(This is the first installment in an occasional series on existing marijuana markets that offer good business opportunities.)

Since launching 1½ years ago, Michigan’s recreational marijuana program offers attractive market opportunities because of its large population, rapid sales growth, additional licenses and relatively affordable acquisition deals.

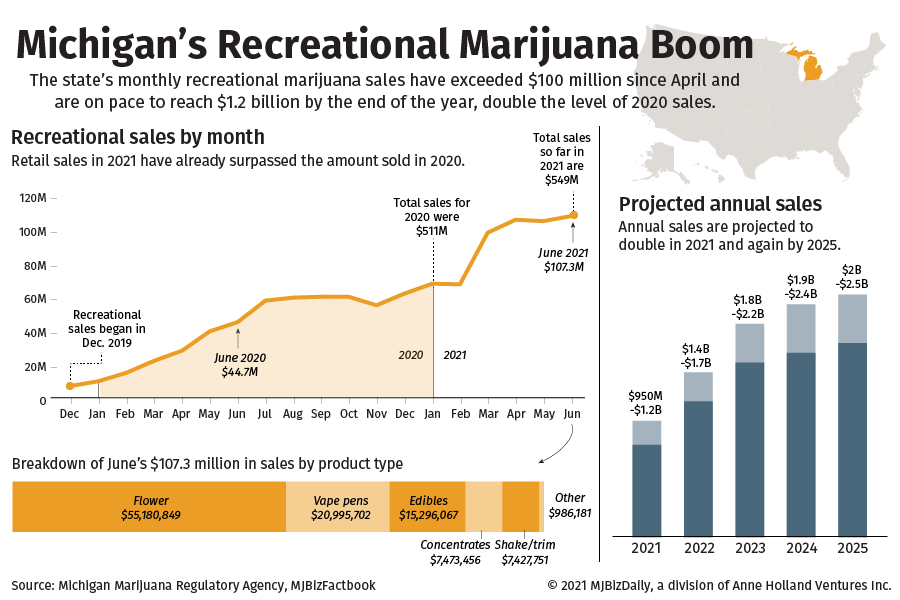

Monthly recreational marijuana sales in Michigan have exceeded $100 million since April, putting sales for all of 2021 on track to exceed $1.2 billion. That would be more than double the level of sales last year.

The 2021 MJBizFactbook projects that adult-use sales in Michigan will quadruple from roughly $500 million in 2020 to $2 billion-$2.5 billion in 2025.

Multistate operators increasingly are focusing on Michigan, but not to the extent that they have on fast-growing adult-use and medical states such as Illinois, Massachusetts and Pennsylvania.

“Activity is heating up in Michigan because the state so far has little (market) penetration” and few large players, said Frank Colombo, director of data analytics for New York-based Viridian Capital Advisors.

“It is in the process of consolidation.”

In a research report this week, New York-based Cowen Group said Michigan has emerged as one of the biggest cannabis markets in the country, although large MSOs for the most part are shying away because of the state’s unlimited licensing structure.

But that isn’t exclusively the case.

Illinois-based Cresco Labs has developed a strong wholesale operation.

And Massachusetts-based Curaleaf, the largest marijuana company in the United States, inherited four dispensary licenses in Michigan through its 2020 acquisition of Grassroots.

Multiple factors at play

Here are some factors that make Michigan enticing, but they also raise potential challenges to rapid growth:

- The state is taking license applications on an ongoing basis, but numerous municipality opt-outs have constrained portions of the market. More municipalities are expected to opt in over time, and some likely will impose license caps. Limited licensing in a particular community could be favorable to existing marijuana businesses operating there in terms of market share and profitability.

- Because of the unlimited licensing on a statewide basis, acquisition prices are lower than in Illinois, for example, providing opportunities for newcomers and existing businesses to scoop up other operators at more affordable prices.

- The state will be sharply reducing license fees beginning Oct. 1 because of strong licensing revenue. For example, new retail store licenses will drop from $25,000 to $7,500.

- The growth of cultivation facilities has reduced flower shortages and high prices that marked the early days of Michigan’s adult-use industry. Flower sales account for roughly half of all recreational sales. But the state still is plagued by a huge illicit market, according to a recent study.

Pablo Zuanic, an equity analyst with New York-based investment banking firm Cantor Fitzgerald, wrote earlier this month that Michigan’s combined recreational and medical marijuana sales now appear to be higher than Illinois’, despite a lower population (10 million versus 12.7 million).

Store openings, he wrote, are driving that growth, with nearly 300 recreational stores in Michigan, up from slightly under 200 in February.

Looking at it another way, Michigan has one adult-use store per 34,000 residents, while Illinois, where additional retail licensing has been held up, has only one store per 125,000 residents, he wrote.

Annualized recreational and medical sales per store are lower in Michigan than in Illinois: $4.6 million versus $17.7 million, according to Zuanic, but that also means acquisition prices are lower, too.

Detroit, the state’s largest city, is an “outlier,” Zuanic said, since it boasts plenty of medical cannabis stores but only two recreational marijuana shops.

Social equity issues

Like other states, Michigan is facing a legal challenge over social equity efforts.

A federal judge recently ordered a temporary halt to the issuing of as many as 75 retail licenses, 35 microbusiness permits and 35 consumption lounge licenses in Detroit.

At issue is how a city ordinance has defined and earmarked at least 50% of the licenses for “legacy” residents. The lawsuit challenging the ordinance was filed by a woman who didn’t meet the requirements even though she has lived in Detroit for 11 of the past 30 years.

Another issue has been tension between caregivers and marijuana businesses.

Some recreational marijuana operators reportedly want caregivers, who can grow up to 72 plants, to face stricter regulations.

Caregivers currently aren’t required to undergo product testing and tracing, for example, and they don’t pay license fees.

A study by East Lansing-based Anderson Economic Group released in June also found that while Michigan’s regulated market is growing rapidly, large quantities of illicit cannabis continue to flood the market. In fact, Anderson said it found 70% of cannabis sales occur outside the regulated market.

The study was commissioned by the Michigan Cannabis Manufacturers Association (MCMA), which has been fighting for more stringent regulations such as product testing to be applied to caregiver growers.

But some industry officials dismissed the report, calling it “corporate protectionism.”

The role of microbusinesses, which enjoy reduced fees and other benefits, also is at issue.

The MCMA successfully fought a bill last fall that would have increased microbusiness grower limits from 100 plants to 150 “flowering” plants.

The association argued that the use of “flowering” would mean that microbusinesses could have far more than 150 plants and, in effect, could become “macro businesses” instead of the mom and pop or brewpub-like operations that were promoted to voters during the 2018 ballot initiative.

Steve Linder, MCMA’s executive director, argued at the time that the bill would undermine the “massive investment and risks” that other growers had taken and “allow microbusinesses to do an end run around the licensing process.”

Some locals thriving

In addition to Cresco and Arizona-based Harvest Health & Recreation, MSOs in the Michigan market include Massachusetts-based Ascend Wellness and Holistic Industries, Arizona-headquartered 4Front Holdings, Toronto-based Red White & Bloom and Illinois-based Verano Holdings.

Meanwhile, homegrown companies are trying to cement their position in the state’s marijuana market.

Troy-based Lume is the largest local company, with 21 dispensaries in addition to cultivation and processing facilities.

Colombo of Viridian specifically mentioned Adrian-based Gage Growth Corp. as one that is increasing market share. Gage has 15 stores and 11 contract growers.

Gage CEO Fabian Monaco recently told MJBizMagazine that the company’s strategy was to start small and focus on developing brand recognition.

“Once we had that brand validation in the market, then we really had the confidence to go big,” Monaco said.

Jeff Smith can be reached at jeff.smith@mjbizdaily.com.

Omar Sacirbey contributed to this report.