(Editor’s note: This story is being published in connection with a special series revealing key elements of more than 200 pages of internal IRS documents obtained by Marijuana Business Daily.)

No longer applying Section 280E of the Internal Revenue Code to the legal cannabis industry would be a big benefit to companies and investors, right?

Yes, but not in the way most investors expect.

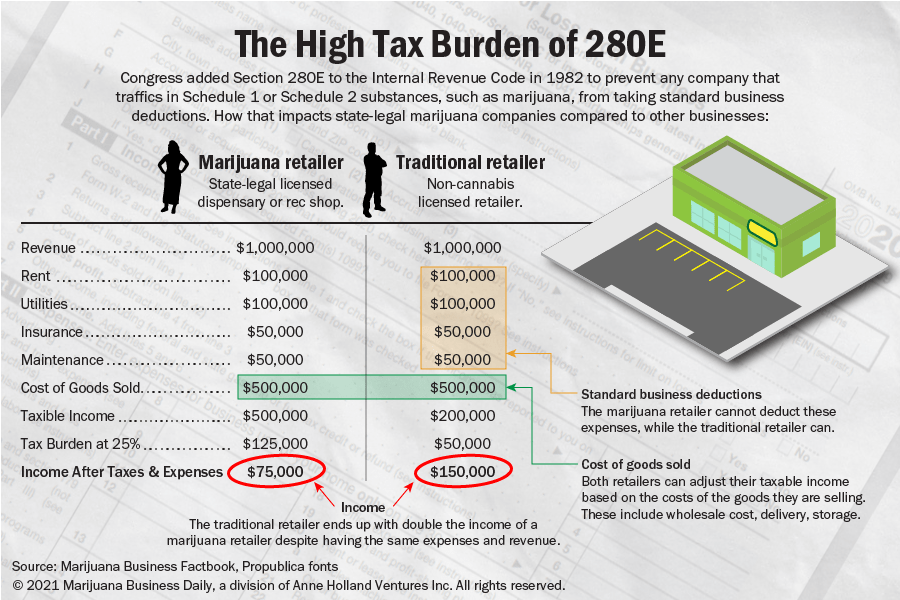

Section 280E prohibits the use of standard business deductions by any company that traffics in federally controlled substances.

If 280E no longer applies, many investors expect tax savings would directly flow into net income, and we have seen some simplistic analyses that point to 50% to 120% increases in earnings.

But we think much of the tax savings will be reinvested into the business instead, because a tax cut is just a low-cost source of capital and the nascent legal cannabis industry still needs to invest billions to build out the entire supply chain.

All the money that went to 280E taxes won’t flow to investors via increased free cash flow or distributions, but smart investors will be happy to own a larger, faster-growing business in the future with less equity dilution today.

Smart CEOs will invest the tax savings to accelerate growth. This could include expanded cultivation or dispensaries, automation improvement across their supply chains, increased advertising and even cutting prices on their products to gain market share.

We recognize that laws have not yet actually changed, and the future details will be key to determining the optimal strategy.

But company managements should have a general philosophy about the reinvestment trade-offs in a post-280E world.

History shows tax cuts get reinvested in competitive industries

Though investors do usually get some one-time direct increase in after-tax profit, history shows that the tax savings from universal tax cuts in competitive and growing industries will be reinvested.

The table below highlights the potential impact of this reinvestment.

| Investment | Result | Margin impact |

| Lower prices & improved product quality | Direct consumer benefit, share gain and possible increase in total demand | Pressures gross margins |

| Increased marketing and branding | Share gain, branding gain and increasing competition | Pressures EBITDA margins |

| Increased employee wages | Direct employee benefit and ability to attract better talent | Pressures EBITDA margins |

| Increased capital expenditures | More capacity, capitalized expenses and accelerated growth plans | Could expand EBITDA margins by capitalizing expense |

| Increased buybacks and dividends | Direct investor benefit and increased valuations |

Many investors simplistically assume that a tax cut just moves money from the IRS to investors.

The thinking is something like “eliminating 280E means I get to keep 21% of gross profit, right?”

But this analysis does not consider the changes in company behavior in response to incentives and constraints in a dynamic market.

After the 2017 Tax Cuts and Job Act cut the corporate tax rate from 35% to 21%, many companies in competitive businesses just accelerated or enlarged existing strategic initiatives, as shown in these quotes from consumer companies in 2018 (bold added for emphasis):

| “We are planning increased brand and organizational investments funded by continued progress on cost savings and efficiency projects and some of the benefit of the recent tax changes.” | Boston Beer 2/21/2018 Earnings Call |

| “As a result of tax reform, we will invest an additional $10 million in our team members in 2018. These investments will cover some labor rate increases, shelter team members from an increase in medical premiums and improve other team member benefits.” | Sprouts Farmers Market 2/22/2018 Earnings Call |

| “Looking at 2018 and beyond, the Tax Cuts and Jobs Act is a catalyst that will enable us to accelerate investments in Restock Kroger. And as we’ve shared a few times since the fall, we are taking a balanced approach to ensure tax reform benefits our associates, customers and shareholders.” | Kroger 3/8/2018 Earnings Call |

| “We’ve been very clear about our intention to invest in superiority across the five touch points… product, package, communication, and in-store. But where we need to sharpen value equations, either at the consumer or the retail level, that could also be a target for investment.” | Procter & Gamble 1/23/2018 Earnings Call |

Source: Company conference call transcripts

Legal cannabis is not an industry with any excess cash (which is why MJResearchCo does not deduct net cash from enterprise values in our comp table), and with much more investment needed over the next decade, the capital allocation acumen of management will determine the amount of long-term value creation for equity holders.

CEOs: What will you do when you can deduct 21% of SGA?

A key criterion we use to judge companies and managements is how they allocate capital over the long term.

Smart CEOs should have at least a reinvestment framework and general game plan for the day 280E no longer applies.

More in this series

- Newly released IRS documents detail efforts to collect taxes from marijuana companies under 280E

- Documents reveal how IRS became more adept at evaluating marijuana company taxes

- Confidential IRS marijuana guide details audit procedures for agents to follow

- 280E is a political weapon targeting marijuana companies, but there may be a fix

- A primer on marijuana-related IRS terminology

And smart investors should have an idea of what that game plan will be.

The questions we would ask include:

- At the very basic level, how much of the savings will go to investors versus back into the business?

- Where will that investment be? For example, will it go to more cultivation, distribution, branding and advertising, lower product pricing or higher quality at the same price, greater capex, more employees, higher wages, etc.? How do you weigh one versus the other?

- Do you just accelerate your five-year plan to three years, or do you fundamentally change it?

- Would your vertical integration strategy change if you could deduct selling, general and administrative (SG&A) expenses for taxes?

It takes only one strategy executive to convince one CEO that “we can reinvest the tax savings in more dispensaries, lower prices, higher advertising spend and wages to drive unit volumes higher; best case, we drive revenue gains and leverage fixed costs to expand margins, or worst case, we see revenue declines. But either way, we still see an increase in net income.”

And then the others in the market say, “Our main competitor just accelerated openings, cut prices, increased ad spend and poached our best employees with 20% raises – how do we respond?”

“Well, we’ve got that extra cash from the tax savings….”

It is better to be proactive rather than reactive.

Michael Regan is the founder of MJResearchCo.com and a regular contributor to Marijuana Business Daily. He and fellow analyst Colin Ferrian can be reached at mikeandcolin@mjresearchco.com.

The previous installment of this series is available here, and MJBizDaily‘s special series on the IRS is available here.

To be considered for publication as a guest columnist, please submit your request here by filling out our form.