The German federal government will buy at least 650 kilograms (1,433 pounds) of medical cannabis flower from domestic producers for approximately 1.5 million euros ($1.66 million) per quarter, which sets the average wholesale price at 2.3 euros per gram.

The wholesale price implies that the high margins medical marijuana companies once enjoyed in that market could soon become a thing of the past.

The German subsidiaries of Canadian-based Aurora Cannabis (250 kilograms per quarter) and Aphria (250 kilograms) as well as Germany-headquartered Demecan (150 kilograms), were the three winners of the cultivation tender.

The government and companies might agree to increase the quantities up to 10% per year over the four-year period.

The companies have not disclosed the prices they offered during the application process, and the government did not reveal how much it will pay each company – only the total.

However, applicants had an incentive to offer a very low price to win the tender, because scoring points related to price accounted for 40% of the criteria.

The government also mentioned the option of buying 325 more kilograms per quarter, also at 2.3 euros per gram.

However, according to Marijuana Business Daily‘s interpretation of the contract between the BfArM and the suppliers, the price for the optional extra kilograms should be lower, something that would drive the average price even further down.

The BfArM did not immediately respond to an MJBizDaily request for comment.

Packaged flower to be supplied

Aphria, Aurora and Demecan will supply the BfArM with packaged flower. German authorities also said that a distribution application process will be launched in the future.

This means producers will not be allowed to supply pharmacies with their domestically grown cannabis through the distribution channels they already spent millions of euros establishing unless they win the future distribution tender.

But they will be able to continue importing from other countries for pharmacy distribution in Germany.

Domestic supply is not expected to be enough to cover demand, meaning the market will continue to rely on imports.

Cannabis producers based in Australia, Colombia, Denmark, Greece, Lesotho, Malta and other countries are planning to join those in Canada, the Netherlands and Portugal in filling the gap. But if price compression continues, making any money will be challenging.

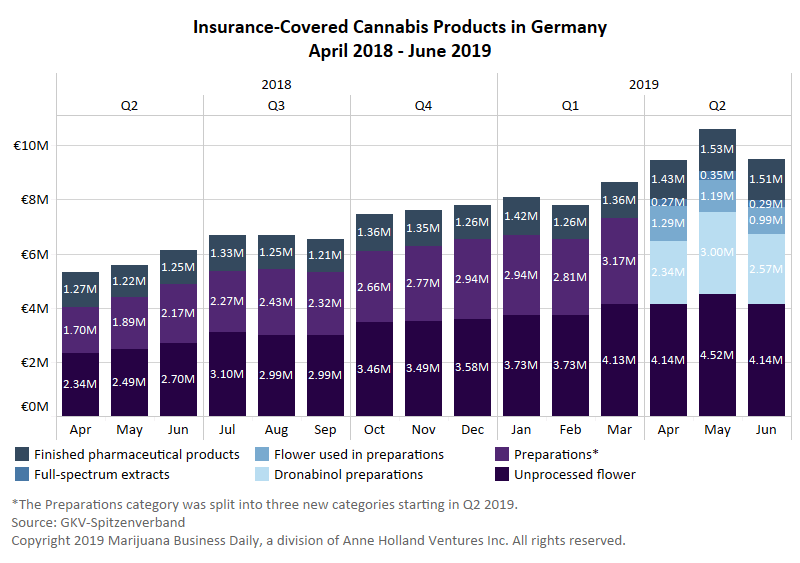

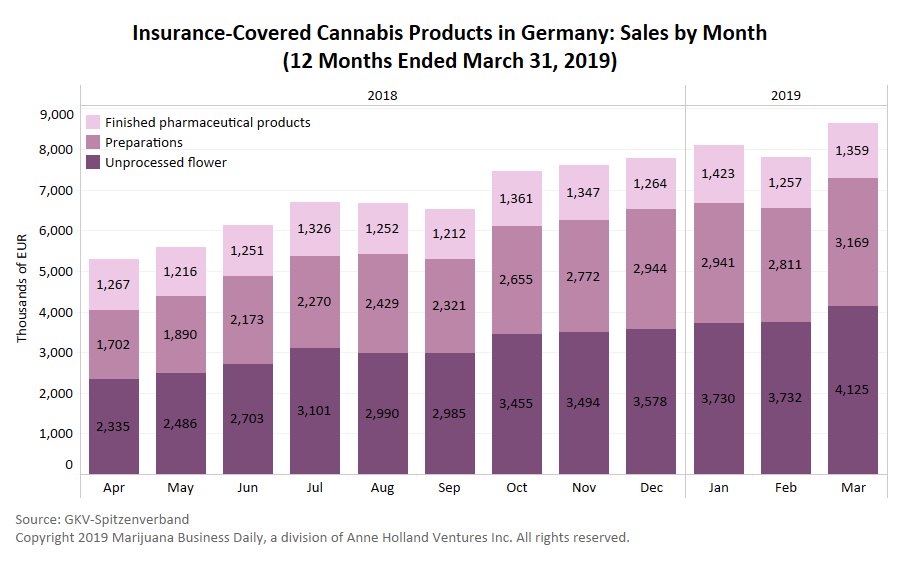

In 2018, Germany imported about 3,000 kilograms of flower.

In the first half of 2019, imports amounted to 2,500 kilograms, indicating that demand might double again this year and could reach as much as 6,000 kilograms.

Assuming demand continues to rise to 10,000 kilograms in 2021, domestic production would cover at least 26% of the market. It could potentially cover about 40% of the market if the option for extra quantities is executed.

Germany is the largest medical cannabis market in Europe – larger than all other countries on the continent producing the medicine combined.

High margins not the norm

The price at which domestically produced cannabis will be sold in Germany confirms the margin depletion that MJBizDaily has been reporting throughout the past year.

Current high retail prices of medical cannabis in Germany – about 20 euros per gram – are an anomaly created by a combination of:

- A domestic cultivation tender that suffered many delays until it was finalized.

- The low number of suppliers of flower from European Union Good Manufacturing Practice-certified facilities around the world that can export to Germany.

- A pharmacy markup of about 100% that the law mandates.

All these factors are changing quickly.

Domestic production is set to kick in by the end of 2020, more countries than ever are planning to supply Germany and the government is in ongoing discussions to reduce retail prices.

In Italy, most of the medical cannabis supply is imported from the Netherlands, with Aurora being the only Canadian supplier of a small slice of the market after winning a contract in which it offered to sell flower to the government at an average price of 1.73 euros per gram.

Recently, the Italian government canceled a portion of that supply agreement.

In Luxembourg, Aurora was the “exclusive supplier” to the government, selling flower at 2.5 euros per gram.

On Oct. 21, Canopy announced it was the new “exclusive supplier” for Luxembourg.

Canopy did not immediately reply a media query about the price at which the company sells in Luxembourg.

Costly indoor grows

German growers are incurring huge capital expenditures to build bunker-style, indoor cultivation facilities required by German regulations.

In the company’s third-quarter 2019 earnings conference call, Aphria’s interim CEO, Irwin Simon, said capital expenditures required for the company’s German facility were 25 million euros, of which 8 million euros had already been spent.

Even in the most positive scenario – assuming the government buys as much as legally possible throughout the whole four-year period contract with domestic suppliers – it is not clear how companies will be able to make any profit considering both the quantities and the price agreed upon with the government are very low.

Demecan announced last month that it raised 7 million euros, but the company has not replied to requests for comment asking if more capital raises would be needed to be fully funded to build the facilities as agreed to with German authorities.

Alfredo Pascual can be reached at alfredop@mjbizdaily.com