48North Cannabis pulled the plug on outdoor marijuana production at its farm in Brant County, Ontario, signaling the changing thinking on the value of low-cost outdoor production in an industry facing a major supply glut.

The outdoor cultivation site was previously pitched as a “game changer” by 48North ahead of its first season in 2019, promising low-cost production of cannabis meant primarily for extraction.

At the time, Ontario-based 48North said it was the first Canadian cannabis producer to apply for an outdoor cultivation license.

In a news release issued Monday, 48North described the decision to end outdoor cultivation as “an important step in the company’s path to profitability as it increases its focus on efficient product manufacturing, branding, and distribution.”

“The decision comes during a significant transitional period for the industry and a nationwide excess of supply,” 48North added.

The company, which is subsequently cutting its workforce by about 20%, said the change will save more than 5 million Canadian dollars ($4 million) in annualized fixed operating costs.

Chief Growth Officer Kirsten Gauthier and Chief Financial Officer Sean Byrne are also leaving 48North, according to the news release.

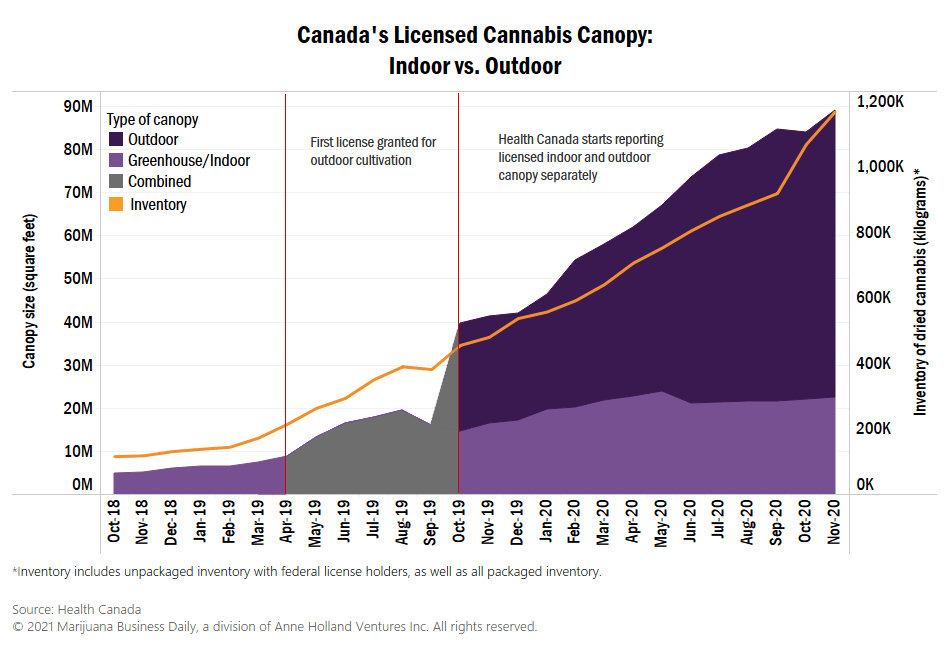

Canada’s licensed outdoor marijuana production area had already exceeded licensed indoor growing space by early 2020.

By February 2020, the number of authorizations for outdoor production had doubled over the previous summer, with many outdoor production applications in Health Canada’s queue.

Licensed Canadian cannabis producers had nearly three times more outdoor canopy space than indoor space by August 2020, according to Health Canada figures, as some major producers cut greenhouse capacity after years of overexpansion.

That 3-to-1 outdoor-to-indoor ratio appears to have held roughly steady as of last November, when the latest Health Canada figures showed that Canadian producers’ 22.5 million square feet of licensed indoor growing area was eclipsed by 66.6 million square feet of outdoor production space.

A glut of unsold marijuana inventory has affected prices and pushed many producers to cut cultivation capacity.

Ontario-based Canopy Growth, for example, announced late last year it was abandoning outdoor cultivation across Canada and also cut indoor production along with other major producers.

Some analysts have warned that the oversupply situation, which has been exacerbated by outdoor supply, will continue having consequences for Canadian producers.

Solomon Israel can be reached at solomon.israel@mjbizdaily.com.