The turbulent California marijuana market is slowly moving toward stability with strong sales growth and plentiful business opportunities – despite being roiled by the coronavirus pandemic, looting from civil unrest and wildfires.

That was among the messages from three sessions focused on the California market during Marijuana Business Daily’s Passholder Days Forum.

He noted how the industry was declared “essential” during the outbreak, which helped lead to robust sales and incentive for local jurisdictions to embrace recreational marijuana to generate tax revenue and economic opportunities.

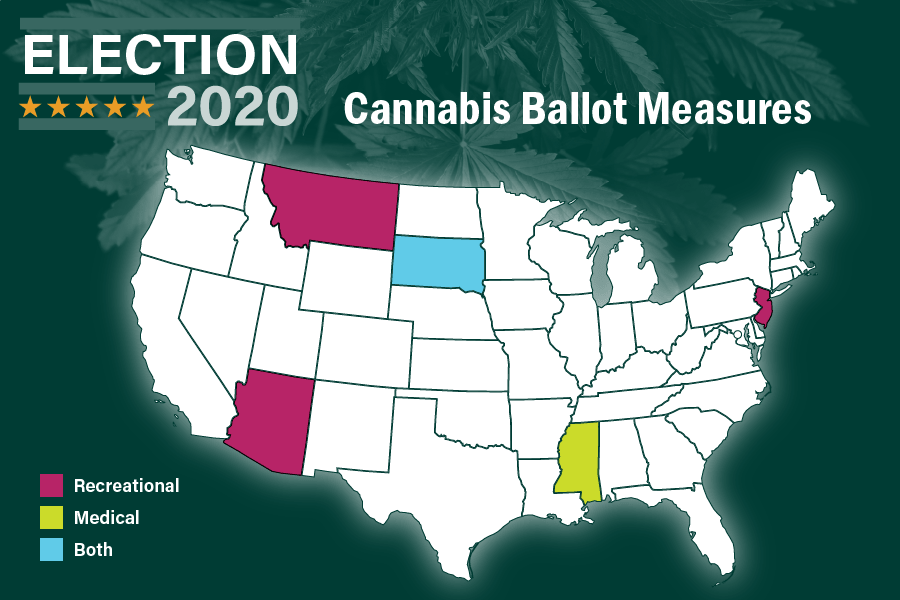

The California industry got more good news on Election Day, when 31 local marijuana ballot initiatives passed, many of them establishing or setting the stage for new marijuana licensing opportunities.

“The war on drugs is over, and drugs won,” Elizabeth Ashford, senior director of corporate communications for cannabis delivery company Eaze, said in describing the big takeaway from the elections.

Here are some of the bright spots for a $3 billion-plus market where hurdles persist, such as competition from the illicit market, high taxes and lack of access to capital and banking services.

- License opportunities exist, and more are on the horizon. Schroyer said that while there are openings in markets such as Los Angeles, some of the best opportunities are in small towns and suburbs, which might allow only a few licenses. But, he cautioned, entrepreneurs need to be of the mindset that they won’t turn a profit quickly. “The long game is the only game,” he said.

- Some of the best opportunities will be in retail. Hirsh Jain, director of government affairs for San Jose-based Caliva, noted that only about one-fifth of California’s cities have authorized retail marijuana shops but more are taking action as evidenced by Tuesday’s election. California has roughly 700 marijuana retailers, but it should have 4,000 or 5,000, he said. The process to open a store in the state currently can take a few years, but Jain said he expects that time frame to decrease to 12-18 months.

- Investment managers described a climate in which capital is slowing coming back, but only to companies that are well-managed and financially sound. Right now, capital is mostly trickling into multistate operators, but it will “cycle down” to private companies, said Morgan Paxhia, managing partner of San Francisco-based Poseidon Asset Management.

- Panelists also said that better access to banking services is urgently needed for marijuana businesses. They were hopeful that cannabis banking reform could occur even if the Republicans maintain control of the U.S. Senate, as it looks like they will.

– Jeff Smith