(Part of Marijuana Business Daily’s ramped-up coverage of the global cannabis market includes a series examining recent marijuana legalization and business developments worldwide. Other installments focused on Colombia, Chile and Argentina, and Brazil, Paraguay and Peru.)

Last year was historic for Uruguay’s marijuana industry, as the country ushered in an era of legal medical and recreational cannabis.

Adult-use, or what’s called “nonmedical,” sales started in July, and medical cannabis sales began in December.

Here’s a look at recent developments in Uruguay.

Snapshot

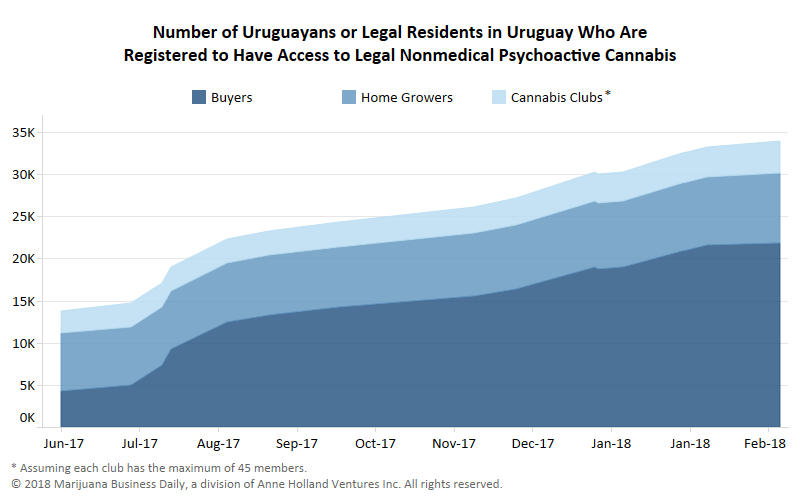

Uruguayans and legal residents must choose one of three legal ways to obtain nonmedical cannabis by registering in a government database. They can:

- Home grow up to six female plants per household but cannot harvest more than 480 grams of marijuana per year.

- Join or create a nonprofit cannabis club, which is allowed to produce only for members. Clubs must have 15-45 members, the number of plants is limited to 99, and each member is allowed to receive a maximum of 480 grams annually.

- Buy up to 10 grams per week from pharmacies at the government fixed price of about $1.40 per gram. Buyers must register with their fingerprints, which are used to ensure the weekly quota is not exceeded at point of sale. Only two strains of cannabis with a maximum of 9% THC and a minimum of 3% CBD are available.

Business opportunities

Only 12 of the country’s 1,000 pharmacies are currently selling nonmedical cannabis, so large regions of the country do not have access through this channel. The Uruguayan press reported on March 10 that five new pharmacies will soon join the program.

Only two licensed domestic producers, ICC Labs (TSX Venture Exchange: ICC) and Symbiosis, are allowed to supply nonmedical cannabis to pharmacies, and both are already cultivating.

Of the fixed price of $1.40 per gram, approximately 90 cents goes to the licensed producer, most of the rest is for the pharmacy and a small fraction finances the government’s regulatory agency.

Both licensed producers grow their nonmedical cannabis in greenhouses built on state-owned land.

ICC Labs, in addition to cultivating nonmedical cannabis, has a hemp segment for the export of concentrated CBD products.

Several other companies also obtained licenses to cultivate hemp.

One of the advantages Uruguay offers over several other jurisdictions is that its legislation, according to the first article of Decree 372/2014, considers cannabis to be nonpsychoactive hemp as long as the THC content is not higher than 1%.

Latest developments

- The first six months of recreational cannabis sales saw a few hurdles, notably product shortages and banking issues.

- On Feb. 9, the Uruguayan government announced distribution of nonmedical psychoactive cannabis would be halted for at least a week because of operative difficulties of the licensed producers. Farmacia La Cabina, one of the 12 pharmacies that sells recreational cannabis, uses a green, yellow or red square as their Facebook profile picture to indicate cannabis availability to its followers. Distribution there was restarted Feb. 23, but the pharmacy ran out of stock the same day and turned its profile picture red. On March 1, the pharmacy’s profile turned back to green for one day, before returning to red. This isn’t the first time pharmacies have run out of stock. A notable example was last October when cannabis was unavailable for more than three weeks because of fungi and bacterial problems.

- Another issue the government hasn’t been able to resolve is the small number of pharmacies selling adult-use cannabis. Unlike most recreational markets in the United States, there are no cannabis retailers in Uruguay. Despite opposition from the Uruguayan Pharmacy Center, the government announced a plan to create cannabis “sales centers” in 2018 that will accept only cash to avoid banking issues.

- The two licensed producers for the national recreational market sold 512 kilograms (1,128 pounds) of dried flower in the last six months of 2017. This represents about 3% of the estimated total consumption in Uruguay in the same period, the rest being obtained either legally through home growing and cannabis clubs or illegally via the black market. Tourists aren’t allowed to legally buy recreational cannabis, but the black market is still thriving. In the latest trend, marijuana-friendly hostels are popping up along the coast.

- The implementation of medical cannabis is still in its infancy. In December 2017, the first – and so far only – medical cannabis product became available at Uruguayan pharmacies. It’s a 2% CBD oil with a concentration of THC below 0.5%. The extract is imported from Switzerland, diluted and bottled in Uruguay and sold to consumers with a medical prescription for about $70.

- While the cultivation of psychoactive cannabis is limited to the two companies with current licenses and no new public tender is planned, nothing stops new companies from applying for licenses to cultivate nonpsychoactive cannabis. As of Jan. 9, the Uruguayan government had awarded nine licenses to cultivate over 1,200 hectares of hemp. ICC Labs recently announced an expected increase of processing capacity at its extraction lab and already has deals in Brazil, Mexico and with Canadian companies Emblem and Nuuvera – all subject to applicable regulatory approvals. On Jan. 30, Cannabis Wheaton acquired a Uruguayan producer for $15 million.