arizona

Population: 7.3 million

Projected first-year sales: $375 million-$400 million

Projected 2024 sales: $700 million-$760 million

Key business factors:

- Existing medical cannabis operators would automatically win entry into the adult-use market.

- State would award 26 social equity licenses.

- Retail marijuana sales would face a 16% tax.

Likelihood of passage: Recent polls have shown a range of results from a close vote to a 12% margin in support.

Likelihood of passage: Recent polls have shown a range of results from a close vote to a 12% margin in support.

A Suffolk University/USA Today poll of likely voters taken Sept. 26-30 found that 46% support the initiative, 34% oppose it and about 19% are undecided. Those results are similar to a poll conducted by Monmouth University of New Jersey earlier in September that found 51% of registered voters said they would vote for the initiative while 41% would vote against it.

But another September poll, by Phoenix-based OH Predictive Insights, found only 46% of the state’s likely voters support adult-use marijuana, while 45% oppose it, with 9% undecided.

MISSISSIPPI

Background: Citizens gathered enough signatures to place a business-friendly medical marijuana initiative on the ballot, but state lawmakers countered with a restrictive competing measure. The state’s election code makes it more difficult for an initiative to prevail when competing measures are on the same ballot.

Ballot measures: Initiatives 65, 65A (medical marijuana)

Sponsor of citizen initiative: Mississippians for Compassionate Care

Population: 2.9 million

Projected first-year sales: $240 million-$265 million*

Projected 2024 sales: $750 million-$800 million*

(*Projections are only for Initiative 65, the citizen initiative.)

Key business factors:

- Regulators would be prevented from limiting the number of MMJ licenses.

- Licenses would be issued no later than Aug. 15, 2021.

- The state sales tax (currently 7%) would apply to retail MMJ products.

Likelihood of passage: 81% favor MMJ legalization, with 52% for the citizen initiative. That would be just enough for the measure to pass under the election rules governing competitive measures. The poll was funded earlier this year by the citizen initiative group.

MONTANA

Background: Voters will decide on a recreational marijuana measure that limits business participation to Montana residents.

Residency requirements are becoming a rarer breed, with their constitutionality increasingly challenged in the courts.

Unrelated to the residency issue, a group called Wrong for Montana filed a last-minute lawsuit seeking to remove the adult-use initiative from the ballot. But the Montana Supreme Court dismissed the suit.

Ballot Measure: Initiative 190 (recreational marijuana)

Sponsor: New Approach Montana

Population: 1.1 million

Projected first-year sales: $217.2 million (University of Montana study)

Projected 2024 sales: $234 million (University of Montana)

Key business factors:

- License holders would be required to be Montana residents.

- Existing medical cannabis operators would get a 12-month head start.

- Prospective MMJ companies wouldn’t face a license cap.

- The business license application process would start by October 2021.

Likelihood of passage: The annual Mountain States poll released Oct. 28 by Montana State University showed 54% in support, 39% against and the remainder undecided.

NEW JERSEY

Background: Residents are being asked to legalize a commercial recreational marijuana program that eventually is expected to become a multibillion-dollar-a-year industry. A successful initiative is almost sure to spur New York, Pennsylvania and other neighboring states to similarly legalize.

Ballot measure: Public Question 1 (recreational marijuana)

Sponsor: State Legislature put the initiative on the ballot

Population: 8.9 million

Projected first-year sales: $375 million-$400 million

Projected 2024 sales: $850 million-$950 million

Key business factors:

- Lawmakers and regulators would decide on the number and type of marijuana business licenses available, but existing MMJ operators would likely get first crack at the recreational market.

- Adult-use products would face a 6.625% sales tax.

- Municipalities could pass ordinances to charge local taxes of up to 2%.

Likelihood of passage: A poll by Stockton University in New Jersey in early- to mid-October found that 66% of voters support adult-use legalization, 23% are opposed and the rest undecided.

SOUTH DAKOTA

Background: South Dakota could become the first state in the country to simultaneously legalize medical and adult-use marijuana in November.

Ballot measures: Amendment A (recreational marijuana); Measure 26 (medical marijuana)

Sponsors: South Dakotans for Better Marijuana Laws, New Approach South Dakota

Population: 884,659

Projected first-year sales: $1.5 million-$2 million*

Projected 2024 sales: $10 million-$12 million*

(*Projections are for a medical marijuana market only.)

Key business factors:

- Medical marijuana: A local government wouldn’t be able to ban MMJ but could establish the number of establishments allowed in its jurisdiction.

- Recreational marijuana: Regulators would have to issue “enough licenses to substantially reduce the illicit production and sale of cannabis throughout the state.” But regulators also would be directed to limit licenses to “prevent an undue concentration” in any municipality. Marijuana product sales would be taxed at 15%.

Likelihood of passage: Voting to decide whether to legalize adult use could be close, but the medical marijuana initiative appears to have strong support.

Adult-use legalization is supported by a margin of 51% to 44% with the remainder undecided, according to a poll by Sioux Falls-based Argus Leader Media and TV station KELO released over the Oct. 24 weekend.

Medical marijuana legalization predictably had stronger support with a 74% to 23% margin in favor; 3% were undecided.

Jeff Smith can be reached at jeffs@mjbizdaily.com