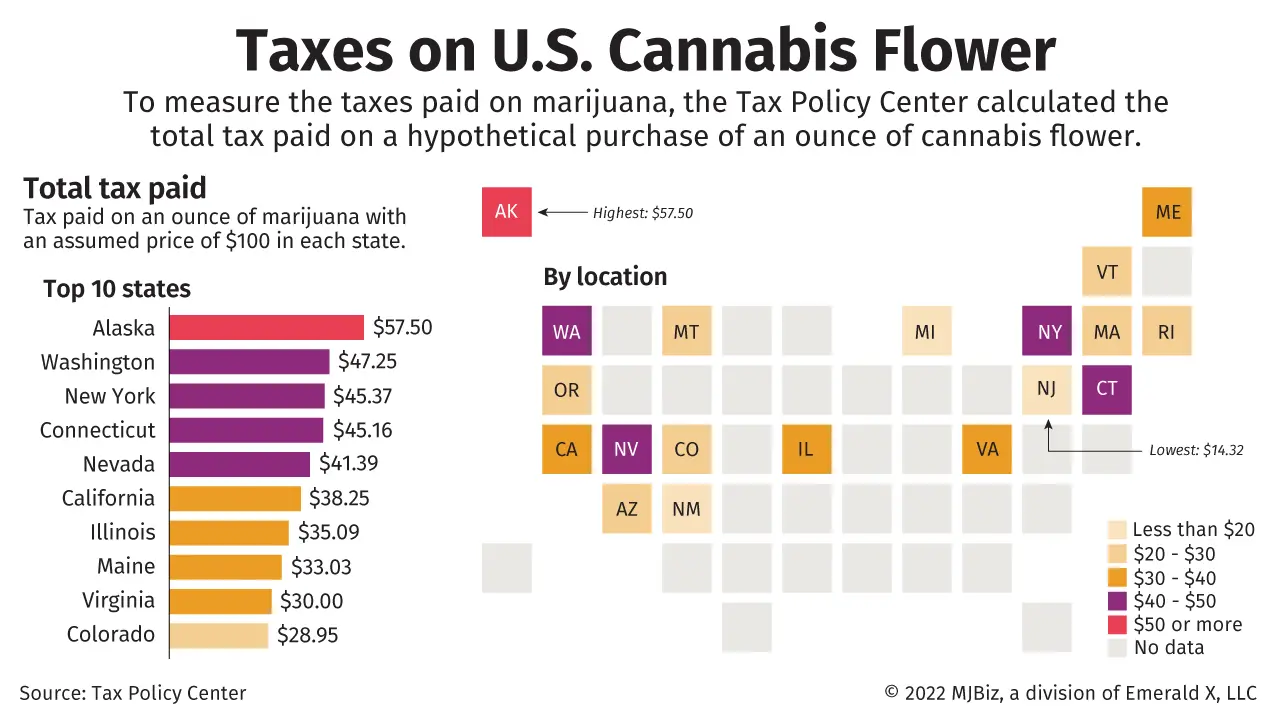

Alaska’s recreational marijuana taxes are the highest in the country, and New Jersey’s are the lowest.

That’s according to Richard Auxier and Nikhita Airi, the authors of the Urban-Brookings Tax Policy Center’s September report, “The Pros and Cons of Cannabis Taxes.”

But it’s a tough comparison to make. No two states where adult-use marijuana is legal approach cannabis taxes the same way.

“Every state is a special and unique flower,” Auxier, senior policy analyst for the Tax Policy Center, told MJBizDaily.

From excise taxes to weight-based taxes to potency taxes to wholesale taxes and their respective rates, those discrepancies can make it difficult to compare adult-use marijuana taxes across the United States.

Such a patchwork can also complicate tax planning for cannabis businesses with aspirations to expand to multiple states.

That’s why Auxier and Research Analyst Nikhita Airi took a creative approach to examining marijuana taxes in various states in their report: comparing the taxes on a retail purchase of 1 ounce of cannabis flower in the 19 states where adult-use taxes were enacted by September 2022.

To create the comparison without getting bogged down in price discrepancies between states, Auxier and Airi decided that the hypothetical retail price of an ounce of cannabis flower before taxes in each state is $100 – a round number that falls between the wholesale cost of an ounce in Colorado ($44) and Nevada ($130).

The authors acknowledge that the actual retail price of an ounce would be higher for customers in most states.

To deal with THC-potency tax rates in some states, Auxier and Airi’s hypothetical ounces all came in at 20% THC.

And to keep it simple, wholesale taxes were applied to the purchase price for each ounce, and it was assumed all wholesale taxes were passed on to customers.

By far, Alaska had the highest estimated tax on an ounce at $57.50, largely attributed to the $50-per-ounce tax on cannabis flower in that state.

It’s the highest weight-based tax rate in the United States. The remaining $7.50 is from a local percentage of price excise tax in Anchorage.

But Auxier and Airi weren't critical of the high tax rate, advising that it's much easier to decrease a tax rate in the future than to raise it.

"There's no failure at the outset because we're all trying and learning," Auxier said.

"If there's ever a failure, it's because you don't update and change as circumstances change."

Washington state had the second-highest total taxes on a hypothetical ounce at $47.25.

But the authors warn that prices in Washington state are lower than average, meaning that the actual price of the ounce would be lower.

And because all cannabis taxes are calculated as a percentage of the retail price, the total tax paid on an ounce would very likely be lower.

New Jersey and Michigan had the lowest total taxes on a hypothetical ounce at $14.32 and $16, respectively.

Michigan, with its higher retail prices and only a 10% excise tax and a 6% general sales tax, is a fairly accurate estimate.

At 6.625%, New Jersey’s tax rate is intentionally low to help legal businesses compete with the unregulated market.

But similar to California, local governments in New Jersey can add a gross receipts tax on regulated retailers, distributors and cultivators.

That means the authors could have underestimated the total tax on an ounce in New Jersey, where it's difficult to calculate where a local tax is being applied.

For the purposes of the calculation, the authors added a 2% gross receipts tax to three parts of the supply chain: cultivation, distribution and retail.

It also means New Jersey is on the list of states the authors are watching.

Will the market play out similarly to California, where local taxes are also common, or are the markets different in other ways?

"(The gross receipts tax) is the one that businesses really hate," said Auxier, referring to the tax California municipalities levy on cannabis purchases.

"You'd think New Jersey would learn from California. (State regulators) actually did considerable work on how tax revenue would help fund programs for social equity and how taxes need to be low to compete with illicit sellers, but they also went ahead with allowing the gross receipts tax."

As for states with a cannabis tax the authors approve of?

"I like New Mexico because they just did a simple retail tax, but they did it so that the rate escalates" Auxier said.

By 2025, New Mexico's cannabis retail tax will increase from 12% to 13%.

"It's basically assuming that the price of the product will come down," Auxier added.

More highlights from the report and its authors:

- 2022 was the first fiscal year in which any state cannabis tax revenue declined from the previous year: California, Colorado, Nevada, Oregon and Washington – the more mature legal markets – all saw declines, while Alaska stayed flat.

- For fiscal year 2022, California collected the most state cannabis tax revenue at $744.4 million, or $20 per capita. Cannabis taxes accounted for 0.3% of total state tax revenue (excluding local taxes).

- Washington state and Colorado had the highest per capita taxes for fiscal year 2022, at $67 and $61, respectively.

- Maine had the lowest per capita total for state cannabis taxes, at just $13 per capita.

- The most popular approach to taxation of marijuana is through a retail tax, which is more streamlined from an administrative perspective. Wholesalers don’t have to pay it out, for example.

- The authors didn’t investigate a relationship between high taxes and illicit markets while cautioning that other factors are related to how a legal market is operating, such as how many and where legal stores are.

- Local taxes are among the most burdensome on consumers and have been blamed for some of the challenges facing the industry in California, for example. But they are often necessary for municipal governments to buy into allowing cannabis businesses to open.

- Potency-based taxes are designed to disincentivize consumers from buying higher-potency products, but they could also incentivize consumers to buy potent products from the illicit market.

- Connecticut and New York’s forthcoming adult-use cannabis markets will be the first to levy a tax calculated per milligram of THC. Illinois also taxes cannabis based on potency, but that state assigns a higher sales-tax percentage to more potent products.

Kate Robertson can be reached at kate.robertson@mjbizdaily.com.