Ontario has roughly 4% of the legal cannabis points of sale it needs to put it on par with markets that are successfully extinguishing illicit channels.

And Quebec is not doing much better, according to a researcher.

A shortage of points of sale for adult-use cannabis in Canada’s two largest markets was cited in January 2019 as one of the industry’s biggest pending issues – a hurdle that remains far from being cleared.

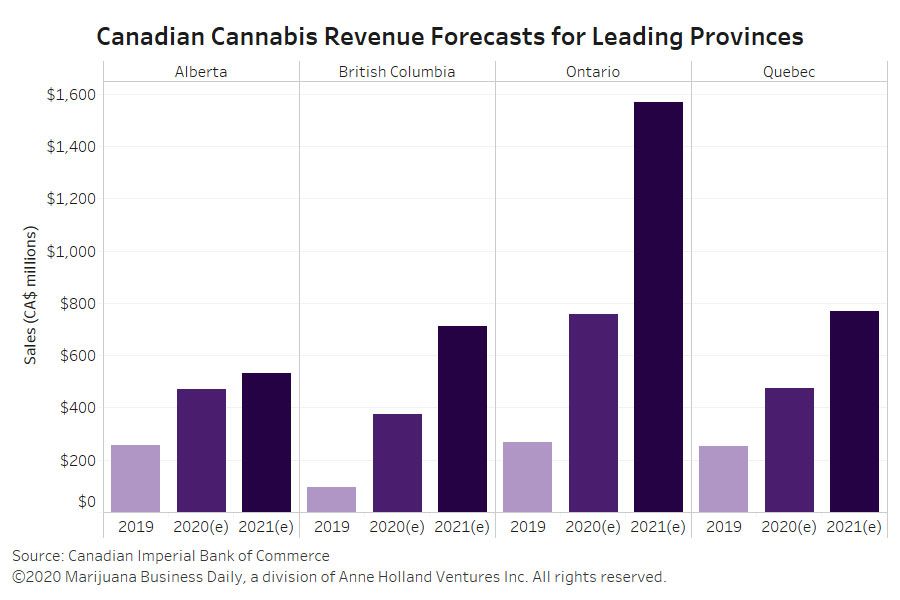

Last week, CIBC Capital Markets, the investment banking subsidiary of the Canadian Imperial Bank of Commerce, trimmed almost a billion dollars off its 2020 forecast for cannabis sales in Canada, in part because of issues stemming from the slow rollout of stores.

Ontario, which has pledged to ramp up new store authorizations this year, started accepting open-market applications on Jan. 6.

As of April 29, Ontario authorized almost five dozen stores.

Quebec is not faring much better than its neighbor.

Damas estimates that Quebec’s cannabis point of sale deficiency at 95% – meaning it is roughly 800 stores shy.

Alberta’s 449 points of sale exceed what the province needs, Damas said.

More than 180 stores have opened in British Columbia, making it 65% deficient in points of sale. B.C. needs 507 points of sale to bring its store count to one per 10,000 people.

Saskatchewan, which recently started accepting cannabis store applications for small communities, could use about 70 more points of sale.

“The headwinds are receding and I see some tailwinds,” Damas said, who sees store counts improving through this and next year.

Damas forecasts 2020 adult-use sales in Canada will reach of CA$2.1 billion ($1.5 billion).

“Pretty much every province except Alberta needs more stores in some form,” Brock University business professor Michael Armstrong said. “Stores absolutely do matter.”

But whether that is one point of sale per 10,000 people or something else depends on many factors, he said, including the regulatory parameters established in each jurisdiction, applicable taxes and the breadth of products retailers are able to sell.

“If they can only sell cannabis, then the number they can support is going to be smaller,” he said.

Ontario’s liquor store model provides applicable comparisons for cannabis policy.

The province has 660 liquor stores in communities that can support stand-alone points of sale, plus another 400 smaller points of sale inside other properties, such as grocery and convenience stores.

“If governments would allow (cannabis) stores to sell other things, at least in rural areas, then that would support much greater store numbers,” Armstrong said.

“That would allow legal products to reach a much wider market in areas that are more sparsely populated.

“Stores are definitely important in making the legal product accessible and the legal industry successful.”

Matt Lamers is Marijuana Business Daily’s international editor, based near Toronto. He can be reached at mattl@mjbizdaily.com.