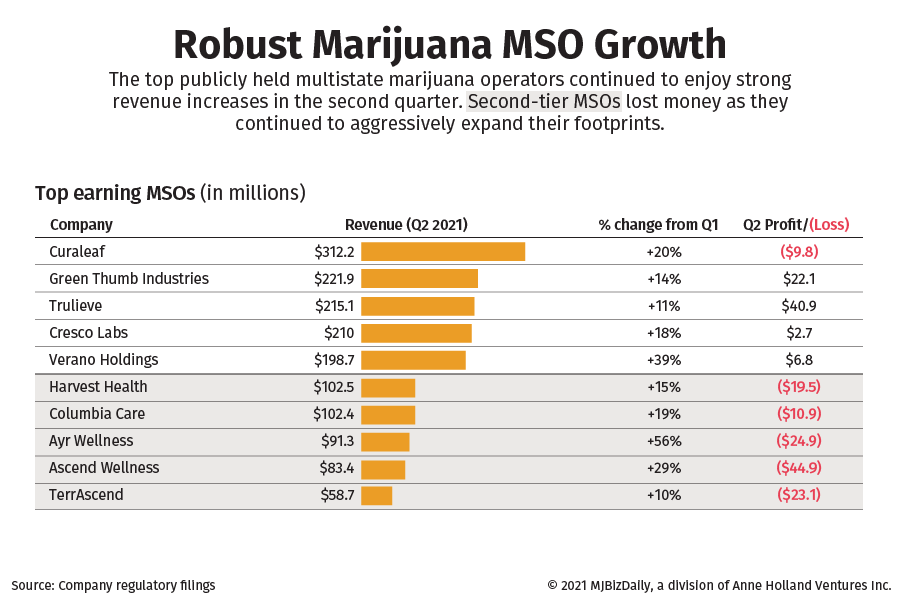

Cannabis multistate operators have made a flurry of acquisitions in Florida totaling more than $500 million over the past year, aiming to make inroads into Trulieve Cannabis’ domination of a medical marijuana market where annual sales top $1 billion.

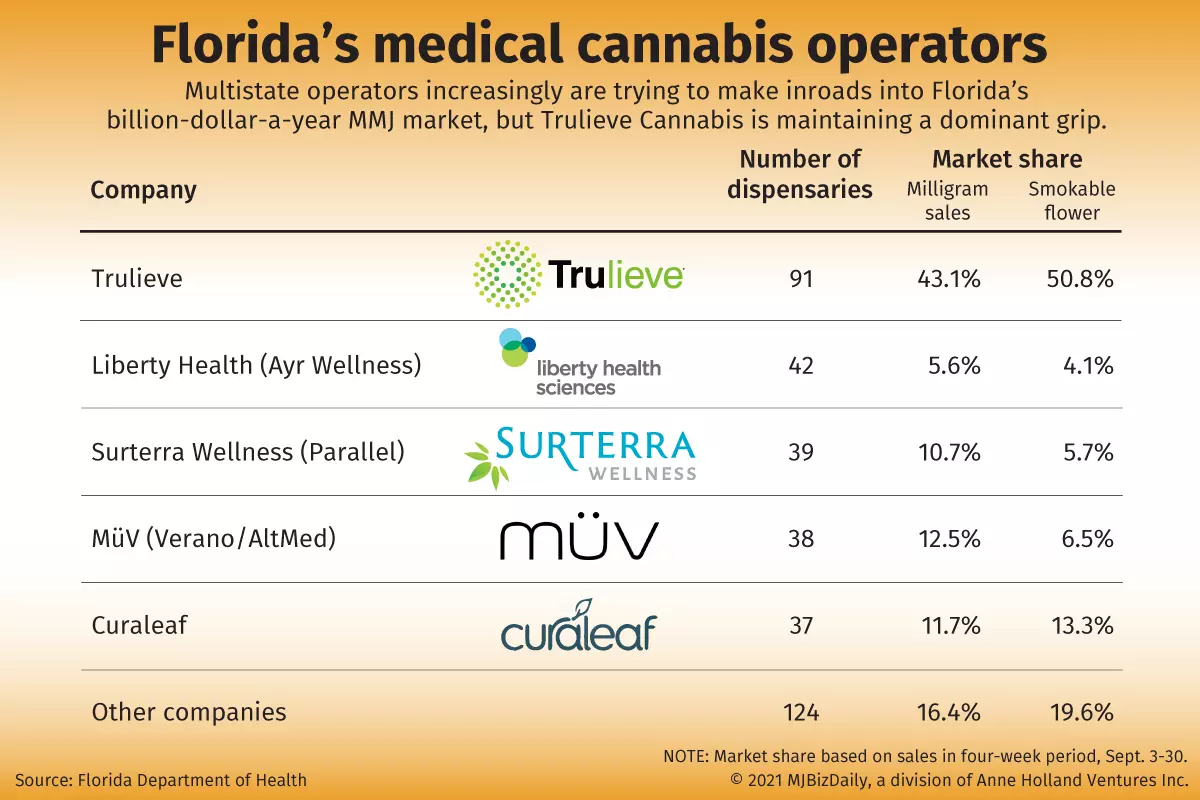

Florida-based Trulieve’s share of the state’s smokable MMJ flower market hovers at around 50%, virtually unchanged from 18 months ago and a level unmatched anywhere in the United States.

But with Florida’s market now running at more than $1.2 billion in annual sales, that still leaves $600 million for other operators, said Andrew Livingston, director of economics and research at the Denver-based cannabis law firm Vicente Sederberg.

“If you had a $600 million market, would others want to enter in? The answer is yes,” he said.

“The continuing expanding market is still enticing, even though there is a very large and dominant existing player.”

The 2021 MJBizFactbook projects that MMJ sales in Florida will reach nearly $2 billion annually by 2025.

And when Florida legalizes adult use – a citizen initiative might be a long shot for next year’s ballot – the state inevitably will become one of the top five marijuana markets in the country, if not one of the top three, Livingston noted.

“Florida is definitely becoming much more competitive,” Frank Colombo, director of analytics for New York-based Viridian Capital Advisors, wrote in an email this week to MJBizDaily.

“You have Ayr (Wellness) buying Liberty (Health Sciences), Cresco buying Bluma Wellness, MedMen getting new financing to build up its presence, and Planet 13 announcing its entrance.”

Business leaders need reliable industry data and in-depth analysis to make smart investments and informed decisions in these uncertain economic times.

Get your 2023 MJBiz Factbook now!

Featured Inside:

- 200+ pages and 50 charts with key data points

- State-by-state guide to regulations, taxes & opportunities

- Segmented research reports for the marijuana + hemp industries

- Accurate financial forecasts + investment trends

Stay ahead of the curve and avoid costly missteps in the rapidly evolving cannabis industry.

Here is a snapshot of a half-dozen deals in just the past year:

- September 2020: California-based Cookies, a privately held, minority-owned cannabis firm, announced plans to build an MMJ operation over two years after quietly acquiring a nonoperational vertically integrated license for an undisclosed price.

- November 2020: Illinois-based Verano Holdings reached an agreement to acquire Florida-based Alternative Medical Enterprises (AltMed) for an undisclosed price.

- December 2020: New York-based Ayr Wellness moved to acquire Florida-based Liberty Health Sciences for $290 million in stock.

- January 2021: Illinois-based Cresco Labs agreed to acquire Florida-based Bluma Wellness, which operates One Plant Florida, for $213 million in stock.

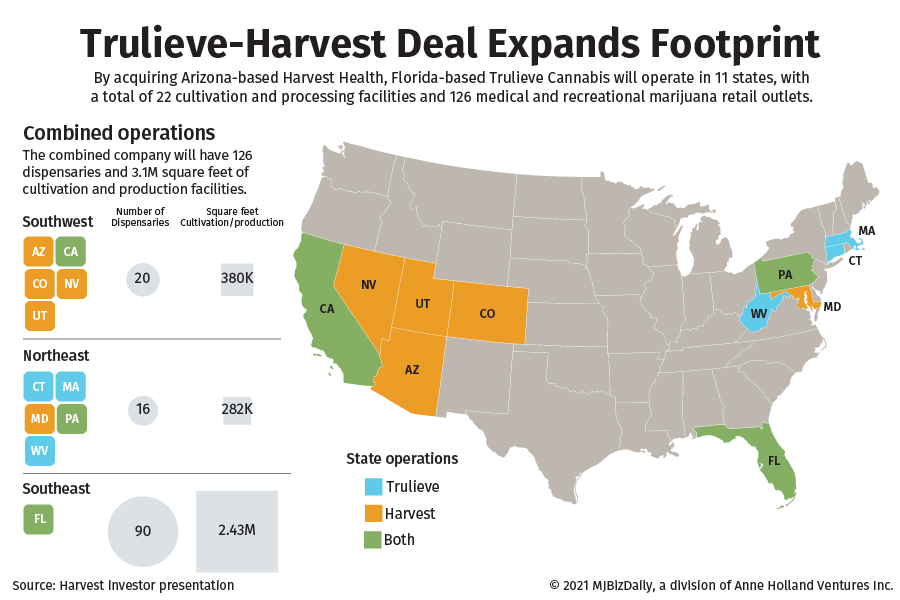

- May 2021: Trulieve agreed to buy Arizona-based Harvest Health & Recreation, which has 14 retail stores in Florida.

- September 2021: Las Vegas-based Planet 13 Holdings agreed to purchase Harvest’s vertical medical marijuana license in Florida for $55 million. The deal excludes Harvest’s operations such as retail stores.

“It’s definitely MSO central in Florida, but that is to be expected given the capital needed to purchase a license and build out enough dispensaries to compete,” Livingston said.

In addition, as noted by Viridian’s Colombo, Los Angeles-based MedMen Enterprises in August received a $100 million equity infusion to fund expansion in states such as Florida, where it opened a dispensary in Orlando last month.

MedMen, which is struggling financially, bought its Florida MMJ license in 2018 for a then-whopping $53 million in what was an early wave of M&A activity in the state. MedMen has six dispensaries in Florida, according to state data.

Rapid store, sales growth

The increased competition is reflected by the fact that Florida now has 371 dispensaries, a 33% jump from 278 a year ago.

But patient growth has more than kept up – increasing 46% during that time, from 424,224 qualified patients to 619,278 as of Oct. 1.

That means there are more patients per store today than a year ago, despite the strong expansion in the number of dispensaries.

Furthermore, sales of smokable flower have risen sharply in the past year, more than doubling in the week ended Sept. 30 versus the same period a year ago.

But while Trulieve has maintained a tight grip on the state’s top spot, other MSOs are aggressively trying to eat into that market share.

Ayr’s Liberty Health, for example, has expanded from 26 dispensaries a year ago to 42.

AltMed Florida, now owned by Verano, has gone from 26 to 38 retail stores under its MüV banner.

Massachusetts-based Curaleaf has increased only from 33 to 37 dispensaries in the past year but has told analysts it will expand to 60 stores in Florida by year-end 2022.

Denver-based MJResearchCo wrote recently for MJBizFinance that the MSOs are undercutting their competitors on price while expanding product variety for patients, all in efforts to increase market share.

Examples this past summer, according to MJResearchCo, included a 40% off sale by Curaleaf, and “flash sales” by Ayr’s Liberty Health.

The obvious beneficiary of such price wars are customers, while the discounts are a drag on MSO profit margins in the state.

A volume game

How Trulieve is even able to maintain such a dominant position comes down in large part to a first-mover advantage, aggressive dispensary rollouts, customer loyalty and production clout.

Trulieve has by far the most dispensaries – 91 before the Harvest acquisition – and, according to Florida Department of Health public data, the company also enjoys the highest flower sales per storefront.

Then there’s production capacity.

Trulieve operates more than 1.9 million square feet of cultivation facilities across five sites in the state, according to company regulatory filings, far more than any of the other 15 operational companies. Another six companies are licensed but not operational.

“It appears a lot of the success of different multistate operators is directly tied to their volume of production,” Livingston said.

“Most other markets allow for wholesale. But Florida is vertically integrated without a wholesale market, so operators must have the ability to supply their dispensaries.”

With the acquisition of Harvest, Trulieve’s number of dispensaries will increase from 91 to 105.

Pablo Zuanic, an investment analyst for New York-based investment banking firm Cantor Fitzgerald, recently wrote that Trulieve management has said all of Harvest’s Florida stores will be converted to Trulieve during the fourth quarter – but this will result in “temporary store closures” of a couple of weeks per store.

However, over time, “management suggested that the increased supply should allow the Harvest stores to be more productive,” Zuanic wrote.

Still, it’s unclear whether Trulieve will be able to maintain such dominance in Florida, as competition from existing and new operators ramps up.

Current license holders are in a favorable position after the state Supreme Court upheld Florida’s limited license, vertically integrated structure.

But operators also are under pressure to invest, because state regulators will be issuing additional vertical licenses at some point to conform with a law that increases the number of permits based on patient growth.

Experts said last summer that roughly 15 additional licenses could be issued.

“What’s really going to be fascinating is what happens when new licenses are issued,” Livingston said. “What will we see then?”

Jeff Smith can be reached at jeff.smith@mjbizdaily.com.