(You can have cannabis finance content such as this delivered directly to your inbox. Simply sign up here for our weekly MJBizFinance newsletter.)

Deal of the Week / In partnership with Viridian Capital Advisors

Plus Products bankruptcy highlights why first-mover advantage isn’t enough to stay ahead

On Sept. 13, California-based Plus Products (CSE: PLUS; OTCQX: PLPRF) filed for protection from creditors under the Companies’ Creditors Arrangement Act (CCAA), the Canadian counterpart to U.S. bankruptcy statutes.

The filing caps a long-running battle to maintain liquidity despite the increasing difficulty in accessing capital markets.

Plus Products enjoyed several advantages early on:

- An initial entrant into the California edibles market, it had three of the top 10-selling SKUs of any branded product category in first quarter 2019.

- Management, led by co-founder and CEO Jake Heimark, was well respected, and the company had a tightly controlled strategy of proving itself in California before venturing into other geographies.

- Its “asset light” strategy appeared to be the prudent way to approach a rapidly evolving market.

What went wrong?

- Competition eroded the company’s position in the California market. Wyld and Kiva Brands displaced Plus as the top two edibles brands in California, according to Seattle-based data analytics firm Headset.

- Increasing competition revealed the weakness of the business model of a small, independent brand selling through independent distributors. This structure makes it difficult for the independents to push products onto retail shelves.

- The COVID-19 pandemic changed cannabis usage patterns. Edibles offer a more discrete method of consumption. But when the pandemic kept more people at home, consumption trends shifted to flower, which benefits from the immediacy of effect and lower cost.

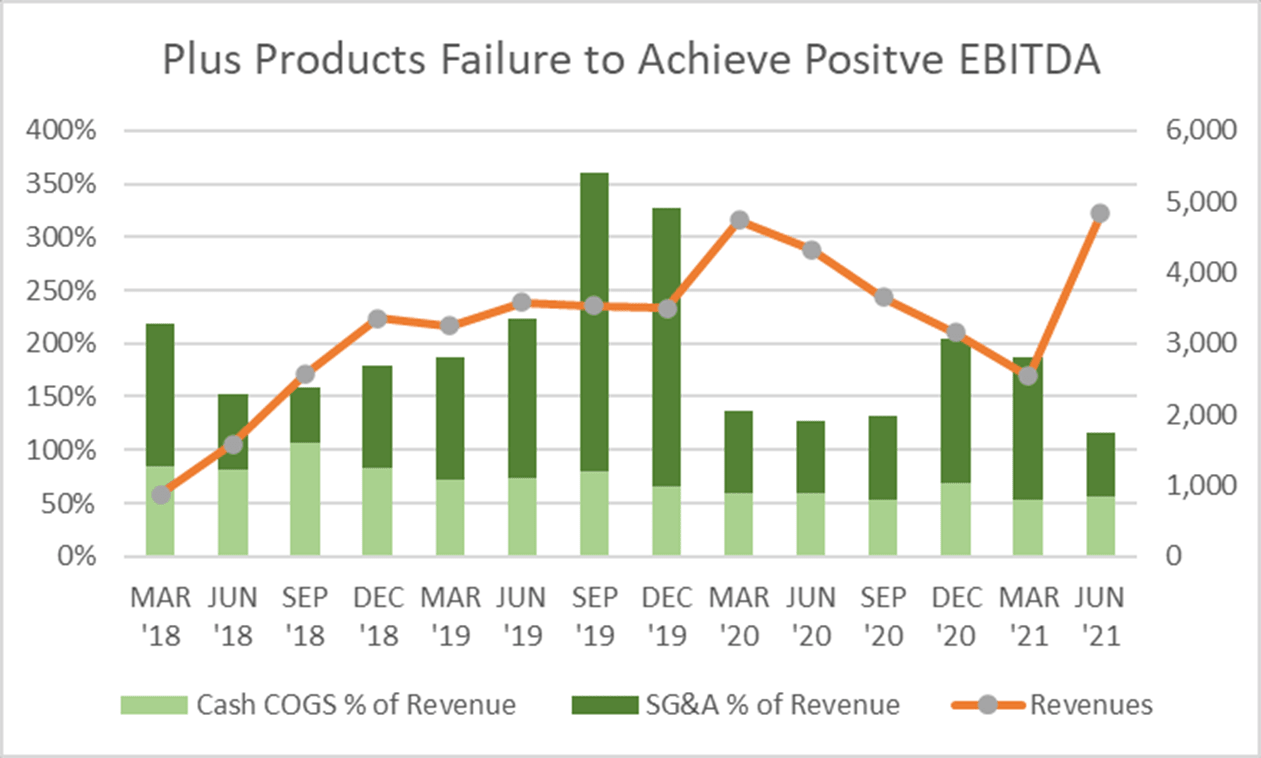

These factors substantially explain the 46% sales decline from March 2020 through March 2021 (shown in the orange line in the graph above).

The convertible notes and warrants financing structure used by Plus (and many other early market participants) had a relatively low conversion premium of 16%, which at the time was thought of as a delayed equity issuance.

But the cannabis stock crash of 2020 reduced Plus’ stock price to less than 1 Canadian dollar, and it never recovered to the CA$6.50 conversion price.

What steps did the company take to right the ship?

With its third-quarter 2020 earnings release, the company said that it was moving to self-distribution, arguably the right move to take control product marketing.

The positive effects started to register in the second quarter of 2021 with a 90% sequential gain in sales to a record $4.8 million.

At the last possible moment, Plus also reached an agreement to extend the maturity dates of the convertible notes from Feb. 28, 2021, to Feb. 28, 2024, staving off an immediate liquidity crisis.

However, the modification was costly.

The interest rate on the bonds increased from 8% to 12%. And a quarter of the bonds were given a one-month, right-to-convert at a below-market price of 95 cents; the remainder of the bonds were made nonconvertible.

The company also issued $499 of warrants per bond as a fee, with each warrant convertible at $1.10.

What could they have done differently?

The company should have been more aggressive about fixing liquidity much earlier.

Several other companies, including Cansortium and Kush, managed to finance their way out of similar dilemmas. The “asset-light” nature of Plus’ balance sheet might have inhibited options, though, as the company has only about $2 million of net property, plant and equipment (PPE) on its June 2021 balance sheet, rendering it unable to offer significant collateral.

Plus Products failed to effectively “read the room” regarding its strategic position as a small independent brand. It lacked scale, cultivation and access to shelf space. Other brands, such as Sublime, pivoted earlier to gain access to benefits for larger companies’ scale.

We don’t know how early or hard Plus pushed for a sale of the company, but Viridian Capital Advisors believes they might have stuck with the idea of going it alone just a bit too long.

Lessons/takeaways

- In a rapidly evolving cannabis market such as California’s, an early mover advantage doesn’t buy you much. Fast followers with better execution or more resources often win out.

- Brands are the mantra of the industry, but it is still early in development. Most small, independent brands cannot command shelf space at retail or the scale efficiencies to drive profitability. Consolidation appears inexorable.

- Liquidity issues rarely resolve themselves, and aggressive early action, although painful, is the best strategy. Raise capital when it is available rather than when it is desirable.

Can optics overshadow performance for cannabis companies?

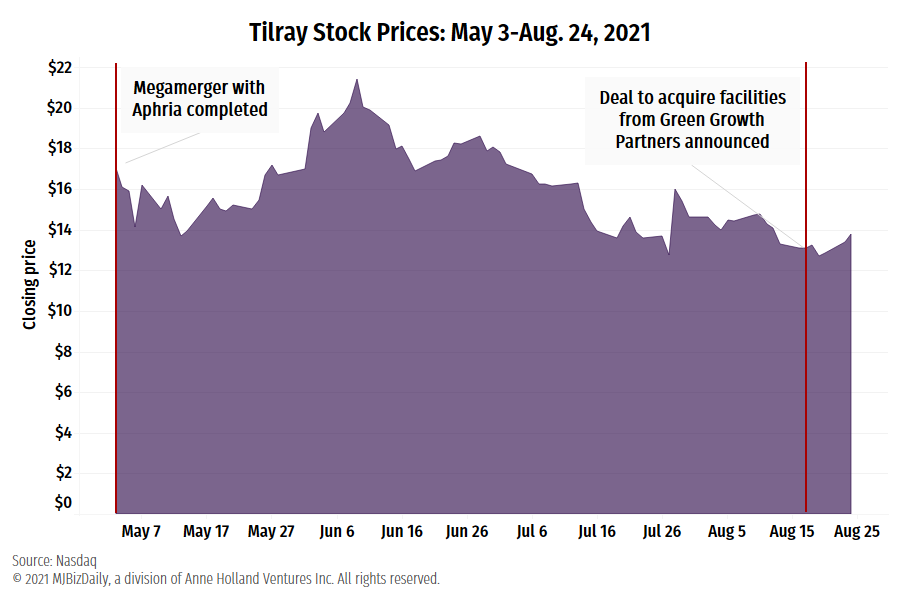

While solid performance and positive financial metrics should be the key determination for investors looking at where to place their money, there’s another factor that business operators – particularly cannabis business operators – need to consider: optics.

Negative headlines, even if they’re only tangentially related to a company, can cause investors to shy away from even the best companies.

“There is usually a knee-jerk reaction to negative publicity regardless of the severity,” said Matt Karnes, founder of GreenWave Advisors, a New York-based financial research and consulting firm.

For example, many industry observers agree that California-based MedMen has implemented significant operational changes to address the challenges created by the poor behavior of its former executives. Despite those changes, the company has struggled to regain its position as a market leader.

Tilray’s recent actions might help boost MedMen’s reputation, but a shadow from the company’s past transgressions still lingers.

At the same time, companies can’t always control the messaging that gets out about them. So what can leadership do to mitigate the impact of negative publicity?

One key step is to make sure there are strong policies in place around all financial and operational decisions – and document them for review. For example, if the company is considering doing business with a related third party, what process is employed to ensure that no preferential treatment is granted based on the relationship?

Another step: Separate the overseers.

Financial experts generally are concerned about one individual holding both the CEO and chair roles – as Kim Rivers does at Florida-based Trulieve Cannabis – because of the influence that person can have over board decisions.

“When a director has significant voting power, there is always the question of how independent the independent directors are,” said Lauren Newell, an associate dean and professor at the Ohio Northern University Pettit College of Law.

– Jenel Stelton-Holtmeier and Jeff Smith