By Anne Holland

The economic threat the black market poses to legalized recreational cannabis sales may have been vastly overstated.

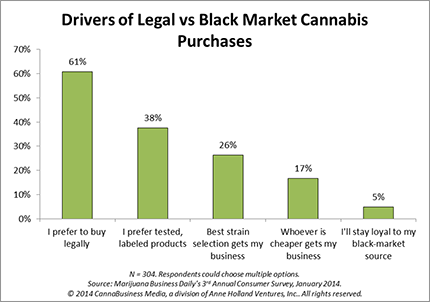

According to a new consumer market research study from the editors of Marijuana Business Daily, more than 60% of cannabis users said their biggest concern when purchasing marijuana is buying it from legal sources.

A large percentage also prefer to buy tested, labeled cannabis products or purchase from those offering a large selection of strains – two areas in which state-legal dispensaries have a huge edge over the black market.

Legal retailers and growers have been concerned because black market producers have two major market advantages. Firstly, their cost of goods is far lower, as they generally do not pay taxes, lab testing fees, licensing fees, etc. Secondly, most black market producers have longstanding customer relations that might present a barrier to competition.

These concerns were underscored when Washington State research, conducted by Botec Analysis Corp. in 2013, revealed that legal retail might only be able to gain 15-25% of total recreational market share.

However, new consumer data indicates the exact opposite may be true.

In fact, the only two categories in which the black market has a distinct advantage to consumers – pricing and relationships – may be the least important market drivers with just 17% and 5% of responses respectively.

The study was conducted by the editors of Marijuana Business Daily via an online survey in January 2014 to self-identified cannabis consumers in the US who use marijuana for recreational versus medical purposes. Respondents could check multiple answer options to the question asking what factors would be behind their decision to buy legally or on the black market.

“I prefer to buy legally” was the overwhelmingly popular answer with 61% of respondents selecting this option.

“I’m not surprised by this data,” noted Cassandra Farrington, Publisher CannaBusiness Media (the firm behind both Marijuana Business Daily and the Recreational Handbook which contains the data.) “For the past three years, our consumer marketplace surveys have shown that pricing is not as significant a factor as quality, strain selection and safety testing. In addition, this year’s legal retail sales boom in Colorado is solid evidence that many more consumers are willing to purchase cannabis from legal retailers than had been projected.”

Consumer preferences aside, the black market still poses a significant threat to legal growers and retailers. With tens of billions of dollars in annual sales at stake, criminal elements who control large market shares of the current black market could be mounting a fight to retain market share, particularly in unregulated states.

Additionally, while the majority of consumers said finding the cheapest cannabis is not the most important consideration, a significant difference in prices between retail shops and the black market could push more customers underground.

Note: Copies of “Profiting in the CannaBusiness Recreational Marketplace,” the new handbook this study data comes from, are available for instant download here: https://mjbizdaily.com/recreational-handbook/