(You can have cannabis finance content such as this delivered directly to your inbox. Simply sign up here for our weekly MJBizFinance newsletter.)

Deal of the Week / In partnership with Viridian Capital Advisors

Is Enveric Biosciences move warranted?

Enveric Biosciences (Nasdaq: ENVB), a biotechnology company in Florida focused on using psychedelic-derived molecules and synthetic cannabinoids to treat mental health and cancer, on Feb. 15 closed on a $10 million public units offering.

Details of the deal:

- Enveric sold 20 million units at 50 cents per unit.

- Each unit included one common share and one warrant with a five-year term and a 10% exercise premium.

- Proceeds were earmarked for working capital and other general corporate purposes.

Enveric stock closed at 66 cents per share before the deal announcement.

Since then, the share price has declined 58% and is down 70% since the beginning of the year.

What’s the big deal?

The unit pricing represents a 24% discount to the preannouncement price, which is not unusual for issues that represent substantial increases to a company’s share count.

The 20 million shares issued in this transaction increased Enveric’s share count by 61%.

Typically, companies include either a half-warrant or a full warrant for each common share in a unit deal, so Enveric is in line here as well.

The real issue is the warrants themselves.

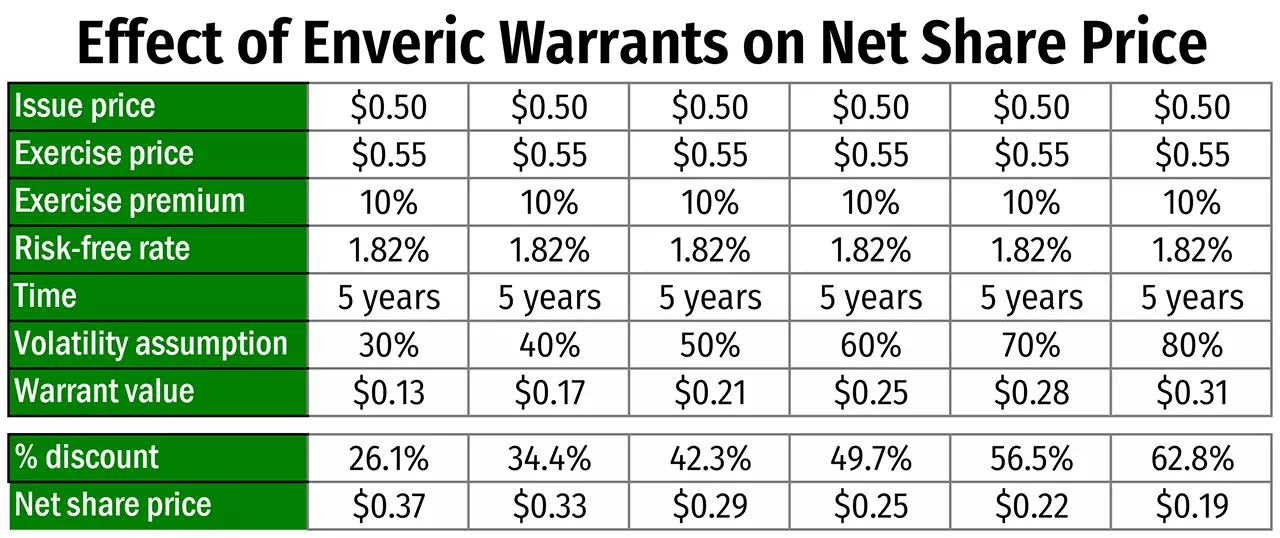

They have unusually low exercise premiums of 10%, and they are five years in duration. This combination of features makes this warrant package worth at least 13 cents per unit for a net share price discount of 26%.

Viridian Capital Advisors tracks dozens of unit transactions every year, and only one of the past 100 logged into the Viridian Deal Tracker had a discount higher than 20%: Skye Bioscience’s Sept. 2021 offering.

The average discount for those transaction was 7%.

The Enveric warrants alone would have crushed the stock, and Viridian is valuing them using low volatility of 30%.

The company values its warrants in its 10-Q financial filing using an 80% discount rate.

The table below shows the impact of using higher volatility on the implied net stock price.

The lack of clear use of proceeds is another issue with the transaction.

Enveric showed cash of $21.4 million on its Sept. 30, 2021, balance sheet. It has negative cash from operations of $2 million-$3 million per quarter, relatively small current liabilities and no debt.

The company should have had around $18 million at year-end and says it “believes that the existing cash on hand at September 30, 2021, is sufficient to fund operations for at least the next 12 months following the filing of these unaudited condensed consolidated financial statements.”

So why did it need to do this highly dilutive $10 million deal?

Other issues

- Business shift: The company’s potential drugs are all in the R&D stage with no clear path to revenue. Historically, Enveric focused on cannabinoids derived from non-hemp botanical and synthetic materials to treat side effects of cancer and cancer treatments, including anxiety, depression pain and skin damage. But since an amalgamation with MagicMed Industries in September 2021, Enveric shifted its focus to synthesizing newer versions of classic psychedelics, such as psilocybin DMT, mescaline and MDMA, and creating new Generation 2 and 3 psychedelics. This strategic shift and the distance to the marketability of these products cause significant doubt about Enveric’s strategy.

- Negative market reaction to Enveric’s business and intellectual property: Pro forma for the transaction, shares outstanding total approximately 52.6 million. At current prices, this gives a market cap of roughly $14.8 million. Subtracting $18 million in pro forma cash gives an enterprise value of -$3.2 million.

- Potential delisting threat: On Feb. 18, Nasdaq notified Enveric that it did not meet the $1 minimum bid price for continued listing on the exchange. The company has until Aug. 17 to see its stocks trade above $1 for at least 10 consecutive days to prevent delisting.

Enveric shareholders might want to invest directly in psychedelics and skip this stock.

Stay informed with MJBiz Newsletters

MJBiz’s family of newsletters gives cannabis professionals an edge in this rapidly changing industry.

Featured newsletters:

- MJBizDaily: Business news for cannabis leaders in your inbox each morning

- MJBiz Cultivator: Insights for wholesale cannabis growers & vertically integrated businesses

- MJBizCon Buzz: Behind-the-scenes buzz on everything MJBizCon

- MJBiz Retail + Brand: New products, trends and news for cannabis retailers, distributors and marketers

- Hemp Industry Week: Roundup of news from hemp farming to CBD product manufacturing

- And more!

Capitalizing on changes in the cannabis industry

We talk a lot about bad news because there are great lessons to be learned from mistakes that others make.

But I want to take a turn and talk about some good news for a change.

In addition to new marijuana states coming online in the near future, some existing markets appear to have realized how they’ve sabotaged the success of their own programs, and they’re taking steps to make changes.

For example, Minnesota’s medical marijuana patients will be allowed to purchase flower as of March 1. Patients already can set up appointments with pharmacists today in preparation.

Connecticut also made changes to its MMJ program, increasing patient purchase limits on cannabis products.

Both moves were made in response to feedback from customers in those markets on how the programs were not meeting patient needs in large part because of the limitations on what and how much can be purchased.

There are lessons that can be learned from good news.

Here are two I gleaned from the above two stories:

- Make your voice heard. As an operator, you are the boots on the ground. You hear directly about the issues and have the knowledge to improve the situation. Speak up! Lend your expertise to the discussion. Participate in the process. You have the power to create change that benefits your customers and your bottom line.

- Be prepared for change. We’ve said it over and over again: The only thing certain in the cannabis industry is that things will change. Make sure your company is ready to respond when it happens. The changes in Minnesota and Connecticut likely require you to update some of your point-of-sale systems and train employees. Don’t wait until the last minute to take those steps. Get yourself in position to benefit as quickly as possible.

– Jenel Stelton-Holtmeier