While marijuana sales have slowed the past couple of months – raising questions about whether a boom in coronavirus-related cannabis purchases is petering out – industry executives are bullish and note that sales remain up versus a year ago.

The sales gains that ignited in the spring of 2020 after widespread business lockdowns appear to be more long term, executives said, with the pandemic having encouraged a new group of consumers to try marijuana for stress relief and other reasons.

Executives also predict that as the U.S. economy continues to reopen and Americans venture into stores and restaurants and take more trips, cannabis consumers will shift their purchases in favor of more discreet forms of consumption such as edibles and vape pens.

The upbeat expectations among industry insiders mirror a similar sentiment among mainstream business executives.

A recent study by the National Federation of Independent Business showed that its small-business optimism index increased by 2.9 points in June to 102.5, the first time it has exceeded 100 since last November.

“It looks like the industry is going to keep chugging along,” said Ankur Rungta, co-founder and CEO of C3 Industries, a vertically integrated Michigan marijuana company that also has operations in Oregon, Missouri and Massachusetts.

Rungta added that he sees the spike in sales during the COVID-19 lockdowns as “the new baseline.”

The industry converted a lot of new consumers amid the pandemic, which led to more acceptance of cannabis, he added.

“That’s not going away,” Rungta said. “People that were exposed to this product during the pandemic are not going to turn away from it.”

Data bears it out

During the COVID-19 lockdowns, cannabis companies experienced record sales month-over-month and year-over-year across nearly every U.S. state market.

At the time, cannabis business owners attributed those spikes to people staying home and spending their stimulus money on cannabis rather than on other recreational activities such as going to restaurants, seeing movies or traveling.

So now that the restrictions have been paused or lifted, marijuana companies expect consumers to shift their product-buying behavior to items such as vape pens, which are more convenient and easier to use when traveling.

They also expect more in-person shopping.

“As consumers become comfortable with dining out and traveling, we’ve seen activity pick up in and around our downtown dispensary locations, which we think can be attributed to an overall increase in foot traffic in those regions,” said Michael Perlman, executive vice president of investor relations and treasury at Florida-based multistate marijuana company Jushi Holdings, which has a footprint covering about half a dozen states.

And while recreational sales in some key states have begun to show signs of flattening, they remain above levels seen a year ago, according to Seattle-based data-analytics firm Headset.

In California, for example, adult-use sales in June eased 0.8% from May but were up 10.4% versus June of last year.

Ditto in Oregon, where sales in June were off 6% from May but up 2.4% from a year earlier. And in Washington state, June sales were off 0.3% from May but up 4.5% from a year earlier.

Retail changes here to stay

Denver-based Flowhub, a marijuana software technology platform, said its dispensary clients experienced 54% sales growth Jan. 1-May 31, 2021, compared to the same period in 2020.

Anne Fleshman, vice president of marketing at Flowhub, said the company expects to see a return to in-store foot traffic along with an uptick in tourism.

To capture the attention of those visitors, stores will likely offer more “experiential” promotions, such as allowing consumers to smell and try products in ways that weren’t allowed during lockdowns, she added.

However, companies that embraced new ways to serve customers during the COVID-19 lockdowns – such as curbside pickup, delivery and online ordering – also stand to gain even more as consumers have gotten accustomed to those forms of shopping.

“Consumers want their cannabis, and they want touchless, cashless transactions,” Fleshman said.

“These are enhancements that many were forced to make quickly, and I don’t see them going away.”

Jushi’s Perlman agreed.

“The fact that cannabis was deemed essential during the pandemic was a turning point,” he said.

“We saw our express and curbside-pickup sales surge, and so far, those consumers have formed shopping habits that appear to be here to stay.”

Travel = discretion

As Americans move about the country more freely, they’re less likely to take more conspicuous forms of consumption such as dab rigs or bongs on the road with them, industry officials predict.

While flower is still king – Fleshman with Flowhub said “flower sales continue to dominate” – it stands to reason that traveling consumers might want more discreet options.

Sebastien Centner, co-founder of Las Vegas-based edibles brand Hervé, said the renewed confidence in life beginning to return to normal, combined with the pent-up demand to get out, travel and socialize, is having a “monumental impact on consumers being willing to spend more.”

Anecdotally, he’s seeing consumers moving from purchasing products exclusively for in-home consumption during the lockdowns.

“The focus was heavily weighted towards smokable products and value products since it was entirely for personal use, to where we are now with the lockdowns ending (hopefully) and people getting out and about,” Centner wrote in an email to MJBizDaily.

Narmin Jarrous, chief development officer of Exclusive Brands, a vertically integrated cannabis company based in Ann Arbor, Michigan, backed that up.

She expects consumers to start moving back toward vapes and edibles.

“As we see people going to back to pre-pandemic-ish life, they’ll go back to their more discreet options,” Jarrous said.

At Maitri Medicinals in Pittsburgh, Jenna Parker, vice president of operations, said this summer she’s seen an uptick in sales of vape cartridges and vape pens.

“Those products give someone the option to benefit from their ease of use,” Parker said.

Maitri hasn’t experienced a drop in sales this summer, fueled by more consumers turning to online ordering versus in-store purchases.

“We have found that our old model of folks ordering in the store has been removed completely,” she said.

Maitri is so optimistic about the future of the market in Pennsylvania the company is looking to open another storefront soon.

Inflation on the rise?

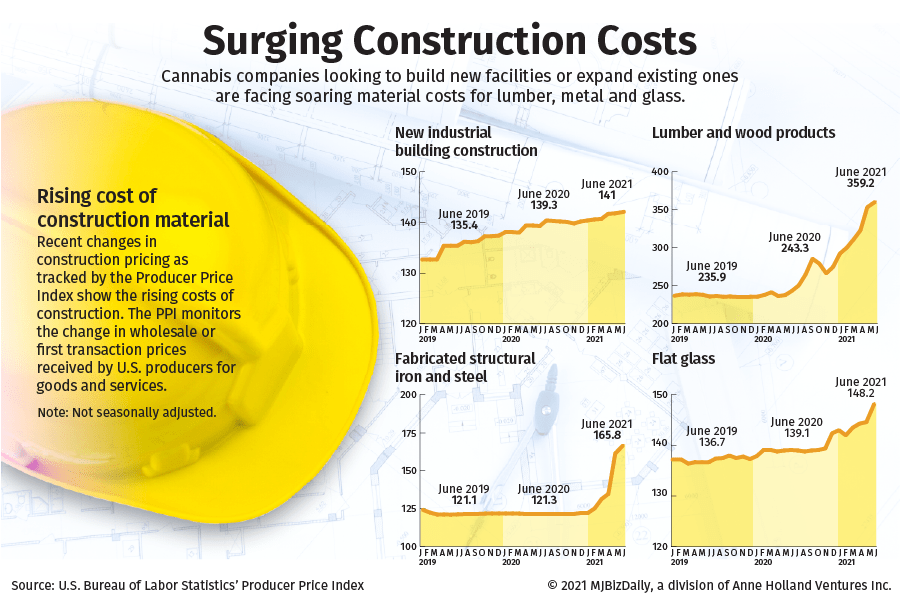

While consumers are seeing higher prices for gasoline, used cars, restaurants and more, inflation doesn’t appear to be taking hold in the cannabis industry – although marijuana companies in the midst of expansion are facing steeper prices for building material.

In the National Federation of Independent Business’ small-business survey, the net percent of owners raising average selling prices increased 7 points to a net 47%, seasonally adjusted, the highest reading since January 1981.

But the cannabis industry is not a traditional, mature industry, and some business owners don’t see price increases on the way.

According to recent Headset analysis, median marijuana product prices “haven’t climbed higher than where they were at a year ago – a strong indicator that inflation isn’t impacting the industry today.”

Rungta in Michigan said he’s not upping prices.

“If anything, they are coming down over time in markets like Michigan,” he said.

Bart Schaneman can be reached at bart.schaneman@mjbizdaily.com.