(You can have cannabis finance content such as this delivered directly to your inbox. Simply sign up here for our weekly MJBizFinance newsletter.)

Deal of the Week / In partnership with Viridian Capital Advisors

Is change on the horizon? Why IIPR canceled a notes issue three days after its announcement

Innovative Industrial Properties (NYSE: IIPR), the largest REIT focused on the cannabis industry, on Feb. 1 announced a $300 million, six-year senior unsecured note offering at its IIP Operating Partnership level.

The notes were to be pari-passu (on equal footing, with no preference) with the existing bonds: one at 3.75% that matures in 2024 and a 5.5% maturing in 2026.

They were structured as senior unsecured obligations at the operating subsidiary level with full senior guarantees from the holding company.

But on Feb. 4, IIPR reversed course, announcing that it would not proceed with the issue “due to market conditions.” Why?

The move is a surprise given that the real estate-backed finance sector has been highly active for the past six months.

Issuance has been particularly active in debt, with approximately $625 million raised in the last-12-month period, including a $300 million, 5.5% IIPR deal in May 2021.

Cannabis financing companies have been expanding rapidly as their clients, principally multistate operators, expand into new states and pursue tuck-in acquisitions to scale in existing states.

The sector, which includes AFC Gamma (Nasdaq: AFCG), Chicago Atlantic (Nasdaq: REFI), IIPR, NewLake Capital (Nasdaq: NLCP), Pelorus and Power REIT (Nasdaq: PW), are enjoying lending spreads that would make traditional lenders incredulous.

IIPR has a debt cost of around 6.5% (assuming the same 470 basis point spread to the five-year treasury at which the company did its previous deal in May 2021).

On the asset side, IIPR typically sets initial base rents in the 10%-16% range with three 4%-4.5% escalators built in.

There are some differences between the companies in that NewLake, Pelorus and Power REIT are most similar to IIPR, focusing on sale-leaseback transactions.

In contrast, AFC Gamma and Chicago Atlantic pursue a secured lending approach. Still, the essentials are the same: lending into a market hungry for debt capital at very high spreads.

These financiers have an incentive to build their loan/lease portfolios as rapidly as prudent underwriting allows. As long as the underlying credits remain solvent, they possess a business model akin to a money-printing machine.

In addition, institutional lenders, who might not feel comfortable lending directly to cannabis businesses, have indirectly participated in marijuana debt via investments in these companies.

So what’s the catch, and why did IIPR pull its deal?

The bond market is indeed pricing in higher inflation through higher interest rates.

The five-year treasury yield has increased by more than 40 basis points in the past month, so it might not be an ideal time to market a big debt deal. But in the face of 1,200 basis point lending spreads, that seems to be an unlikely driver.

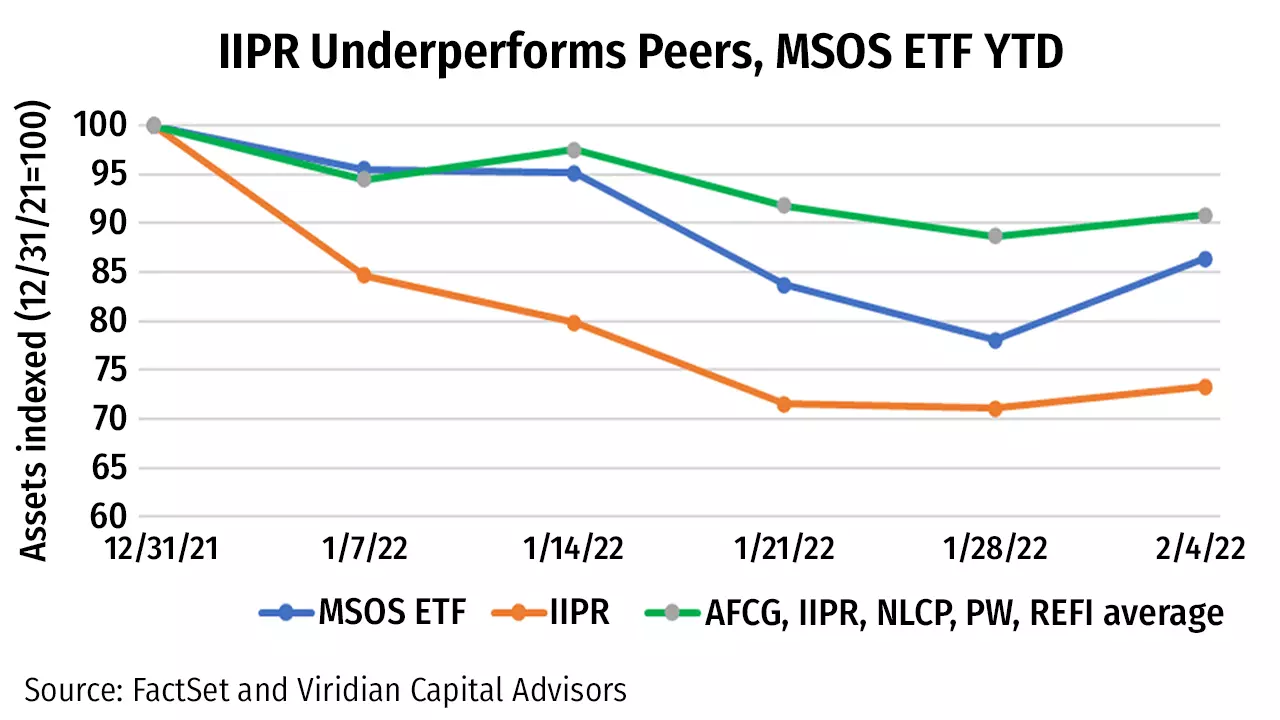

IIPR does seem to have underperformed both its peer group and the MSOS ETF year-to-date.

The REIT is down more than 25% versus a decline of only about 10% for its peer group. This might reflect the increased aggressiveness of recently financed AFC Gamma, NewLake and Chicago Atlantic, or it could signal an increased preference for secured debt as opposed to sale-leasebacks.

While these might have contributed to the decision, Viridian Capital Advisors believes the reintroduction of the SAFE Banking Act is primarily to blame. Renewed hope of banking reform spiked the MSOS ETF index upward by more than 10% this week.

But what is good for the goose is not necessarily good for the gander. The bill would open up the cannabis lending market to more competitors and reduce the lending spreads of the companies already in this sector.

Viridian does not believe the bill is likely to pass, and if it did, its impact would take time to percolate through the market. Moreover, the short-term effect would be to increase the value of existing lending portfolios.

It seems likely that IIPR is waiting for the renewed hope of banking reform to fade back before pursuing a new debt raise.

Are you a social equity cannabis license holder or applicant?

The MJBizCon team is now accepting 2023 Social Equity Scholarship Program applications.

The mission of this program is to provide social equity cannabis license holders or applicants access to the #1 global cannabis industry conference + tradeshow in Las Vegas.

Who can apply?

- Students currently enrolled in a cannabis-related program at an accredited university or college.

- Cannabis executives at licensed social equity cultivation, extraction/processing, retail, manufacturing/brand businesses (or awaiting application approval).

Don’t miss out on this potentially life-changing opportunity.

Apply to attend MJBizCon today – The application period will close on July 24!

Know the Lines: Don’t let your overexuberance erase your opportunities

New York is still working through the logistics of launching its legal adult-use marijuana market, but it seems that some existing operators are already trying to get a head start by “gifting” marijuana to patrons who purchase other items.

That’s not going over well with the state’s Office of Cannabis Management (OCM), which issued more than two dozen cease-and-desist letters to businesses suspected of trying to exploit the fact that possession is now legal, even if sales aren’t.

People are excited. I get it.

The problem, according to the OCM, is that the practice of gifting could jeopardize eligibility for those recreational licensees and cut off the path to participation in the legal market altogether.

The overlap of legal and illicit sales in new markets isn’t unique to New York.

California, for example, is still trying to figure out how to stop the proliferation of illegal sales years after launching a regulated market.

But if you do want to participate in the legal market, it’s good to identify the boundaries that exist within the current structure and abide by them.

Testing the boundaries is one thing, and several New York operators began doing just that once legalization was approved.

But continuing to do so after receiving a formal warning could put a target on your business and prevent you from getting a piece of the legal pie.

“We want to make sure these operators fully understand the law and the consequences they face,” OCM Executive Director Chris Alexander said in a news release.

“And now that these letters have been sent, we fully expect them to cease and desist their activities – if they don’t, we will take action.”

Gifting has also come under scrutiny in other states, including New Jersey, New Mexico and Vermont, during the transition period between legalization and implementation of adult-use cannabis sales.

Michigan, on the other hand, took a different tack, making the practice legal so long as it’s not advertised.

– Jenel Stelton-Holtmeier