Michigan’s medical marijuana industry is girding itself for a heap of disorder – including possible product shortages and revenue losses to the black market – unless state regulators approve many more business licenses by next month’s deadline, experts warn.

Regulators have approved only 16 medical cannabis licenses, including seven dispensaries, under a new statewide regulatory regime that’s been bogged down in part by strict financial disclosure requirements.

There is one more application review meeting scheduled before the Sept. 15 deadline, when all existing businesses without a permanent license from the state will be required to shut down until they get one.

1. Numbers may not add up, with demand potentially dwarfing legal supplies.

“You’ve got seven dispensaries to cover 290,000 patients. You do not need to be an expert in mathematics to know those numbers simply won’t work,” observed Michael Stein, a Bloomfield Hills attorney who said about 50 of his clients are bogged down in the license application process.

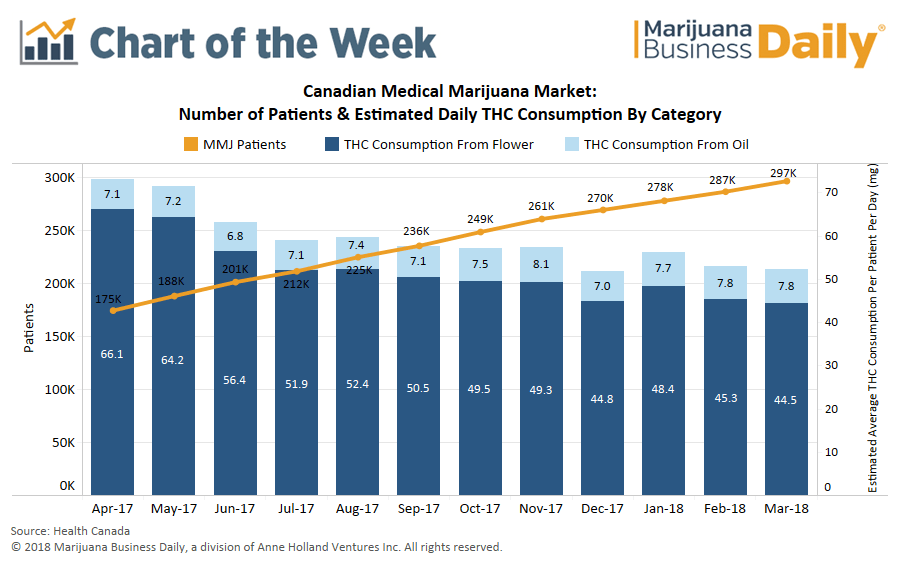

It’s unclear how long it will take for things to sort out, but once they do, Michigan – which has the second-largest patient base in the country – should regain its spot as one of the most potentially lucrative markets in the country for MMJ businesses and ancillary services, according to projections by experts and the Marijuana Business Factbook 2018.

The Factbook projects dispensary sales could hit $325 million-$425 million this year, with a caveat that sales could vary widely depending on how smooth the transition to the new regulatory structure is and how long a supply-and-demand imbalance persists.

That would represent a massive sales increase from an estimated $100 million-$150 million in 2017.

But Rick Thompson, a board member at the Michigan affiliate of the National Organization for the Reform of Marijuana Laws (NORML), is more skeptical, predicting that many patients simply will go to the black market to buy MMJ.

“Then there’s no real incentive for them to go back to the (regulated market) because they’ll have taxes, daily purchase limits, hours of operation limits, (sales) tracking,” Thompson said.

Despite all that uncertainty, entrepreneurs and investors have a reason to be keen on Michigan: An MMJ license is a possible path to early entry into recreational cannabis, which voters will consider in November. A May poll suggested strong support.

2. Tumult isn’t new to Michigan market.

Michigan’s MMJ industry has experienced turbulence since voters first approved legalized MMJ in 2008. The turmoil included a patchwork of local rules, as well as a court ruling that for a time outlawed sales of MMJ products from storefronts.

The new regulatory system, the result of laws enacted in 2016, is designed to impose a statewide regulatory framework on the industry and put the program on a stable course.

Experts say the solution to averting chaos is to extend the Sept. 15 deadline. However, the date’s already been extended from June 15, and regulators are adamant it won’t be postponed further. (A group of lawmakers has asked the governor to intervene and extend the deadline.)

It’s uncertain how many dispensaries are operating with temporary local approval, but it is believed to be little more than 100 statewide, according to NORML’s Thompson. State officials said they’re not sure how many MMJ businesses currently are operating.

The state earlier this year trimmed the ranks through cease-and-desist letters claiming MMJ businesses hadn’t properly filed paperwork for permanent licenses under the new system.

If businesses without state licenses don’t close Sept. 15, they run the risk of never getting a license.

The state will issue cease-and-desist letters and will note businesses’ lack of voluntary compliance in their files, said David Harns, spokesman for the Michigan Department of Licensing and Regulatory Affairs (LARA).

The state has calculated two-thirds of Michigan’s registered patients are within 30 minutes of the seven dispensaries already licensed and says there will be many more MMJ businesses licensed within a short period of time.

But experts still predict a supply crunch and scramble among patients to access MMJ products.

3. Financial review of businesses has caused licensing bottleneck.

Higher net-worth individuals who have multiple businesses and/or bank accounts especially are being scrutinized, with massive amounts of documents required, observed Stein and other attorneys.

The applicants must disclose every business and financial account they have and explain both routine and unusual deposits.

In some cases, the state “is scrutinizing every transaction over $1,000,” noted Michigan cannabis attorney Paula Givens. State officials, she said, are seeing if bank records match an individual’s tax-return documents.

Applicants also must disclose their property agreements and marijuana sources or, in the case of wholesalers, their retail customers if they are currently operating under temporary, local approval.

4. Despite hurdles, the market is seen as lucrative.

Michigan cannabis consultant Connie Maxim-Sparrow said she has about 35 clients statewide and only three are trying to position themselves to be acquired within a few years. “So these people are in it for the long haul.”

There are no statewide limits to the number of MMJ licenses. It’s up to municipalities to decide whether to restrict the number of medical cannabis businesses or ban them altogether.

Detroit – by far Michigan’s largest market – capped the number of dispensaries at 75. At one time, there were nearly 250 dispensaries.

The cap provides an advantage to existing dispensaries in Detroit but leaves little room for others, Givens said.

However, the attorney added, the city has no specified caps in other business categories – including growers, processors, transport companies and testing labs – so those do offer great opportunities for investors.

5. Out-of-state investors targeting Michigan.

“An extraordinary amount of out-of-state money is flowing in,” observed Stein.

He’s seen interest primarily from investors in more mature markets such as California, Oregon, Washington state and Colorado.

“They’ve already made money and can absorb the carrying costs” needed to enter Michigan, Stein said.

Pedro Sotomayor, chief business officer for PPi Consulting Group – a cannabis consultancy that does work in Michigan – said licenses in Detroit are selling for more than $1 million.

According to Stein, even licenses in some smaller cities like Lansing are going for around $1 million, while others might go for $500,000 or less.

“People want to get up and running now. There’s a high value to getting in early,” he said.

Experts are beginning to see some activity in the transfer or sale of municipal licenses.

As of Aug. 8, LARA’s Harns noted that 15 businesses had gone through ownership changes, which, as a result, had caused delays in the state processing their applications.

6. Recreational marijuana’s potential heightens interest.

Michigan voters will decide Nov. 6 whether to legalize recreational marijuana.

If a rec cannabis program is approved in Michigan, Sparrow noted, a business without an MMJ license would have to wait until 2022 before it could apply to enter the new market.

That’s because the initiative calls for the state to accept applications in the first two years of the program only from those who already have a medical marijuana license. And the initiative calls for that application process to begin a year after the effective date of the law.

The exception, according to the initiative, is if the state determines additional licenses are necessary to minimize the illegal market, to meet demand or to provide better access to marijuana in rural areas.

Jeff Smith can be reached at jeffs@mjbizdaily.com