Recreational marijuana sales in Colorado are continuing to grow, but at a slower pace – another sign that the nation’s oldest adult-use market is reaching maturity.

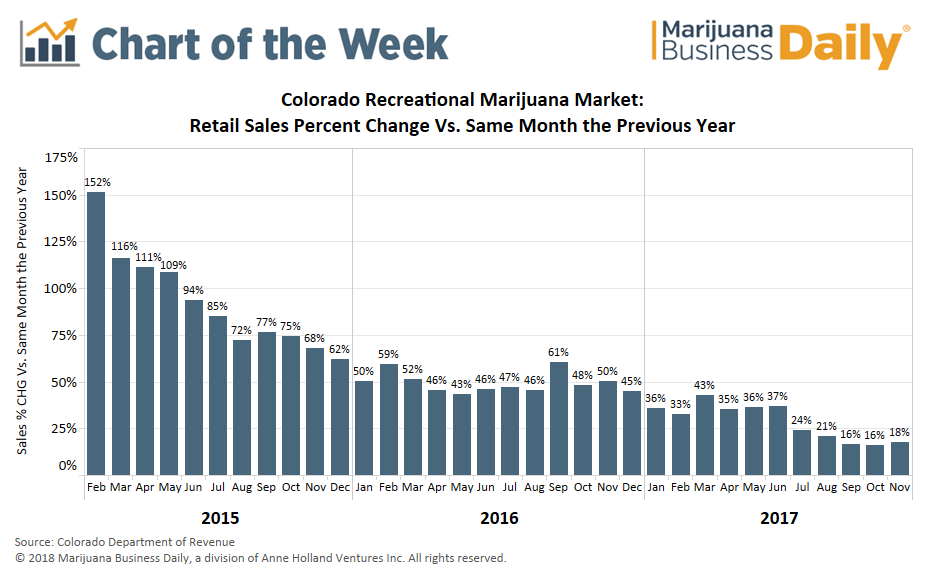

For example, the chart shows that sales of recreational marijuana in February 2016 were 59% higher compared to sales in February 2015.

By comparison, sales in February 2015 were 152% higher than sales in February 2014, the first year when adult-use sales began.

The slowdown in sales growth illustrates a gradual stabilization in the market amid several years of rapid expansion.

Over the course of 2016, sales in a given month beat sales of that same month in 2017 by an average of 49%.

Through November 2017, by comparison, monthly sales grew by an average of 29% compared to the same month in 2016 – though this number will likely decline even further once December sales figures are released.

This is not an entirely unexpected or unfavorable development, as growth in any booming market will naturally decelerate over time.

After four years of recreational sales, the state’s capacity for double-digit growth may soon be tested.

Here’s what you need to know about the situation:

- The phenomenon of slowing sales growth is not unique to Colorado’s adult-use market, as retail marijuana sales in Washington state are exhibiting very similar patterns of slowdown. Like Colorado, Washington state’s rec markets went online in 2014.

- Further indications that Colorado’s rec market is maturing include a rising number of retail cannabis chain stores in the state, falling wholesale marijuana prices and shakeups at one of Colorado’s oldest and largest infused products companies.

- Colorado is on pace to sell $1.1 billion worth of retail marijuana in 2017, which would represent a 26% increase over 2016. Even though sales growth is slowing, it’s significantly higher compared to more established industries like alcohol – where spirit makers are celebrating a 4.5% annual sales increase.

Eli McVey can be reached at elim@mjbizdaily.com