Vape pens and pre-rolls continue to grow in popularity among U.S. marijuana consumers seeking out more potent products, as well as those excited about innovations in each category.

Vapor pens were the second-largest category by revenue behind flower in the U.S. cannabis market during 2020 and 2021, netting nearly $2.6 billion in retail sales last year across six adult-use markets tracked by Seattle-based data-analytics firm Headset.

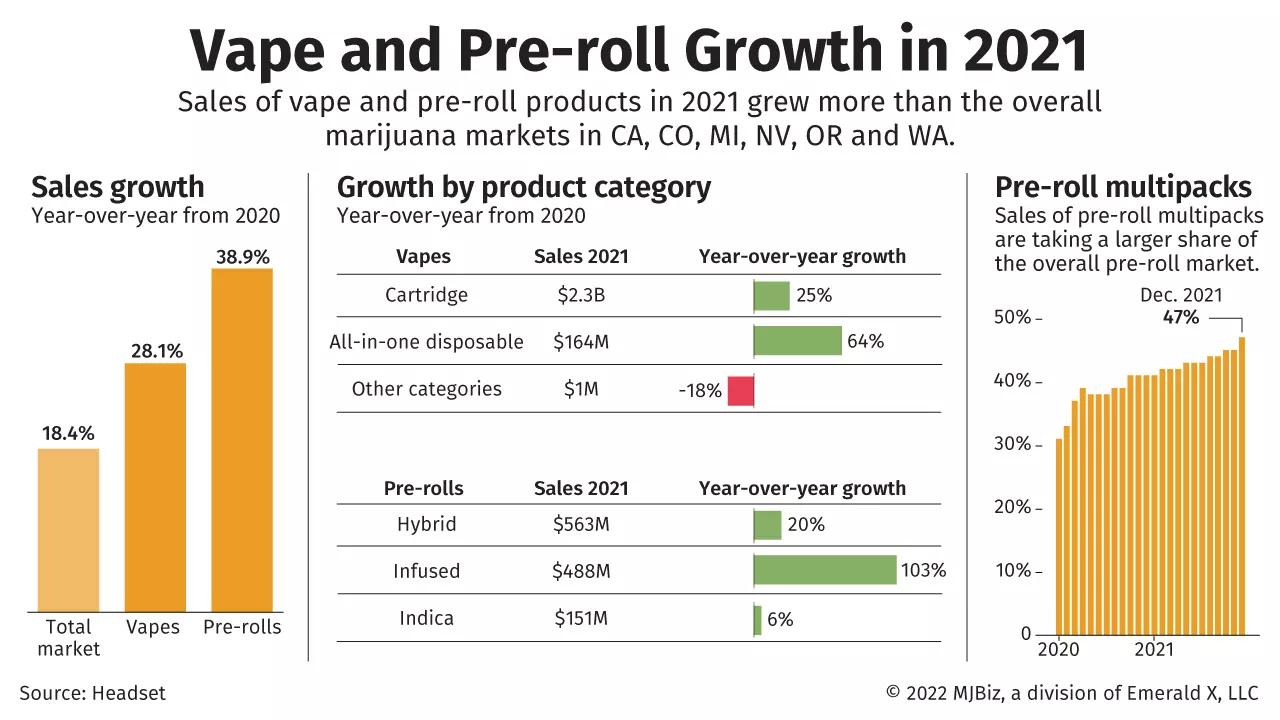

Those markets were California, Colorado, Michigan, Nevada, Oregon and Washington state.

Cooper Ashley, Headset’s senior data analyst, said the pre-roll category rose from fourth-largest to No. 3 with $1.42 billion in sales in 2021, unseating edibles from the top three highest-revenue categories.

Both categories had strong year-over-year growth in 2021, with vapor pens up 28.1% and pre-rolls up 38.9% from 2020, according to retail sales data from the six rec markets Headset tracks.

The total marijuana market, by comparison, grew 18.4%.

“These consumers are looking for more potent products and are willing to spend a premium for them,” said Brian MacIver, senior cannabis insights manager for Chicago-based analytics firm Brightfield Group.

Convenient, discreet

Cartridges made up the vast majority of vapor pen sales, but disposable vape pens had very strong growth in 2021, Ashley pointed out.

Arshad Lasi, CEO of the Nirvana Group, a vertically integrated medical marijuana company in Tulsa, Oklahoma, said he’s seen an uptick in people buying disposable vapes as consumers look for discreet, convenient products.

As COVID-19 pandemic restrictions are lifted, he added, “people want things that they can consume at a place like a sporting event.”

According to Brightfield data, vape products are “extremely popular” with younger U.S. consumers: Nearly half – 47% – of U.S. cannabis vape consumers are younger than 35.

For context, only 40% of U.S. cannabis consumers are younger than 35, according to MacIver.

Are you a social equity cannabis license holder or applicant?

The MJBizCon team is now accepting 2023 Social Equity Scholarship Program applications.

The mission of this program is to provide social equity cannabis license holders or applicants access to the #1 global cannabis industry conference + tradeshow in Las Vegas.

Who can apply?

- Students currently enrolled in a cannabis-related program at an accredited university or college.

- Cannabis executives at licensed social equity cultivation, extraction/processing, retail, manufacturing/brand businesses (or awaiting application approval).

Don’t miss out on this potentially life-changing opportunity.

Apply to attend MJBizCon today – The application period will close on July 24!

Brightfield data also shows that vape consumers are generally heavier cannabis consumers than the average user.

Vape consumers, for example, are willing to spend more per month on cannabis, according to MacIver.

In particular, 51.5% of vape consumers spend more than $150 per month on cannabis. By comparison, 42.8% of the general cannabis consumer population spends that much.

Souped-up pre-rolls

The more standard forms of pre-rolls, such as those made with a single flower strain, experienced fairly small year-over-year growth, while other, more specialized segments saw strong growth, according to Headset’s Ashley.

For example, infused pre-rolls – often made by applying concentrates or cannabis oil to flower – stood out as the second-largest segment in both 2020 and 2021.

Sales of infused pre-rolls more than doubled in each of those years.

“This is definitely the pre-roll segment to watch in 2022,” Ashley said.

Nirvana Group’s Lasi agreed, saying that “consumers are looking for more potent products.”

For example, one cannabis company that Lasi works with in Oklahoma offers a product with concentrate oil applied to the outside of the product. It is then dusted with kief, or THC crystals.

Infused pre-rolls such as these can achieve levels of THC potency – testing in the 40%-50% THC range – that flower on its own cannot achieve.

“Generally, pre-rolls have become more interesting and exotic over time,” said Steve Gutterman, CEO of Falcon Brands, a vertically integrated cannabis company based in Irvine, California, that has multiple pre-roll products that are infused and dipped.

“They are much more interesting products than the pre-rolls that existed in the market five years ago,” he added.

Packs of pre-rolls – think a pack of cigarettes, but often only five to 10 pre-rolls – are also a growing trend.

“The sales share of these products within the pre-roll category has been steadily rising over the last several years,” Headset’s Ashley said, “reaching nearly 50% of all pre-roll sales by the end of 2021.”

Multipacks are often filled with smaller pre-rolls – commonly referred to as dog walkers – in the 0.25- to 0.33-gram range.

“There are people who like pre-rolls who need something to smoke quick during the day,” said Oliver Summers, a cannabis consultant based in Los Angeles who also serves as president of retail for the Unified Patient Alliance.

He sees the audience for pre-rolls as broader than the “hard-core” flower consumer. Pre-rolls come ready to smoke and don’t need additional preparation to consume – something new consumers appreciate.

Like vapes, 47% of U.S. pre-roll consumers are younger than 35, according to Brightfield’s MacIver.

Higher-quality flower, solventless extracts

What’s on the horizon in terms of innovations in each product category?

While the lion’s share of vape sales are for marijuana THC distillate, mature consumers – or cannabis connoisseurs – often want more from their products, including minor cannabinoids and terpenes.

That’s where vapes formulated with live resin and rosin come in. Both have grown in popularity recently and can offer a more “whole-plant experience.”

“People are leaning toward that pricier, higher-quality vape,” Lasi said.

MacIver said Brightfield is seeing an increase in live resin products.

“This trend, interestingly, is more of a production-driven trend rather than a consumer-driven one. But consumers are appreciating these products for their terpene content and ‘closer to flower’ flavor profiles, despite their often-higher price point,” he added.

Mike Martinez, director of retail operations at Las Vegas cannabis retailer Deep Roots Harvest, said he’s seen an interest in live resin and rosin vapes among connoisseurs.

He’d like to see more technological advancements on the production side, including extraction equipment that could produce such solventless products at a larger scale to help lower costs and meet consumer demand.

“People are starting to realize that there are these different types of vapes,” he added.

Brands looking to compete in the pre-roll sector should also consider using higher-quality flower than just shake or trim, according to MacIver.

Summers agreed, saying consumers want better flower quality in their pre-rolls.

“We have a lot more knowledgeable consumers who are more particular about what they consume,” he added.

“People realize there’s a huge difference between just the dried-up, shake joint and a fresh one.”

Bart Schaneman can be reached at bart.schaneman@mjbizdaily.com.